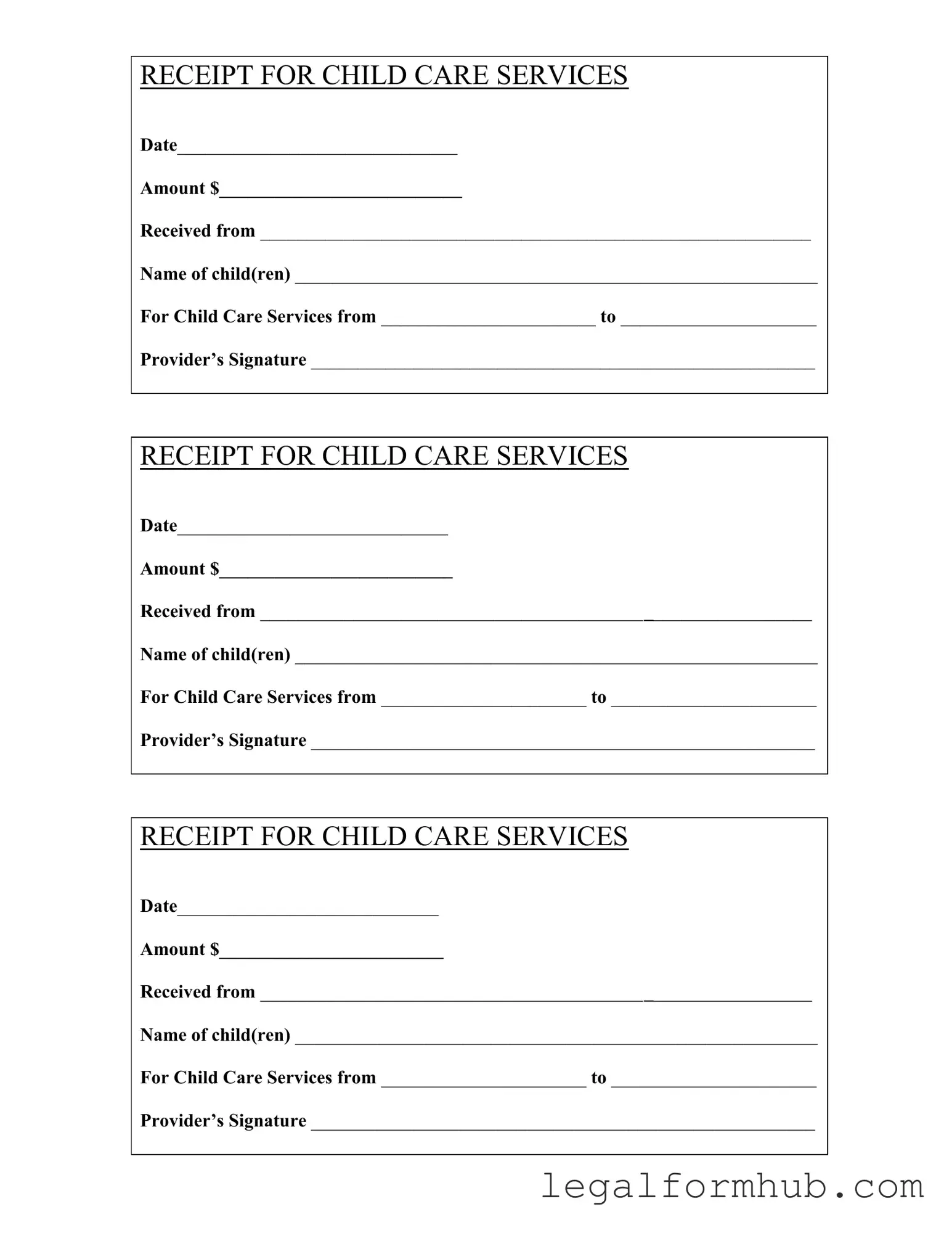

Fill Your Childcare Receipt Form

Different PDF Templates

California Sdi - Beneath its straightforward appearance, the EDD DE 2501 is essential for securing financial support.

To simplify the process of obtaining a Doctors Excuse Note, you can use online resources that help you generate the necessary documents efficiently. One useful tool is the Fill PDF Forms, which allows you to complete the form quickly and accurately, ensuring you have the proper verification needed for your absence.

Wage and Tax Statement - The W-2 is typically issued by employers by the end of January each year.

Payroll Advance Form - Use this tool to alleviate financial stress between pay periods.

Similar forms

The Childcare Receipt form shares similarities with the Tuition Receipt form, which is commonly used by educational institutions. Both documents serve as proof of payment for services rendered. Just like the Childcare Receipt, the Tuition Receipt includes essential details such as the date of payment, the amount paid, and the name of the student. This clarity helps parents and guardians keep track of their financial commitments, whether for childcare or educational expenses.

Another document akin to the Childcare Receipt is the Medical Payment Receipt. This receipt is provided by healthcare providers when a patient pays for medical services. Similar to the Childcare Receipt, it outlines the date of service, the amount paid, and the name of the patient. Both receipts are vital for individuals seeking reimbursement from insurance companies or for tax deductions, as they provide documented evidence of expenses incurred for essential services.

