Free Promissory Note Template for California

Create Other Popular Promissory Note Forms for Different States

Loan Agreement Template Texas - Borrowers may be asked to provide a personal guarantee as part of the note's terms.

Obtaining an Emotional Support Animal Letter is an important step for those seeking to improve their mental well-being, and you can start this process by using the form provided at Fill PDF Forms, ensuring you have the proper documentation for your support animal needs.

Create Promissory Note - Interest rates in the Note can vary depending on the agreement between the parties.

Similar forms

The California Promissory Note is similar to a Loan Agreement. Both documents outline the terms of a loan, including the amount borrowed, interest rate, and repayment schedule. A Loan Agreement typically provides a more detailed framework, including clauses about default, collateral, and responsibilities of both parties. However, like the Promissory Note, it serves to formalize the borrowing arrangement and ensure that both parties understand their obligations.

Another document akin to the California Promissory Note is a Mortgage. While a Promissory Note represents a promise to repay a loan, a Mortgage secures that loan against real property. The Mortgage includes the terms of the loan and provides the lender with rights to the property if the borrower defaults. Both documents work together in real estate transactions to protect the lender’s interests while detailing the borrower’s commitments.

A Credit Agreement also shares similarities with the California Promissory Note. This document outlines the terms under which a borrower can access credit from a lender. Like a Promissory Note, it specifies the amount, interest rate, and repayment terms. However, a Credit Agreement often includes provisions for ongoing borrowing and may cover multiple transactions, while a Promissory Note is typically for a single loan.

The California Promissory Note can also be compared to an IOU. An IOU is a simple acknowledgment of a debt, indicating that one party owes money to another. While it lacks the formal structure and detailed terms of a Promissory Note, it serves a similar purpose of documenting a debt. Both documents signify a borrower’s obligation to repay, though an IOU is less enforceable in a legal context.

For those navigating legal documents, understanding the details surrounding a "Hold Harmless Agreement" can be crucial. This agreement plays a significant role in ensuring you are protected from liabilities that may arise during specific activities. To gain further insight, consider exploring this helpful overview of the Hold Harmless Agreement.

Lastly, a Secured Note is another document that resembles the California Promissory Note. A Secured Note includes a promise to repay a loan, but it also specifies collateral that the lender can claim if the borrower defaults. This adds an extra layer of security for the lender, similar to how a Mortgage secures a loan against real estate. Both documents emphasize the importance of repayment while providing different levels of protection for the lender.

