Free Quitclaim Deed Template for California

Create Other Popular Quitclaim Deed Forms for Different States

How to Gift a House to a Family Member - In family matters, this form can secure property interests during life events like marriage or death.

Quit Claim Deed Form Texas - Quitclaim Deeds can be used to transfer property interests in trusts or estates.

For those looking to safeguard their wishes, the process of obtaining a Durable Power of Attorney document can provide peace of mind, ensuring that a trusted individual can make important decisions on your behalf in times of need.

Quick Deed Michigan - Quitclaim Deeds can also clarify ownership changes between business partners.

Quitclaim Deed Georgia - Quitclaim deeds can sometimes be filed in public records to provide notice of the ownership change.

Similar forms

The Grant Deed is a document often compared to the Quitclaim Deed. Both serve the purpose of transferring ownership of real property from one party to another. However, the Grant Deed provides a guarantee that the property has not been sold to anyone else and that it is free from any undisclosed encumbrances. This added assurance can be important for buyers who want to ensure their investment is secure.

The Warranty Deed is another document that shares similarities with the Quitclaim Deed. Like the Quitclaim Deed, it transfers property ownership. However, the Warranty Deed offers the highest level of protection to the buyer. It guarantees that the seller holds clear title to the property and is responsible for any legal issues that may arise regarding ownership. This makes it a preferred choice for many real estate transactions.

The Bargain and Sale Deed is also comparable to the Quitclaim Deed, as it conveys property rights without warranties. While it does not guarantee a clear title, it implies that the seller has an interest in the property being sold. This type of deed is often used in foreclosure sales or tax sales, where the seller may not have full knowledge of the property's history.

If you're considering applying for a position at Chick Fil A, it's important to understand the application process, which requires filling out the Chick Fil A Job Application form to collect necessary details. To get started, you can easily access the application online. For more convenience, you can visit Fill PDF Forms to help you with your submissions and ensure a smooth application experience.

A Special Purpose Deed, such as a Trustee’s Deed, shares some characteristics with the Quitclaim Deed. This type of deed is used to transfer property held in a trust. While it may not provide the same level of assurance as a Warranty Deed, it still serves the function of transferring ownership. The key difference lies in the context of the transfer, as it often involves a fiduciary duty to act in the best interest of the beneficiaries.

The Deed of Trust is another document that can be likened to the Quitclaim Deed. While it primarily serves as a security instrument for a loan, it does involve the transfer of property rights. In this case, the borrower conveys the property to a trustee, who holds the title until the loan is paid off. If the borrower defaults, the trustee can sell the property to satisfy the debt.

The Affidavit of Death of Joint Tenant is a document that may come into play after the use of a Quitclaim Deed. When one joint tenant passes away, this affidavit can be used to remove their name from the title, effectively transferring full ownership to the surviving tenant. It simplifies the process of property transfer without the need for probate, similar to how a Quitclaim Deed transfers ownership without warranties.

The Life Estate Deed is another document that bears resemblance to the Quitclaim Deed. This deed allows a property owner to transfer ownership while retaining the right to use the property for the duration of their life. Upon the owner's death, the property automatically transfers to the designated beneficiary. Like the Quitclaim Deed, it facilitates the transfer of interest but with specific conditions attached.

Finally, the Partition Deed is similar in function to the Quitclaim Deed, as it is used to divide property among co-owners. When co-owners decide to separate their interests in a property, a Partition Deed can be executed to clarify ownership of the divided portions. This deed, like the Quitclaim Deed, does not provide warranties regarding the title, focusing instead on the division of interests.