In addition to the various receipt forms discussed, it is crucial to have appropriate templates such as the Non-disclosure Agreement which safeguards confidential information and encourages transparency. For those interested in drafting such documents, you can find useful resources at https://arizonapdfs.com/non-disclosure-agreement-template/.

The Invoice is also comparable to the Childcare Receipt. Invoices are often issued by service providers for goods or services rendered. They typically include the date, total amount due, and a description of the services, much like the Childcare Receipt, which details the care provided. While an invoice may request payment, the Childcare Receipt confirms that payment has already been made, serving as a record for both parties involved.

Another similar document is the Rental Receipt. When a tenant pays rent, a landlord often provides a receipt that includes the payment date, amount, and property details. Like the Childcare Receipt, this document serves as proof of payment and is essential for record-keeping. Both receipts help in maintaining transparency in financial transactions, whether for housing or childcare services.

Lastly, the Payment Confirmation Receipt is closely related to the Childcare Receipt. This type of receipt is generated by various businesses and organizations when a payment is successfully processed. It typically includes the payment date, amount, and a brief description of the service or product purchased. Just as the Childcare Receipt confirms payment for childcare services, the Payment Confirmation Receipt provides assurance that a financial transaction has been completed, making it a useful document for personal and financial records.

Instructions on Writing Childcare Receipt

Filling out the Childcare Receipt form is a straightforward process that requires careful attention to detail. Once completed, this form serves as a record of the childcare services provided, which can be important for both parents and providers. Follow the steps below to ensure that you fill out the form correctly.

- Begin by writing the Date at the top of the form. This should reflect the date when the payment was made.

- Next, enter the Amount received for the childcare services. Make sure to write this amount clearly, using numerals and, if necessary, spelling it out for clarity.

- In the section labeled Received from, write the name of the person making the payment. This is typically the parent or guardian of the child.

- Then, fill in the Name of child(ren) who received the childcare services. If there are multiple children, list all their names.

- Indicate the period for which the childcare services were provided by filling in the dates in the For Child Care Services from and to sections. Be sure to include both start and end dates.

- Finally, the childcare provider should sign the form in the Provider’s Signature section. This confirms that the services were rendered and payment was received.

Misconceptions

Understanding the Childcare Receipt form is essential for parents and guardians. Here are some common misconceptions:

- It is not necessary for tax purposes. Many believe that a receipt is optional, but it is crucial for claiming childcare expenses on taxes.

- All childcare providers automatically issue receipts. Not all providers give receipts, so it is important to request one after payment.

- The receipt must be printed. A digital version of the receipt is acceptable as long as it contains all necessary information.

- Only full-time care requires a receipt. Receipts are needed for any form of childcare, whether full-time or part-time.

- Receipts are only for payments made in cash. Receipts should be issued for all forms of payment, including checks and electronic transfers.

- The provider's signature is optional. A valid receipt must include the provider's signature to verify the transaction.

- Receipts can be handwritten without any specific format. While they can be handwritten, they should still include all required details as per the standard form.

- Parents do not need to keep receipts for future reference. It is advisable to keep all receipts for at least three years in case of audits.

- The receipt does not need to specify the dates of service. Accurate dates of service are essential for proper record-keeping and tax claims.

By clarifying these misconceptions, parents can ensure they have the necessary documentation for childcare services.

Key takeaways

Here are some important points to remember when filling out and using the Childcare Receipt form:

- Complete all sections: Ensure you fill in the date, amount, and names clearly. This helps avoid confusion later.

- Keep a copy: Always make a copy of the receipt for your records. It’s useful for tracking payments and for tax purposes.

- Provider’s signature: The receipt must include the childcare provider’s signature. This confirms that the payment was received.

- Use for tax deductions: This receipt can help you claim childcare expenses on your taxes. Make sure to keep it safe.

- Specify the service period: Clearly note the dates of service. This shows the timeframe for which you are paying.

- Check for errors: Before handing over the receipt, double-check for any mistakes. Correct information is crucial.

- Store securely: Keep the receipts in a safe place, as you may need them for future reference or audits.

- Communicate with your provider: If you have questions about the receipt or payment, don’t hesitate to ask your childcare provider.

File Information

| Fact Name | Description |

|---|---|

| Purpose | The Childcare Receipt form serves as proof of payment for childcare services rendered. |

| Date Requirement | Each receipt must include the date the payment was made to document the transaction accurately. |

| Amount Specification | The total amount paid for childcare services should be clearly stated on the receipt. |

| Recipient Information | The form requires the name of the person making the payment, ensuring proper identification. |

| Child Identification | Names of the children receiving care must be included to link the payment to specific services. |

| Service Dates | Providers need to indicate the dates during which childcare services were provided, enhancing clarity. |

| Provider’s Signature | A signature from the childcare provider is necessary to validate the receipt and confirm the transaction. |

| State-Specific Regulations | In some states, specific laws govern the issuance of childcare receipts, ensuring compliance with local regulations. |

| Tax Implications | Parents may use these receipts for tax purposes, as they can claim childcare expenses on their tax returns. |