Free Prenuptial Agreement Template for California

Create Other Popular Prenuptial Agreement Forms for Different States

Texas Premarital Agreement - A prenup should be created before the marriage, not after.

When engaging in the sale or purchase of a motorcycle, it is important to properly document the transaction with the Arizona Motorcycle Bill of Sale. This legal form not only confirms the transfer of ownership but also helps safeguard both parties by detailing critical information, including the buyer's and seller's contact details, motorcycle specifications, and agreed sale price. For those looking to streamline this process, you can find a useful template at https://arizonapdfs.com/motorcycle-bill-of-sale-template.

Ohio Premarital Agreement - This form includes provisions for debt liability and management.

North Carolina Premarital Agreement - It can mitigate the emotional impact of divorce by establishing predefined terms for asset division.

Similar forms

The California Prenuptial Agreement form shares similarities with a Cohabitation Agreement. Both documents are designed to outline the financial and property rights of partners. A Cohabitation Agreement is often utilized by couples who live together but are not married, allowing them to define how assets will be divided in case of separation. Like a prenuptial agreement, it requires full disclosure of assets and liabilities, ensuring both parties are informed and protected.

An Estate Plan is another document that parallels a Prenuptial Agreement. While a Prenuptial Agreement focuses on asset division during marriage or divorce, an Estate Plan addresses what happens to those assets after death. Both documents require careful consideration of assets and beneficiaries. They provide clarity and direction, helping to prevent disputes among surviving family members.

A Separation Agreement also shares characteristics with a Prenuptial Agreement. This document is used when a couple decides to live apart but not necessarily divorce. It details the rights and obligations of each party during the separation. Like a prenuptial agreement, it can cover financial matters, property division, and child custody arrangements, providing a framework for both parties to follow.

To ensure a smooth transaction when transferring trailer ownership, it is essential to accurately complete the necessary documents. The California Trailer Bill of Sale is one such document that serves to formalize this transfer and protect the interests of both parties involved. For those looking to fill out this critical form, you can easily access and complete it through Fill PDF Forms.

Similar to a Prenuptial Agreement, a Postnuptial Agreement is created by couples who are already married. It serves a similar purpose in that it outlines the financial arrangements and property rights of each spouse. A Postnuptial Agreement may be necessary when circumstances change, such as one spouse receiving a significant inheritance. Both agreements require mutual consent and understanding of the terms involved.

A Business Partnership Agreement can also be compared to a Prenuptial Agreement. This document outlines the roles, responsibilities, and financial arrangements between business partners. Just as a prenuptial agreement delineates the assets and liabilities of each spouse, a Business Partnership Agreement specifies the contributions and profit-sharing of each partner. Both documents aim to minimize conflicts and provide clarity in the event of a dispute.

A Living Trust shares some similarities with a Prenuptial Agreement in terms of asset management. A Living Trust allows individuals to specify how their assets should be managed during their lifetime and distributed after death. Both documents require careful planning and consideration of assets, ensuring that the intentions of the parties involved are clearly articulated and legally binding.

A Will is another document that parallels a Prenuptial Agreement. While a Prenuptial Agreement addresses asset division during marriage or divorce, a Will specifies how a person's assets will be distributed upon their death. Both documents require clear communication and understanding of asset ownership. They help to ensure that the wishes of the individuals involved are respected and upheld.

Finally, a Financial Disclosure Statement is similar to a Prenuptial Agreement in that it requires both parties to disclose their financial situations. This document is often used in divorce proceedings to ensure transparency regarding assets and debts. Like a prenuptial agreement, it is essential for both parties to fully understand each other's financial standing to make informed decisions about asset division.