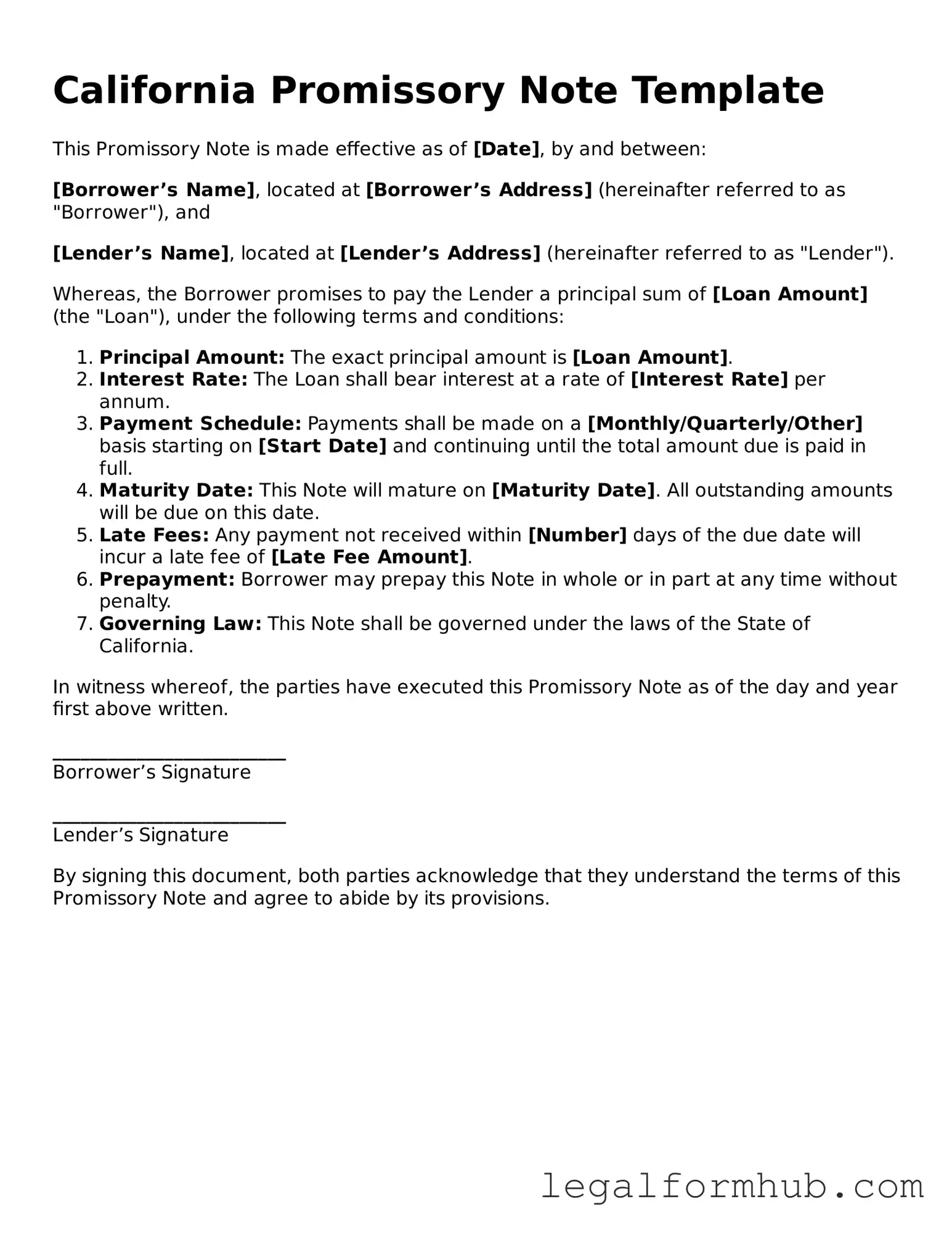

Instructions on Writing California Promissory Note

Completing the California Promissory Note form is an important step in formalizing a loan agreement between a borrower and a lender. Once the form is filled out correctly, both parties should retain a copy for their records. Below are the steps to guide you through the process of filling out the form.

- Begin by entering the date at the top of the form. This date marks when the agreement is made.

- Next, fill in the name and address of the borrower. Ensure that all details are accurate.

- Provide the name and address of the lender. This information is crucial for identifying the parties involved.

- Specify the principal amount of the loan. This is the total amount borrowed, without interest.

- Indicate the interest rate, if applicable. Clearly state whether it is a fixed or variable rate.

- Define the repayment terms. Include the payment schedule, such as monthly or quarterly payments, and the duration of the loan.

- Include any late fees or penalties for missed payments. This section outlines the consequences of default.

- Sign and date the form. Both the borrower and lender must sign to validate the agreement.

- Make copies of the signed form for both parties. Retain these copies for future reference.

Misconceptions

Understanding the California Promissory Note form can be challenging, especially with several misconceptions surrounding it. Here are five common misunderstandings:

-

All Promissory Notes Must Be Notarized. Many people believe that a promissory note must be notarized to be valid. In California, notarization is not a requirement for a promissory note to be enforceable. However, having a notary can provide an extra layer of authenticity.

-

Promissory Notes Are Only for Large Loans. Some think that promissory notes are only necessary for significant financial transactions. In reality, they can be used for any amount of money, whether it’s a small personal loan or a large business transaction.

-

Interest Rates Must Be Included. Another misconception is that all promissory notes must include an interest rate. While many do, it is not a legal requirement. A note can be structured as an interest-free loan if both parties agree.

-

Promissory Notes Are the Same as IOUs. Some people confuse promissory notes with IOUs. While both documents acknowledge a debt, a promissory note is a formal contract that includes specific terms, such as repayment schedules and interest rates.

-

They Are Only for Personal Loans. Lastly, there is a belief that promissory notes are only used in personal lending situations. In fact, they are commonly used in business transactions, real estate deals, and various other financial agreements.

Recognizing these misconceptions can help individuals navigate the complexities of promissory notes more effectively.

Key takeaways

When filling out and using the California Promissory Note form, keep the following key takeaways in mind:

- Understand the Basics: A promissory note is a written promise to pay a specified amount of money at a designated time.

- Identify the Parties: Clearly state the names and addresses of both the borrower and the lender to avoid confusion.

- Specify the Loan Amount: Clearly indicate the principal amount being borrowed. This number should be accurate and easy to find.

- Outline Interest Rates: If applicable, specify the interest rate. Ensure that it complies with California usury laws.

- Set the Repayment Terms: Define the repayment schedule, including due dates and payment amounts. Be clear about whether payments are monthly, quarterly, or on another schedule.

- Include Late Fees: If there are penalties for late payments, state these fees explicitly to avoid disputes later.

- Signatures Matter: Both parties must sign the document for it to be legally binding. Ensure that signatures are dated.

- Keep Copies: After signing, both parties should retain copies of the promissory note for their records. This helps in tracking payments and resolving any future issues.

File Overview

| Fact Name | Details |

|---|---|

| Definition | A California Promissory Note is a written promise to pay a specified amount of money to a designated person or entity at a future date. |

| Governing Law | The California Civil Code governs promissory notes in California, specifically Sections 3300-3400. |

| Parties Involved | Typically, there are two parties: the borrower (maker) and the lender (payee). |

| Interest Rate | The note can specify an interest rate, which can be fixed or variable, as agreed upon by the parties. |

| Repayment Terms | Repayment terms, including the due date and payment schedule, should be clearly outlined in the note. |

| Secured vs. Unsecured | A promissory note can be secured by collateral or be unsecured, depending on the agreement. |

| Default Consequences | The note should include consequences for default, such as late fees or acceleration of the debt. |

| Transferability | Promissory notes can often be transferred or assigned to another party, unless stated otherwise. |

| Legal Enforceability | For a promissory note to be legally enforceable, it must contain essential elements like the amount, terms, and signatures of the parties. |