Free Real Estate Purchase Agreement Template for California

Create Other Popular Real Estate Purchase Agreement Forms for Different States

Purchase Contract for Home - The purchase agreement serves as the foundation for the property’s sale closing.

North Carolina Realtors - It can include clauses related to repairs and property disclosures.

Utilizing a Durable Power of Attorney form guide can help you ensure that your interests are represented when you cannot personally make decisions. This document plays a crucial role in safeguarding your preferences regarding healthcare and financial matters, providing peace of mind for you and your loved ones.

Ga Realtor Forms - Allows for the property inspection and any required buyer rights.

Similar forms

The California Residential Purchase Agreement is similar to the Commercial Purchase Agreement. Both documents outline the terms of a property sale, including the purchase price, financing arrangements, and contingencies. While the Residential Purchase Agreement is tailored for residential properties, the Commercial Purchase Agreement is designed for business properties. Each agreement serves to protect the interests of the buyer and seller, ensuring that all parties are aware of their rights and obligations throughout the transaction.

Another similar document is the Lease Agreement. While a Lease Agreement typically governs the rental of a property, it shares many similarities with a Purchase Agreement in terms of outlining the terms and conditions of property use. Both documents specify the parties involved, property details, and payment terms. However, a Purchase Agreement results in ownership transfer, whereas a Lease Agreement maintains the property owner's rights while allowing another party to use the property for a specified period.

If you find yourself in a situation where you need to justify an absence due to health reasons, a Doctors Excuse Note can be essential. This document serves to confirm your medical condition and is often required by employers or schools to validate your absence. To efficiently complete this form, you can visit Fill PDF Forms for guidance and assistance.

The Option to Purchase Agreement is also closely related. This document grants a potential buyer the exclusive right to purchase a property at a predetermined price within a specified timeframe. Like the Purchase Agreement, it details the terms of the transaction but does not finalize the sale until the buyer exercises their option. This agreement allows buyers to secure a property while they decide whether to proceed with the purchase.

The Seller Financing Agreement is another similar document. In situations where the seller agrees to finance the buyer's purchase, this agreement outlines the terms of the loan. It specifies the interest rate, repayment schedule, and consequences of default. While the Real Estate Purchase Agreement focuses on the sale itself, the Seller Financing Agreement provides the financial framework that enables the transaction to occur, ensuring both parties understand their financial commitments.

Lastly, the Escrow Agreement bears similarities to the Purchase Agreement. An Escrow Agreement is established to hold funds and documents during the transaction process. It outlines the responsibilities of the escrow agent and the conditions under which the funds will be released. While the Purchase Agreement details the sale terms, the Escrow Agreement ensures that all conditions are met before the transaction is completed, providing a layer of security for both the buyer and seller.

