Free Loan Agreement Template for California

Create Other Popular Loan Agreement Forms for Different States

Promissory Note Template Illinois - It may include privacy provisions regarding borrower information.

For those looking to streamline the purchase or sale process, having a reliable template is vital. You can find an excellent resource for this purpose at arizonapdfs.com/motorcycle-bill-of-sale-template, which provides a comprehensive Motorcycle Bill of Sale form, ensuring all necessary details are captured to protect both parties in the transaction.

Loan Agreement Template Texas - Includes references to any promotional offers or discounts applicable to the loan.

Similar forms

The California Loan Agreement form is similar to a Promissory Note. A Promissory Note is a written promise to pay a specified amount of money to a designated person or entity at a particular time. Like the Loan Agreement, it outlines the terms of the loan, including the interest rate and repayment schedule. Both documents serve as legal evidence of the borrower's commitment to repay the loan and can be enforced in court if necessary.

Another document that shares similarities with the California Loan Agreement is the Security Agreement. This document is used when a borrower pledges collateral to secure a loan. In both cases, the terms of the loan are clearly defined, and the lender has the right to claim the collateral if the borrower defaults. This added layer of security can make lenders more willing to extend credit.

The California Loan Agreement also resembles a Mortgage Agreement. A Mortgage Agreement specifically pertains to loans used to purchase real estate. It outlines the borrower’s obligation to repay the loan and details the lender’s rights regarding the property if payments are not made. Both documents establish a legal framework for the borrowing process, ensuring that both parties understand their rights and responsibilities.

In addition, the California Loan Agreement is akin to a Line of Credit Agreement. This type of agreement allows borrowers to access funds up to a certain limit and pay interest only on the amount they use. Like the Loan Agreement, it specifies the terms of borrowing, including interest rates and repayment conditions. Both documents help borrowers manage their finances while providing lenders with a clear understanding of the loan structure.

Completing a transaction for a trailer can be simplified by utilizing the correct documentation, and for this purpose, it's essential to use the California Trailer Bill of Sale. This form not only serves as a record of the ownership transfer but also helps protect both the buyer and the seller in the process. For convenience, you can find the necessary paperwork at Fill PDF Forms, ensuring that all required details are accurately captured.

The California Loan Agreement can also be compared to a Lease Agreement, particularly when it involves financing for leasing equipment or property. A Lease Agreement outlines the terms under which one party rents property from another. Both documents include details about payment schedules and obligations, ensuring that all parties are aware of their commitments and rights throughout the duration of the agreement.

Lastly, the California Loan Agreement shares features with a Personal Loan Agreement. This document is typically used for unsecured loans made between individuals or between an individual and a financial institution. Like the Loan Agreement, it defines the loan amount, interest rate, and repayment terms. Both agreements serve to protect the interests of both the lender and the borrower, creating a clear understanding of the loan's conditions.

