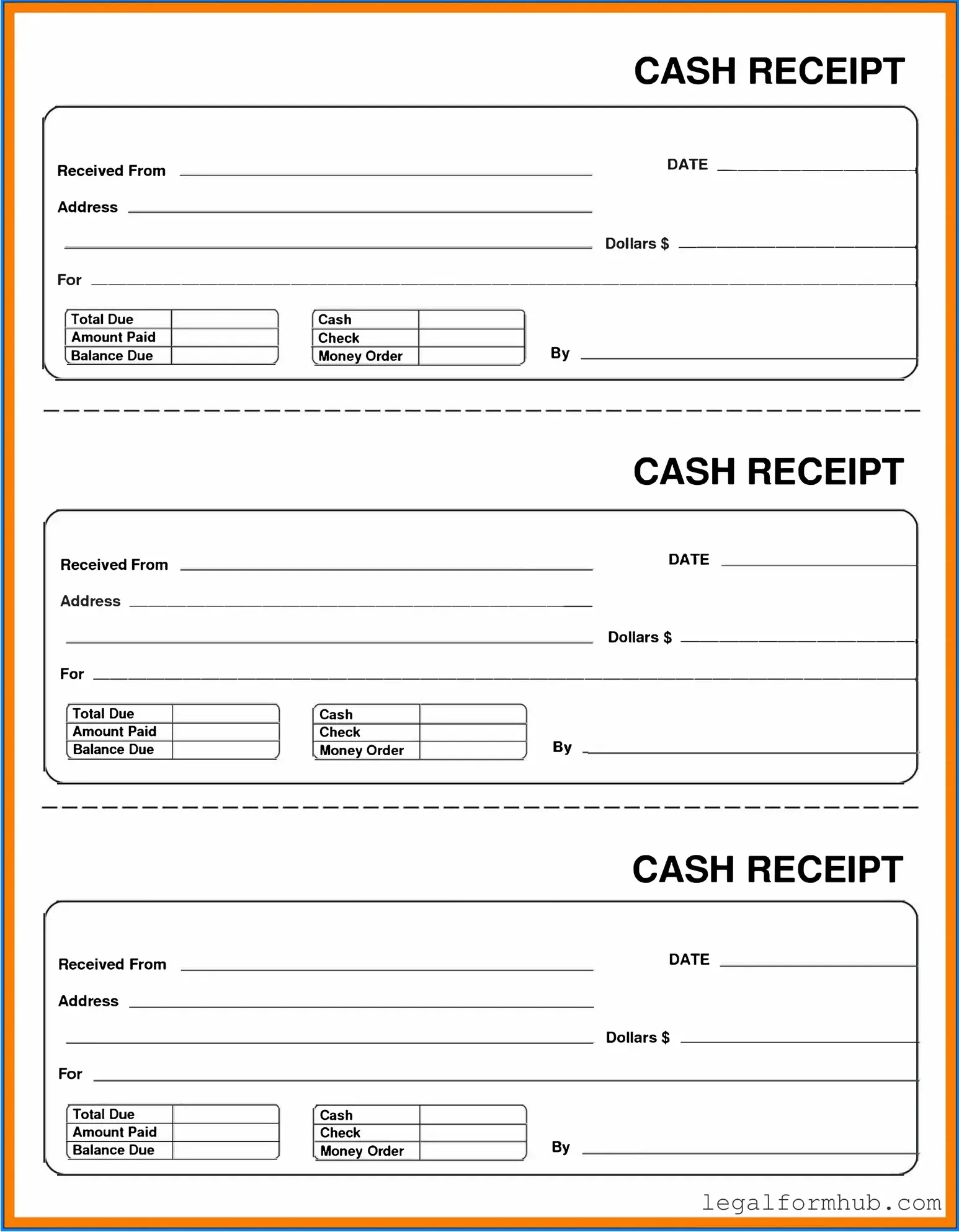

Fill Your Cash Receipt Form

Different PDF Templates

Da - Inaccurate entries can result in costly logistical errors.

To ensure your company operates smoothly, it is crucial to familiarize yourself with the essential details of the Missouri Employee Handbook, which can provide invaluable insights into employment policies and expectations. For further information on this vital document, please visit the Missouri Employee Handbook guidelines.

Filing a Lien in Florida - Property owners must act promptly to prevent additional legal expenses.

Similar forms

The Cash Receipt form is similar to an Invoice in that both documents serve as proof of a transaction. An invoice is typically issued by a seller to request payment from a buyer, detailing the goods or services provided along with their prices. In contrast, a Cash Receipt acknowledges that payment has been received. While invoices can be outstanding, cash receipts confirm that the financial obligation has been settled, providing a clear record for both parties involved.

Another document akin to the Cash Receipt form is the Payment Voucher. A Payment Voucher is used to authorize payment and often includes details about the transaction, such as the amount and purpose. Like a Cash Receipt, it serves as a record of payment but is typically initiated by the payer rather than the recipient. Both documents help ensure accurate financial tracking and accountability within an organization.

The Deposit Slip is also similar to the Cash Receipt form. A Deposit Slip is used when funds are deposited into a bank account. It includes information such as the amount being deposited and the account number. While a Cash Receipt confirms that a payment has been made, a Deposit Slip provides a record of the funds being deposited, linking the transaction to the bank’s records.

Another related document is the Sales Receipt. This document is issued at the point of sale and serves as proof of purchase for the buyer. It includes details like the items purchased, the total amount paid, and payment method. Both the Sales Receipt and Cash Receipt confirm that a financial transaction has occurred, although the former is typically issued immediately at the time of sale, while the latter may be generated later.