Instructions on Writing California Real Estate Purchase Agreement

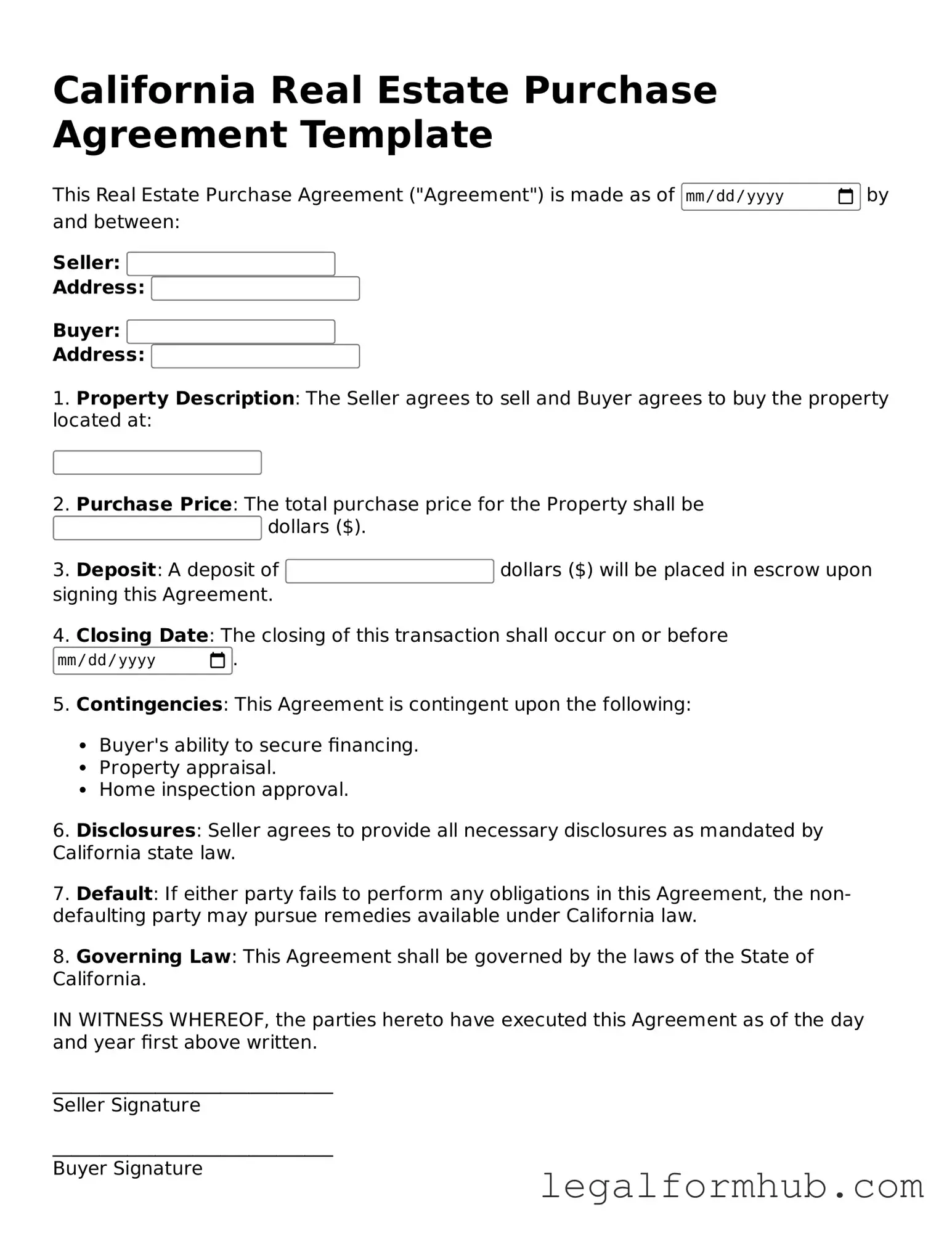

Completing the California Real Estate Purchase Agreement form is a crucial step in the home buying process. This form serves as a legally binding contract between the buyer and seller, outlining the terms of the sale. It is essential to fill it out accurately to ensure a smooth transaction. Below are the necessary steps to guide you through the process.

- Obtain the Form: Acquire the California Real Estate Purchase Agreement form. This can be done through a real estate agent, online resources, or legal offices.

- Fill in Buyer Information: Enter the full names and contact information of all buyers involved in the transaction.

- Fill in Seller Information: Provide the full names and contact details of the sellers.

- Property Description: Clearly describe the property being sold, including the address, legal description, and any additional details that may be relevant.

- Purchase Price: Specify the agreed-upon purchase price for the property.

- Deposit Amount: Indicate the amount of the initial deposit that the buyer will provide upon acceptance of the offer.

- Financing Terms: Detail how the buyer intends to finance the purchase, whether through a loan or cash payment.

- Closing Date: Set a proposed closing date for the transaction, when the title will transfer from the seller to the buyer.

- Contingencies: Include any contingencies that must be met for the sale to proceed, such as home inspections or financing approval.