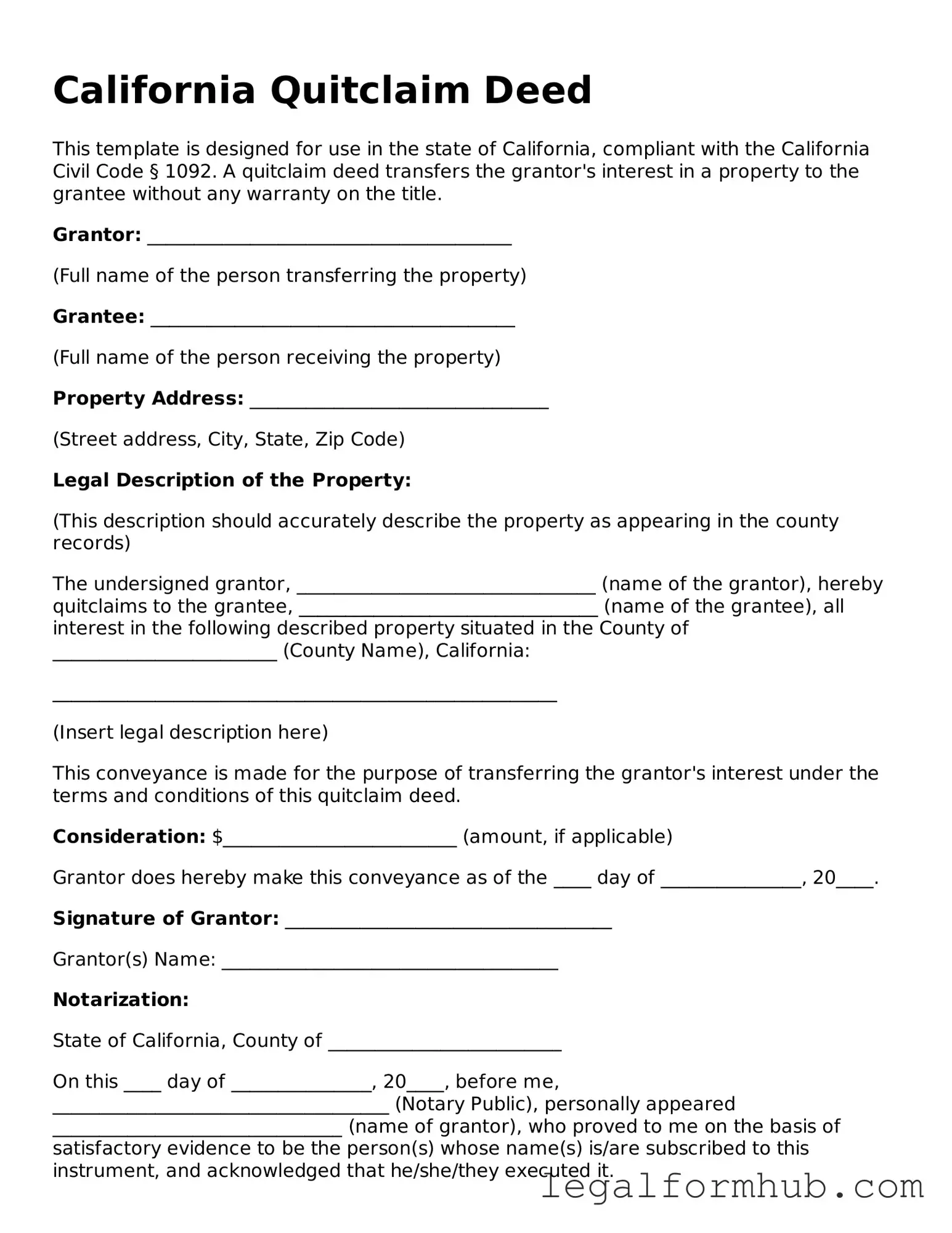

Instructions on Writing California Quitclaim Deed

After completing the California Quitclaim Deed form, the next step involves ensuring the document is properly executed and recorded with the county recorder's office. This process helps to officially transfer property rights from one party to another.

- Obtain the California Quitclaim Deed form. This can be done online or at a local office supply store.

- Fill in the names of the grantor (the person transferring the property) and the grantee (the person receiving the property) at the top of the form.

- Provide the property address in the designated section. Include the complete street address, city, and zip code.

