Fill Your Cash Drawer Count Sheet Form

Different PDF Templates

Free Printable 5 Wishes Form - Five Wishes can be revisited and revised as your needs and wishes evolve over time.

Obtaining a Doctors Excuse Note is crucial for ensuring that your absence from work or school is understood and validated, particularly when health issues arise. To streamline this process and make it easier for both patients and institutions, you can utilize the Fill PDF Forms service, which simplifies the completion of necessary documentation.

Direction to Pay Form Contractor - This form represents a formal commitment to have repairs funded through insurance proceeds.

Which of These Items Is Checked in a Pre-trip Inspection - Check the condition of the exhaust system for any visible leaks.

Similar forms

The Cash Register Reconciliation Report is similar to the Cash Drawer Count Sheet in that it serves to verify the cash on hand against sales records. Both documents aim to ensure accuracy in financial reporting. While the Cash Drawer Count Sheet focuses on the physical count of cash in the drawer, the Reconciliation Report compares this count with the total sales recorded during a specific period. Discrepancies can be identified through either document, helping to maintain financial integrity.

The Daily Sales Report also shares similarities with the Cash Drawer Count Sheet. It summarizes the total sales made during the day, including cash, credit, and other payment methods. By reviewing both reports together, a business can confirm that the cash collected matches the sales figures. This alignment is crucial for detecting any potential errors or theft, reinforcing trust in the financial processes.

For those looking to understand company policies in-depth, the guidelines for the Employee Handbook form can be extremely beneficial. This document acts as a foundational resource that aligns employer expectations with employee responsibilities, ensuring a compliant work environment.

The Petty Cash Log is another document that relates closely to the Cash Drawer Count Sheet. This log tracks small cash expenditures made for everyday business needs. Like the Cash Drawer Count Sheet, it requires regular counting and reconciliation. Keeping an accurate Petty Cash Log helps ensure that all funds are accounted for, preventing discrepancies that could lead to financial losses.

The Bank Deposit Slip is also comparable to the Cash Drawer Count Sheet. This slip records the amount of cash being deposited into a bank account, reflecting the cash available in the drawer. Both documents serve to track cash flow and ensure that the amounts deposited match the cash counted. This consistency is vital for maintaining accurate financial records.

The Inventory Count Sheet is similar in that it involves counting physical items to ensure that records match reality. While the Cash Drawer Count Sheet focuses on cash, the Inventory Count Sheet addresses the stock on hand. Both documents help businesses identify discrepancies between recorded and actual amounts, aiding in effective inventory and cash management.

The Expense Report serves a different purpose but is still related to the Cash Drawer Count Sheet. It details the expenses incurred by employees, often requiring receipts for verification. While one focuses on cash received, the other emphasizes cash spent. Both documents are essential for maintaining accurate financial records and ensuring that all transactions are accounted for.

The Profit and Loss Statement, while broader in scope, connects to the Cash Drawer Count Sheet through its emphasis on financial accuracy. This statement summarizes revenues and expenses over a period, highlighting the importance of accurate cash counts. Discrepancies in cash counts can directly affect the figures reported in the Profit and Loss Statement, making both documents essential for sound financial management.

Finally, the Sales Receipt serves a similar function as the Cash Drawer Count Sheet by providing proof of transactions. Each receipt documents a sale, indicating the amount of cash received. When combined with the Cash Drawer Count Sheet, businesses can verify that the cash in the drawer matches the total of all sales receipts issued. This alignment is crucial for ensuring accurate record-keeping and financial accountability.

