Free Last Will and Testament Template for California

Create Other Popular Last Will and Testament Forms for Different States

Last Will and Testament North Carolina - Establishes a clear intention for the distribution of estate assets.

The Employment Application PDF form is a standardized document used by employers to gather essential information about job applicants. This form typically includes sections for personal details, work history, and educational background, facilitating a streamlined hiring process. To get started, you can Fill PDF Forms and complete your application quickly.

Last Will and Testament Template Georgia - Provides an official record of the testator's intentions for after their passing.

Illinois Last Will and Testament - Should be regularly reviewed to accommodate changes in personal circumstances.

Similar forms

A Living Will is a document that outlines a person's wishes regarding medical treatment in the event they become incapacitated. Unlike a Last Will and Testament, which deals with the distribution of assets after death, a Living Will focuses on healthcare decisions. It allows individuals to specify what types of medical interventions they do or do not want, ensuring their preferences are honored when they cannot communicate them directly.

A Durable Power of Attorney is similar in that it grants someone the authority to make decisions on behalf of another person. This document is particularly important for financial matters. While a Last Will and Testament only takes effect after death, a Durable Power of Attorney is active during the person’s lifetime, allowing the designated agent to manage financial affairs if the individual is unable to do so.

A Health Care Proxy is another document that is closely related. It designates a specific person to make medical decisions on behalf of someone else when they are unable to do so. This document works alongside a Living Will. While the Living Will expresses personal wishes regarding treatment, the Health Care Proxy appoints someone to interpret and act on those wishes, providing a clear line of authority.

A Trust is a legal arrangement where one party holds property for the benefit of another. Trusts can be used to manage assets during a person's lifetime and after death. Unlike a Last Will and Testament, which goes through probate, a Trust can help avoid this process, making it a quicker and often less expensive option for asset distribution. Trusts can also provide more privacy since they do not become public records.

A Codicil is a document that allows a person to make changes to an existing Last Will and Testament. This can include adding or removing beneficiaries, changing the executor, or modifying specific bequests. A Codicil must be executed with the same formalities as a Last Will to ensure its validity, making it a convenient way to update an estate plan without creating an entirely new will.

A Power of Attorney (POA) form in Arizona is essential for individuals wishing to secure their healthcare and financial decisions. This legal document allows a person to appoint another individual to act on their behalf, which can be vital in situations where one may become incapacitated. For those interested in a more comprehensive understanding of how to create this document, further details can be found at https://arizonapdfs.com/power-of-attorney-template.

An Advance Directive combines elements of a Living Will and a Health Care Proxy. This document provides instructions for medical care and appoints someone to make decisions if the individual is unable to do so. It ensures that both personal wishes and decision-making authority are clearly outlined, making it easier for loved ones and healthcare providers to follow the individual's preferences.

A Guardianship document is essential for parents who want to designate a guardian for their minor children in the event of their death. This document ensures that children are cared for by someone the parents trust. While a Last Will addresses asset distribution, a Guardianship document focuses on the welfare and upbringing of dependents, making it a crucial part of family planning.

A Prenuptial Agreement is a contract entered into before marriage that outlines the division of assets in the event of divorce. While it serves a different purpose than a Last Will, both documents deal with the distribution of property and assets. A Prenuptial Agreement can help clarify financial responsibilities and expectations, providing peace of mind for both parties.

An Estate Plan is a broader term that encompasses various documents, including a Last Will and Testament, trusts, and powers of attorney. An Estate Plan aims to manage an individual's assets during their lifetime and after death. It ensures that a person's wishes are carried out and can help minimize taxes and legal complications, providing a comprehensive approach to financial and healthcare decisions.