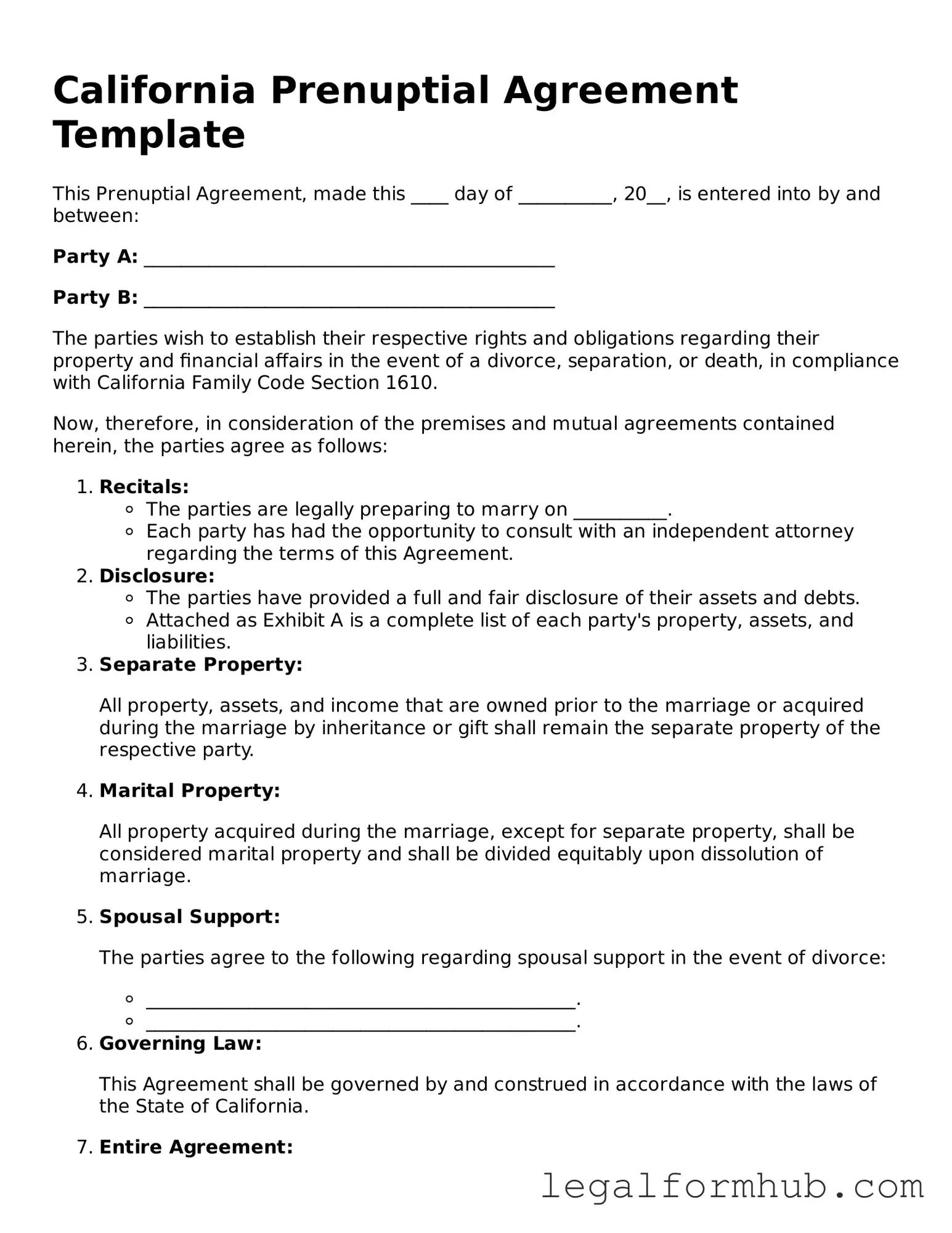

Instructions on Writing California Prenuptial Agreement

Completing the California Prenuptial Agreement form requires careful attention to detail and clear communication between both parties. After gathering all necessary information, you will be able to accurately fill out the form to reflect your intentions and agreements.

- Begin by obtaining the official California Prenuptial Agreement form. You can find this form online or through legal resources.

- Read through the entire form to understand the sections and requirements before filling it out.

- In the first section, provide your full legal names and addresses. Ensure that both parties’ information is accurate and current.

- Next, outline the assets and debts each party is bringing into the marriage. This may include bank accounts, real estate, and personal property.