The Credit Memo shares similarities with the Cash Receipt form as well. A Credit Memo is issued when a seller credits a buyer’s account, often due to a return or adjustment. While a Cash Receipt confirms payment, a Credit Memo indicates a reversal of that payment or a reduction in the amount owed. Both documents are essential for maintaining accurate financial records and ensuring that all transactions are accounted for.

If you are looking to obtain a Doctors Excuse Note to justify your absence, it's important to understand how these forms work within the larger context of documentation. Much like the financial documents we rely on, such as Cash Receipts or Payment Vouchers, the accuracy and legitimacy of a Doctors Excuse Note can be crucial for validating your situation. Should you need assistance in completing this important form, you can access the necessary tools at Fill PDF Forms.

Another document that resembles the Cash Receipt form is the Expense Report. An Expense Report is submitted by employees to document expenses incurred during business activities. It includes receipts and other documentation supporting the claimed expenses. Similar to a Cash Receipt, it serves as a record of financial transactions, but it focuses on expenditures rather than income.

Lastly, the Acknowledgment of Receipt is comparable to the Cash Receipt form. This document is used to confirm that goods or services have been received. It may not always involve a financial transaction, but it serves as proof that the recipient has accepted delivery. Both documents provide verification and accountability, ensuring that all parties are aware of what has transpired in the transaction.

Instructions on Writing Cash Receipt

After you have gathered all necessary information, you are ready to fill out the Cash Receipt form. This form helps document the receipt of cash payments, ensuring that all transactions are recorded accurately. Follow the steps below to complete the form correctly.

- Begin by entering the date of the transaction in the designated field.

- Write the name of the person or entity making the payment.

- Indicate the amount of cash received, ensuring that it is clearly legible.

- Provide a brief description of the purpose of the payment.

- Include any reference number associated with the transaction, if applicable.

- Sign the form to validate the receipt.

- Make a copy of the completed form for your records.

Misconceptions

Understanding the Cash Receipt form is essential for accurate financial record-keeping. However, several misconceptions can lead to confusion. Below is a list of common misunderstandings about this form.

- All cash receipts must be recorded immediately. Some believe that every cash receipt needs to be documented right away. In reality, while prompt recording is best practice, it may not always be necessary if a system is in place for later documentation.

- The Cash Receipt form is only for cash transactions. Many think this form is limited to cash only. However, it can also be used for transactions involving checks, money orders, and electronic payments.

- Only large transactions require a Cash Receipt form. It is a common belief that only significant cash transactions need documentation. In truth, even small amounts should be recorded to maintain accurate financial records.

- Cash Receipt forms are only for internal use. Some assume that these forms are not necessary for external parties. In fact, they can serve as proof of payment for customers and clients.

- Once a Cash Receipt form is filled out, it cannot be changed. There is a misconception that any errors on the form are permanent. Corrections can be made, but they should be documented properly to maintain transparency.

- Only the accounting department needs to handle Cash Receipt forms. This form is often viewed as the sole responsibility of the accounting team. However, all departments that handle cash transactions should understand how to use and manage these forms.

- Cash Receipt forms are the same as invoices. Some people confuse these two documents. While both are related to transactions, a Cash Receipt form confirms payment received, whereas an invoice requests payment.

- The format of the Cash Receipt form is unchangeable. Many believe that the layout and design of the form cannot be altered. In fact, organizations can customize the form to fit their specific needs, as long as all necessary information is included.

Clearing up these misconceptions can lead to better financial practices and improved communication within organizations.

Key takeaways

When filling out and using a Cash Receipt form, it’s important to keep several key points in mind. Here are ten takeaways to ensure accuracy and efficiency:

- Complete Information: Always include the date of the transaction to maintain a clear record.

- Accurate Amounts: Double-check the amount received to avoid discrepancies.

- Payment Method: Specify the method of payment, whether it’s cash, check, or credit card.

- Recipient Details: Clearly identify the person or entity receiving the payment to ensure proper allocation.

- Purpose of Payment: Include a brief description of the purpose for which the payment was made.

- Signature Requirement: Ensure that the form is signed by the authorized person to validate the transaction.

- Record Keeping: Keep a copy of the Cash Receipt for your records to support accounting practices.

- Sequential Numbering: Use a unique number for each receipt to track transactions easily.

- Review Before Submission: Always review the completed form for any errors before finalizing it.

- Compliance: Ensure that the form meets any relevant legal or organizational requirements.

By following these guidelines, you can streamline your cash handling processes and maintain accurate financial records.

File Information

| Fact Name | Description |

|---|---|

| Purpose | The Cash Receipt form is used to document cash transactions, providing a record for both the payer and the payee. |

| Components | This form typically includes fields for the date, amount received, payer's name, and purpose of the payment. |

| Legal Requirement | In many states, businesses are required to maintain accurate records of cash transactions for tax purposes. |

| State-Specific Forms | Some states have specific requirements for cash receipt forms, governed by state tax laws. |

| Record Keeping | Organizations should keep copies of cash receipts for a minimum of three to seven years, depending on local laws. |

| Audit Trail | The form serves as an essential part of an audit trail, helping to verify cash flow and financial integrity. |

| Payment Types | It can be used for various payment types, including cash, checks, and electronic payments. |

| Internal Controls | Using a cash receipt form can enhance internal controls by ensuring that all cash received is documented. |

| Distribution | Typically, a copy of the cash receipt is given to the payer, while another is retained for the organization's records. |

| Compliance | Failure to properly document cash transactions may lead to compliance issues with tax authorities. |