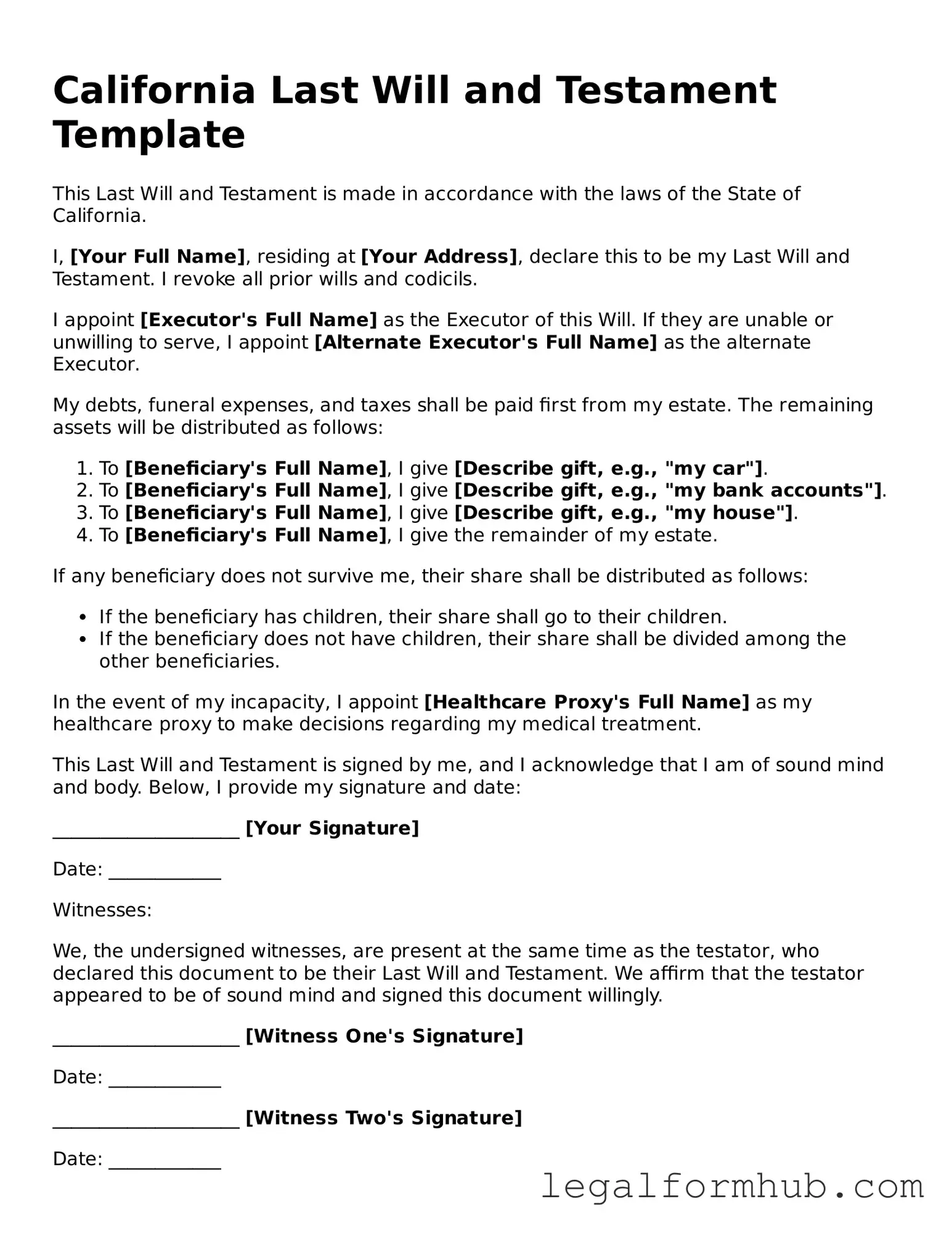

Instructions on Writing California Last Will and Testament

Completing your California Last Will and Testament is an important step in ensuring your wishes are honored after your passing. This form allows you to specify how your assets will be distributed and who will be responsible for carrying out your wishes. Below are the steps to guide you through the process of filling out this form accurately.

- Obtain the Form: Start by downloading the California Last Will and Testament form from a reliable source or visit your local courthouse to obtain a physical copy.

- Title the Document: At the top of the form, clearly label it as "Last Will and Testament."

- Personal Information: Fill in your full name, address, and date of birth in the designated sections. Ensure that all information is accurate.

- Revocation Clause: If you have any previous wills, include a statement revoking all prior wills and codicils. This clarifies your current intentions.

- Appointment of Executor: Choose an executor who will manage your estate. Provide their full name and contact information. This person should be someone you trust.

- Beneficiaries: List the names and addresses of the individuals or organizations you wish to inherit your assets. Clearly specify what each beneficiary will receive.

- Guardianship: If you have minor children, designate a guardian for them. Include the guardian's full name and relationship to you.

- Sign the Document: Sign and date the form in the presence of at least two witnesses. Ensure they also sign the document, confirming they witnessed your signature.

- Store the Will Safely: Keep the signed will in a secure location, such as a safe or a safety deposit box. Inform your executor and loved ones where it is stored.

After completing these steps, your Last Will and Testament will be ready for use. It is advisable to review the document periodically and make updates as necessary, especially after significant life changes. Always consult with a legal professional if you have questions or need assistance with specific circumstances.

Misconceptions

Understanding the California Last Will and Testament form is essential for anyone looking to plan their estate. However, several misconceptions can lead to confusion. Here are five common misunderstandings:

-

Misconception 1: A will can only be created with the help of a lawyer.

Many people believe that legal assistance is mandatory for drafting a will. While consulting a lawyer can be beneficial, individuals can create a valid will on their own, as long as they follow California's requirements.

-

Misconception 2: A will automatically goes into effect upon signing.

Some assume that signing a will makes it immediately effective. In reality, a will only takes effect after the testator's death, and it must go through the probate process before assets can be distributed.

-

Misconception 3: All assets must be included in the will.

People often think that every asset must be listed in their will. However, certain assets, such as those held in a trust or joint accounts, may not need to be included, as they pass outside of the will.

-

Misconception 4: A handwritten will is not valid in California.

While many believe that only typed wills are valid, California does recognize handwritten wills, known as holographic wills, as long as they meet specific criteria set by the state.

-

Misconception 5: Once created, a will cannot be changed.

Some individuals think that a will is permanent once it is executed. In fact, wills can be updated or revoked at any time, as long as the testator is of sound mind and follows the proper procedures.

Addressing these misconceptions can help individuals make informed decisions about their estate planning needs.

Key takeaways

Filling out and using the California Last Will and Testament form is an important step in estate planning. Here are some key takeaways to keep in mind:

- Understand the purpose: A will allows you to specify how your assets will be distributed after your death. It also lets you name guardians for your minor children.

- Eligibility: To create a valid will in California, you must be at least 18 years old and of sound mind.

- Witnesses required: California law requires that your will be signed in the presence of at least two witnesses. They must also sign the document.

- Revocation: You can revoke your will at any time by creating a new will or by physically destroying the original document.

- Consider legal advice: While you can fill out the form on your own, consulting with a legal professional can help ensure your wishes are clearly articulated and legally binding.

File Overview

| Fact Name | Description |

|---|---|

| Legal Requirement | In California, a Last Will and Testament must be in writing and signed by the testator (the person making the will). |

| Witnesses | The will must be witnessed by at least two individuals who are not beneficiaries of the will. |

| Revocation | A will can be revoked by the testator at any time, provided they are of sound mind. |

| Governing Law | The California Probate Code governs the creation and execution of wills in the state. |

| Holographic Wills | California recognizes holographic wills, which are handwritten and do not require witnesses, as long as they meet certain criteria. |