Instructions on Writing Cash Drawer Count Sheet

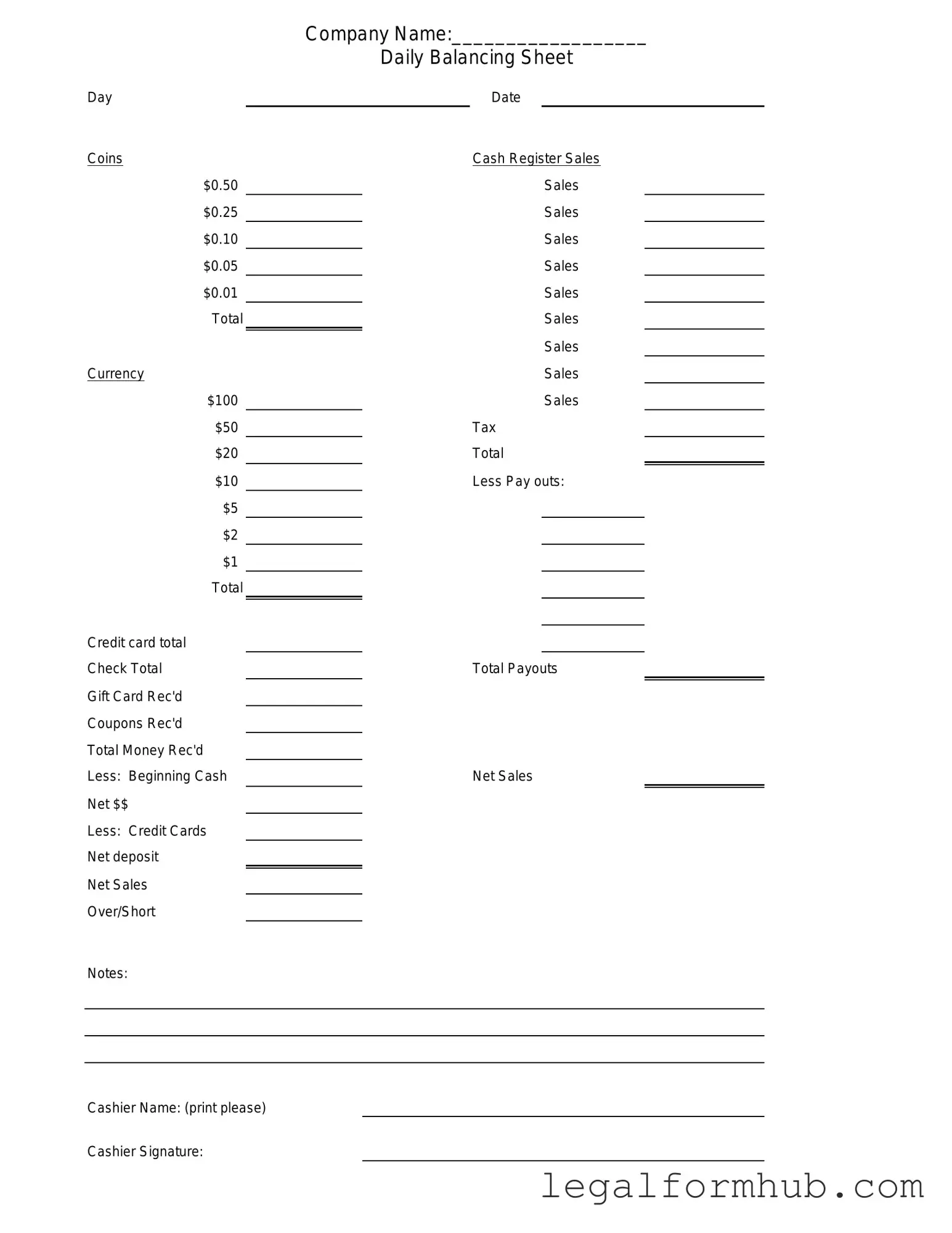

Once you have the Cash Drawer Count Sheet form ready, you can proceed to fill it out accurately. This process ensures that you maintain proper records of cash transactions and balances. Follow the steps below to complete the form effectively.

- Begin by entering the date at the top of the form.

- In the designated section, write your name or the name of the person responsible for the cash drawer count.

- Record the starting cash balance in the appropriate field.

- List all denominations of cash in the provided columns. Include the number of each type of bill and coin.

- Calculate the total amount for each denomination and write it in the total column.

- Add all totals together to find the overall cash amount in the drawer.

- Compare the overall cash amount with the expected balance. Note any discrepancies in the remarks section.

- Finally, sign and date the form to verify the count.

Misconceptions

Misconceptions about the Cash Drawer Count Sheet form can lead to confusion and errors in financial reporting. Here are seven common misconceptions:

- It is only for cash transactions. Many believe the Cash Drawer Count Sheet is solely for recording cash. In reality, it can also track checks, credit card payments, and other forms of payment.

- Only managers need to complete it. Some think that only managers are responsible for filling out the form. However, all employees handling cash should be familiar with it to ensure accuracy.

- It is not necessary for small businesses. Many small business owners feel that they can skip this form due to their size. Yet, regular counts help maintain financial integrity, regardless of business size.

- It is only used at the end of the day. Some assume that the Cash Drawer Count Sheet is only needed for end-of-day reconciliation. In fact, it can be useful throughout the day for monitoring cash flow.

- All cash drawers are the same. A common belief is that all cash drawers function identically. In truth, different businesses may have unique requirements, necessitating tailored count sheets.

- It does not need to be reviewed. Some think that once the form is filled out, it is final. Regular reviews and audits of the count sheets can help catch discrepancies early.

- It is too complicated to use. Many believe that the Cash Drawer Count Sheet is overly complex. In reality, it is designed to be straightforward and user-friendly, facilitating accurate reporting.

Key takeaways

Using the Cash Drawer Count Sheet form effectively can streamline cash management and enhance accountability. Here are some key takeaways to keep in mind:

- Ensure accuracy: Always double-check your counts to prevent discrepancies. An accurate count protects against potential losses.

- Document clearly: Fill out all required fields legibly. This helps maintain clarity and ensures that anyone reviewing the sheet can easily understand the information.

- Use it consistently: Regularly use the Cash Drawer Count Sheet at the beginning and end of each shift. Consistency fosters trust and reliability in cash handling procedures.

- Keep records: Retain completed sheets for future reference. Having a record can be invaluable for audits or resolving discrepancies.

File Information

| Fact Name | Description |

|---|---|

| Purpose | The Cash Drawer Count Sheet is used to document the cash and other forms of payment in a cash drawer at the end of a business day. |

| Importance | This form helps ensure accurate financial reporting and assists in identifying discrepancies in cash handling. |

| Components | Typically, the form includes sections for recording the total cash, checks, credit card receipts, and any other payment methods. |

| Frequency of Use | Businesses usually complete the Cash Drawer Count Sheet daily, often at the close of business. |

| Record Keeping | Maintaining these sheets is essential for audits and financial reviews, providing a clear trail of cash transactions. |

| State-Specific Requirements | Some states may have specific laws governing the handling of cash and record-keeping, which can impact how this form is used. |

| Governing Laws | For example, California's Business and Professions Code may outline requirements for cash management in retail environments. |

| Signature Requirement | It is common for the form to require the signature of the individual completing the count, ensuring accountability. |

| Training | Employees handling cash should receive training on how to accurately complete the Cash Drawer Count Sheet. |

| Software Integration | Many businesses now use point-of-sale systems that can integrate cash counting features, streamlining the process. |