- Signatures: Ensure that all parties involved sign the agreement, including any necessary witnesses or notaries.

Once the form is completed, it is advisable to review it thoroughly for accuracy. After all parties have signed, the agreement can be submitted to the appropriate parties for further processing. This step is vital in moving forward with the real estate transaction.

Misconceptions

Understanding the California Real Estate Purchase Agreement (RPA) is crucial for anyone involved in buying or selling property in the state. However, several misconceptions can lead to confusion. Here’s a list of common misunderstandings:

- The RPA is a standard form that can be used for any type of real estate transaction. This is not true. The RPA is specifically designed for residential real estate transactions and may not be suitable for commercial properties or other types of real estate deals.

- All terms in the RPA are negotiable. While many terms can be negotiated, certain legal requirements and standard practices must be adhered to. Understanding which elements can be changed is essential.

- Once signed, the RPA is final and cannot be altered. This misconception is misleading. Parties involved can amend the agreement if both agree to the changes, but it must be documented properly.

- The RPA protects the buyer more than the seller. The RPA is designed to protect both parties. It outlines obligations and rights, ensuring that both buyers and sellers are treated fairly.

- You don’t need a real estate agent to complete an RPA. While it's possible to fill out the RPA without an agent, having professional assistance can help avoid costly mistakes and ensure compliance with local laws.

- All contingencies must be removed before the RPA is signed. This is a misunderstanding. Contingencies can be included in the agreement to protect buyers, such as financing or inspection contingencies, and can be negotiated.

- The RPA guarantees the sale will go through. The RPA does not guarantee a transaction will be completed. Various factors, such as financing issues or inspection results, can derail a sale.

- You can use the RPA to make verbal agreements. Any verbal agreements should be documented in writing within the RPA. Relying solely on verbal agreements can lead to misunderstandings and disputes.

Being aware of these misconceptions can help individuals navigate the real estate process more effectively. Proper understanding of the RPA is key to a successful transaction.

Key takeaways

When filling out and using the California Real Estate Purchase Agreement form, it is important to understand several key points to ensure a smooth transaction. Here are some essential takeaways:

- Accuracy is Crucial: Ensure that all information, including names, addresses, and property details, is filled out accurately. Mistakes can lead to legal complications.

- Understand the Terms: Familiarize yourself with the terms and conditions outlined in the agreement. This includes the purchase price, contingencies, and closing date.

- Contingencies Matter: Pay attention to contingencies such as inspections, financing, and appraisal. These protect your interests and allow you to back out if certain conditions are not met.

- Review Deadlines: Be aware of important deadlines for submitting offers, responses, and completing contingencies. Missing these dates can jeopardize the transaction.

- Seek Professional Guidance: Consider consulting with a real estate agent or attorney. Their expertise can help navigate the complexities of the agreement and ensure compliance with California laws.

File Overview

| Fact Name | Description |

|---|---|

| Purpose | The California Real Estate Purchase Agreement is a legally binding document used to outline the terms of a property sale between a buyer and a seller. |

| Governing Law | This agreement is governed by the laws of the State of California, specifically under the California Civil Code. |

| Parties Involved | The agreement includes the names and contact information of both the buyer and the seller. |

| Property Description | A detailed description of the property being sold is required, including the address and any relevant legal descriptions. |

| Purchase Price | The total purchase price must be clearly stated, along with any deposit amounts and financing terms. |

| Contingencies | Buyers can include contingencies, such as financing, inspections, and appraisals, which must be met for the sale to proceed. |

| Closing Date | The agreement specifies a closing date, which is the date when the property transfer is finalized. |

| Disclosures | Sellers are required to disclose any known defects or issues with the property, as mandated by California law. |

| Signatures | Both parties must sign the agreement for it to be valid and enforceable. |

| Standardized Form | The California Real Estate Purchase Agreement is often based on standardized forms provided by real estate associations to ensure consistency. |