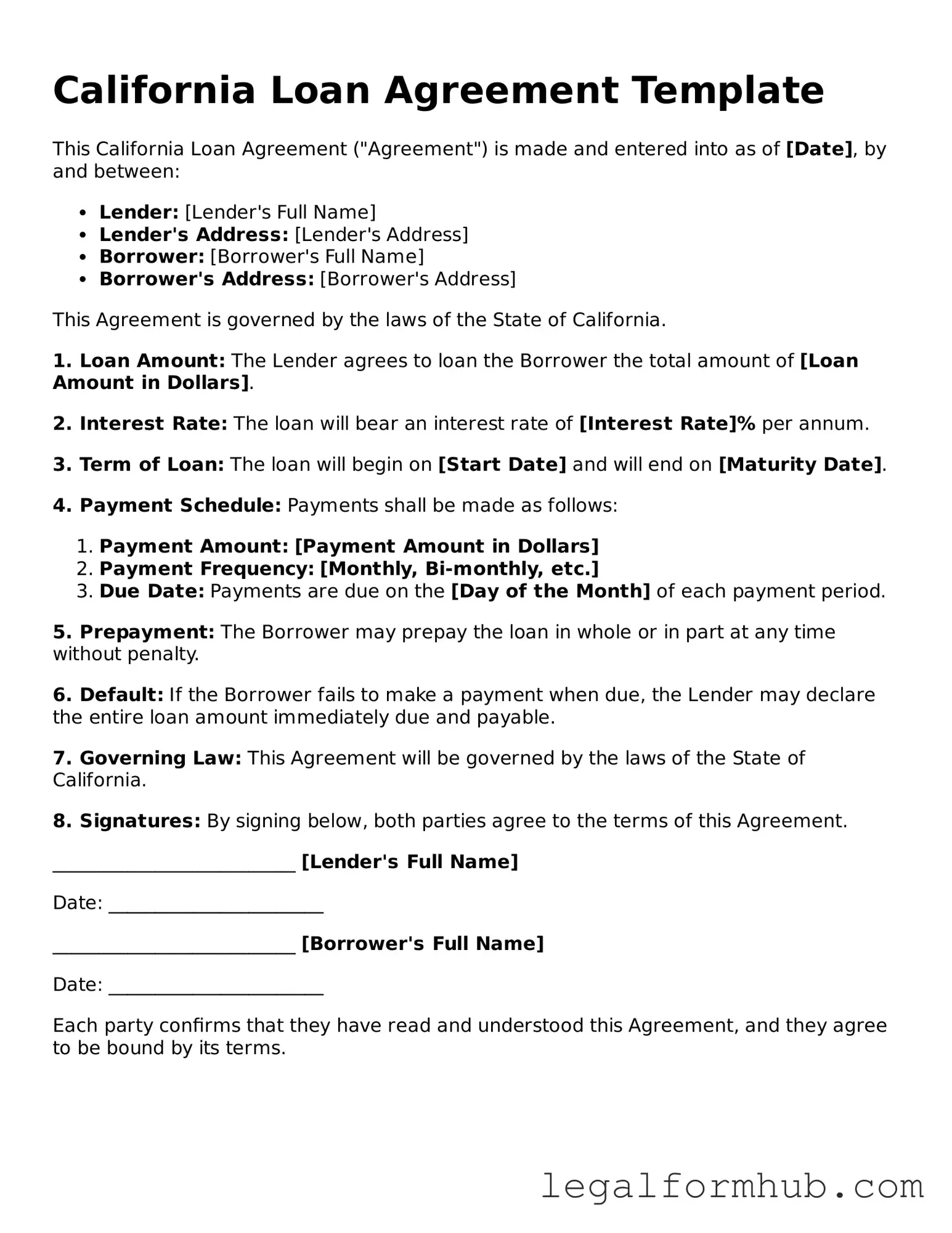

Instructions on Writing California Loan Agreement

Completing the California Loan Agreement form is an important step in formalizing a loan arrangement. This document outlines the terms and conditions of the loan, ensuring that both parties are clear on their obligations. To proceed effectively, follow the steps outlined below to ensure all necessary information is accurately captured.

- Begin by entering the date at the top of the form. This establishes when the agreement is being made.

- Next, fill in the names and addresses of both the lender and the borrower. Ensure that all details are correct to avoid any future misunderstandings.

- Specify the loan amount. This should be clearly stated in both numerical and written form to prevent any discrepancies.

- Indicate the interest rate applicable to the loan. If there are any conditions for changing the rate, include those details as well.

- Outline the repayment schedule. This includes the frequency of payments, such as weekly or monthly, and the total duration of the loan.

- Include any fees or charges associated with the loan. This might cover late fees or origination fees, and should be clearly defined.

- Describe any collateral, if applicable. If the loan is secured by an asset, provide details about that asset.

- Both parties should review the terms carefully. After ensuring that all information is accurate, proceed to sign and date the agreement.

- Finally, provide copies of the signed agreement to both the lender and the borrower for their records.

Misconceptions

-

Misconception 1: A California Loan Agreement is only for large loans.

Many people believe that loan agreements are only necessary for substantial amounts of money. In reality, a loan agreement can be beneficial for any amount. Whether the loan is for a small personal expense or a significant investment, having a written agreement helps clarify the terms and protects both parties.

-

Misconception 2: Loan agreements are only needed for formal lenders.

Some individuals think that only banks or formal lending institutions require a loan agreement. However, loan agreements are equally important for personal loans between friends or family members. A written agreement helps prevent misunderstandings and maintains relationships.

-

Misconception 3: Oral agreements are sufficient.

Many assume that an oral agreement is enough to secure a loan. While verbal agreements can be legally binding, they are often difficult to enforce. A written loan agreement provides clear documentation of the terms, reducing the risk of disputes.

-

Misconception 4: All loan agreements must be notarized.

There is a common belief that notarization is mandatory for all loan agreements. In California, notarization is not always required unless specified by the parties involved. While notarization can add an extra layer of security, it is not a legal necessity for the agreement to be valid.

-

Misconception 5: Loan agreements are only for short-term loans.

Some people think that loan agreements are only relevant for short-term loans. However, they are just as important for long-term loans. Regardless of the duration, having a loan agreement in place ensures that all terms are understood and agreed upon by both parties, regardless of the loan's length.

Key takeaways

When filling out and using the California Loan Agreement form, it is important to keep several key points in mind. Here are some essential takeaways:

- Understand the Parties Involved: Clearly identify the lender and borrower. Include their full names and addresses to avoid confusion.

- Specify the Loan Amount: Clearly state the total amount of money being loaned. This ensures that both parties agree on the financial terms.

- Outline Interest Rates: If applicable, specify the interest rate. This should be clearly defined to prevent misunderstandings later on.

- Detail Repayment Terms: Include the repayment schedule. Specify when payments are due and the method of payment.

- Include Default Terms: Define what constitutes a default. This section should outline the consequences if the borrower fails to meet the repayment terms.

- Signatures Are Essential: Both parties must sign the agreement. This formalizes the document and makes it legally binding.

- Keep Copies: After signing, ensure that both parties retain a copy of the agreement. This is important for future reference and accountability.

File Overview

| Fact Name | Details |

|---|---|

| Definition | The California Loan Agreement form outlines the terms and conditions of a loan between a lender and a borrower. |

| Governing Law | This agreement is governed by California state laws, specifically the California Civil Code. |

| Parties Involved | The form identifies the lender and the borrower, ensuring both parties are clearly defined. |

| Loan Amount | The total amount being borrowed is specified, providing clarity on the financial obligation. |

| Interest Rate | The agreement states the interest rate applicable to the loan, which can be fixed or variable. |

| Repayment Terms | Details regarding how and when the loan will be repaid are included, ensuring both parties understand the schedule. |

| Default Conditions | The form outlines what constitutes a default and the consequences that follow, protecting the lender's interests. |

| Amendments | Any changes to the agreement must be made in writing and signed by both parties, ensuring mutual consent. |

| Signatures | The agreement must be signed by both the lender and borrower to be legally binding. |