- Include a legal description of the property. This may be found on the original deed or through county records.

- Indicate the amount of consideration paid for the property, if applicable. If no payment is made, state “love and affection” or similar wording.

- Sign the form in the presence of a notary public. The notary will verify identities and witness the signing.

- Fill out the notary acknowledgment section, which includes the notary’s signature, seal, and date.

- Make copies of the completed deed for your records.

- Submit the original Quitclaim Deed to the county recorder’s office for recording. Pay any required recording fees.

Misconceptions

Understanding the California Quitclaim Deed form is essential for anyone involved in property transactions. However, several misconceptions often arise. Below is a list of common misunderstandings about this legal document.

- A Quitclaim Deed transfers ownership of property. Many believe that a quitclaim deed guarantees ownership transfer. In reality, it only transfers the grantor's interest in the property, if any exists.

- Quitclaim Deeds are only for divorces. While they are commonly used in divorce settlements, quitclaim deeds can be utilized in various situations, such as transferring property between family members or in estate planning.

- A Quitclaim Deed eliminates all liens and debts on the property. This is incorrect. A quitclaim deed does not remove any existing liens or debts. The new owner may still be responsible for these obligations.

- Quitclaim Deeds are only for individuals. Businesses and organizations can also use quitclaim deeds to transfer property interests.

- Notarization is not required for a Quitclaim Deed. In California, a quitclaim deed must be notarized to be valid and enforceable.

- All Quitclaim Deeds are the same. There are different forms and requirements based on the specific situation and jurisdiction. It’s important to use the correct form for your needs.

- Using a Quitclaim Deed is a fast way to sell property. A quitclaim deed does not equate to a sale. It merely transfers interest without a sale transaction, which can lead to complications.

- A Quitclaim Deed does not need to be recorded. While it is not mandatory to record a quitclaim deed, doing so protects the new owner's interests and provides public notice of the transfer.

- Quitclaim Deeds are only for residential properties. This form can be used for any type of property, including commercial and industrial real estate.

- Legal advice is unnecessary when using a Quitclaim Deed. While some may feel confident handling the process alone, consulting a legal expert can help avoid potential pitfalls and ensure compliance with local laws.

By addressing these misconceptions, individuals can better understand the role of a quitclaim deed in property transactions and make informed decisions.

Key takeaways

Filling out and using a California Quitclaim Deed form can seem daunting, but understanding the essentials can simplify the process. Here are some key takeaways to keep in mind:

- Purpose of the Quitclaim Deed: This form is primarily used to transfer ownership of property from one party to another without guaranteeing that the title is clear. It’s often used in situations like divorce or transferring property between family members.

- Completing the Form: Ensure that all required fields are filled out accurately. This includes the names of the grantor (the person giving up the property) and the grantee (the person receiving the property), along with a clear description of the property.

- Notarization Requirement: A Quitclaim Deed must be signed in front of a notary public to be valid. This step is crucial, as it helps prevent fraud and confirms the identities of those involved in the transaction.

- Recording the Deed: After the form is completed and notarized, it should be recorded with the county recorder’s office where the property is located. This step is vital to make the transfer official and to protect the new owner’s rights.

By following these key points, you can navigate the process of using a Quitclaim Deed with confidence. Always consider seeking professional advice if you have specific questions or concerns about your situation.

File Overview

| Fact Name | Description |

|---|---|

| Definition | A California Quitclaim Deed is a legal document used to transfer ownership of real property from one party to another without any warranties regarding the property’s title. |

| Governing Law | This form is governed by California Civil Code Sections 1091 and 1092, which outline the requirements for property transfers in the state. |

| Purpose | It is commonly used among family members or in situations where the grantor does not want to guarantee the title, such as in divorce settlements or gifting property. |

| Signature Requirements | The deed must be signed by the grantor in the presence of a notary public to ensure its validity. |

| Recording | To make the transfer official, the Quitclaim Deed must be recorded with the county recorder's office where the property is located. |