- Clearly state how you wish to handle these assets and debts during the marriage and in the event of a divorce.

- Discuss and agree upon any spousal support terms. Document any agreements regarding financial support in case of separation.

- Both parties should review the completed form for accuracy and clarity. Make any necessary corrections.

- Once satisfied with the content, both parties must sign the document in the presence of a notary public to ensure its validity.

- Keep copies of the signed agreement for your records. It’s advisable to provide a copy to each party involved.

Misconceptions

Understanding prenuptial agreements can be challenging, especially when misconceptions abound. Here are ten common misconceptions about the California Prenuptial Agreement form, along with clarifications to help you navigate this important topic.

- Prenuptial agreements are only for the wealthy. Many people believe that only those with significant assets need a prenuptial agreement. In reality, anyone can benefit from one, regardless of their financial status. A prenup can help clarify financial responsibilities and protect individual interests.

- Prenuptial agreements are unromantic. While some may view a prenup as a lack of trust, it can actually foster open communication about finances. Discussing expectations can strengthen a relationship, promoting transparency and understanding.

- A prenuptial agreement is not legally binding. When properly drafted and executed, a prenuptial agreement is enforceable in California. It must meet specific legal requirements, including full disclosure of assets and voluntary agreement by both parties.

- Prenuptial agreements can cover anything. While a prenup can address many financial matters, it cannot dictate child custody or support arrangements. Courts prioritize the best interests of the child in these cases, regardless of what the prenup states.

- You cannot change a prenuptial agreement after marriage. It is possible to modify a prenuptial agreement after marriage, but both parties must agree to the changes. This process often requires a new written agreement, ensuring both parties are informed and consenting.

- Prenuptial agreements are only for first marriages. Individuals entering second or subsequent marriages often find prenuptial agreements beneficial as well. They can help protect existing assets and clarify financial arrangements with children from previous relationships.

- A prenup guarantees a fair division of assets. While a prenuptial agreement can outline how assets will be divided, fairness is subjective. Both parties should ensure that the terms are reasonable and mutually agreeable to avoid disputes later.

- Prenuptial agreements are only for divorce situations. Beyond divorce, a prenup can provide clarity during the marriage. It can help manage financial expectations and responsibilities, reducing potential conflicts over money during the relationship.

- All prenups are the same. Each prenuptial agreement is unique and should be tailored to the specific needs and circumstances of the couple. Factors such as income, assets, and individual goals can all influence the terms of the agreement.

- You don’t need a lawyer for a prenuptial agreement. While it is possible to create a prenup without legal assistance, having a lawyer is highly recommended. An attorney can ensure that the agreement complies with California laws and adequately protects both parties' interests.

By dispelling these misconceptions, individuals can approach prenuptial agreements with a clearer understanding and a more positive perspective. Open discussions about finances can lead to healthier relationships and greater peace of mind.

Key takeaways

When filling out and using the California Prenuptial Agreement form, keep the following key takeaways in mind:

- Ensure both parties fully disclose their financial information. Transparency is crucial for the agreement's validity.

- Each party should have independent legal representation. This helps prevent claims of coercion or unfairness later on.

- Clearly outline the terms regarding property division and spousal support. Specificity can prevent disputes in the future.

- Review the agreement regularly. Life circumstances change, and the agreement may need updates to reflect new situations.

- Sign the agreement well in advance of the wedding. Last-minute changes can lead to complications and potential challenges to the agreement's enforceability.

File Overview

| Fact Name | Description |

|---|---|

| Governing Law | The California Prenuptial Agreement is governed by the Uniform Premarital Agreement Act (UPAA), found in California Family Code Sections 1600-1617. |

| Written Requirement | To be valid, a prenuptial agreement must be in writing. Oral agreements regarding prenuptial terms are not enforceable in California. |

| Full Disclosure | Both parties must provide a fair and reasonable disclosure of their assets and liabilities. This transparency is crucial for the agreement's enforceability. |

| Voluntary Execution | Each party must enter into the agreement voluntarily, without coercion or undue influence. This ensures that both individuals have freely agreed to the terms. |