Free Gift Deed Template for California

Create Other Popular Gift Deed Forms for Different States

How to Transfer Property Deed in Georgia - Be sure to record the Gift Deed with local authorities where necessary.

Completing the Arizona Medical Power of Attorney form is crucial for ensuring that your healthcare preferences are respected, even when you cannot communicate them yourself. This document is not just a piece of paper; it represents your values and wishes regarding medical treatment. It is advisable to review a reliable template to understand the specifics of how to fill it out accurately, such as the one found at arizonapdfs.com/medical-power-of-attorney-template/, to help you navigate this important legal process.

Texas Gift Deed - The process can be quicker than traditional property sales.

Similar forms

The California Gift Deed form is similar to a Quitclaim Deed. Both documents transfer ownership of property from one party to another without any warranties. A Quitclaim Deed is often used to transfer property between family members or in situations where the grantor does not want to guarantee that they hold clear title. This type of deed is straightforward and does not require the same level of scrutiny as other types of deeds, making it a quick option for property transfer.

For those involved in vehicle transactions, understanding the proper documentation is vital, particularly the California Motor Vehicle Bill of Sale, which details the exchange between buyer and seller. This form is essential for a smooth transfer of ownership and can often lead to questions about how to complete it accurately. For further assistance in filling out the necessary paperwork, you can visit Fill PDF Forms for helpful resources.

Another document comparable to the Gift Deed is the Warranty Deed. Unlike a Gift Deed, a Warranty Deed provides a guarantee from the seller that they hold clear title to the property and have the right to sell it. This document protects the buyer against any claims that may arise regarding the property’s title. While a Warranty Deed is more comprehensive in its assurances, both documents serve the purpose of transferring ownership and can be used in real estate transactions.

The Grant Deed is also similar to the Gift Deed. A Grant Deed transfers property ownership and includes certain guarantees from the seller, such as the assurance that the property has not been sold to anyone else. While a Grant Deed offers more protection than a Gift Deed, both are used to facilitate the transfer of property. The primary distinction lies in the level of protection and the assurances provided by the seller.

A Deed of Trust shares similarities with the Gift Deed in that both documents involve property transfer, but they serve different purposes. A Deed of Trust is used in real estate transactions to secure a loan. It involves three parties: the borrower, the lender, and a trustee. While a Gift Deed transfers ownership without any financial exchange, a Deed of Trust is a security instrument that protects the lender’s interest in the property until the loan is repaid.

Lastly, a Lease Agreement can be compared to a Gift Deed in that both documents involve the use of property. A Lease Agreement allows one party to use another party’s property for a specified period, typically in exchange for rent. While a Gift Deed transfers full ownership, a Lease Agreement retains ownership with the lessor. Both documents are essential in real estate but serve different functions regarding property rights and usage.

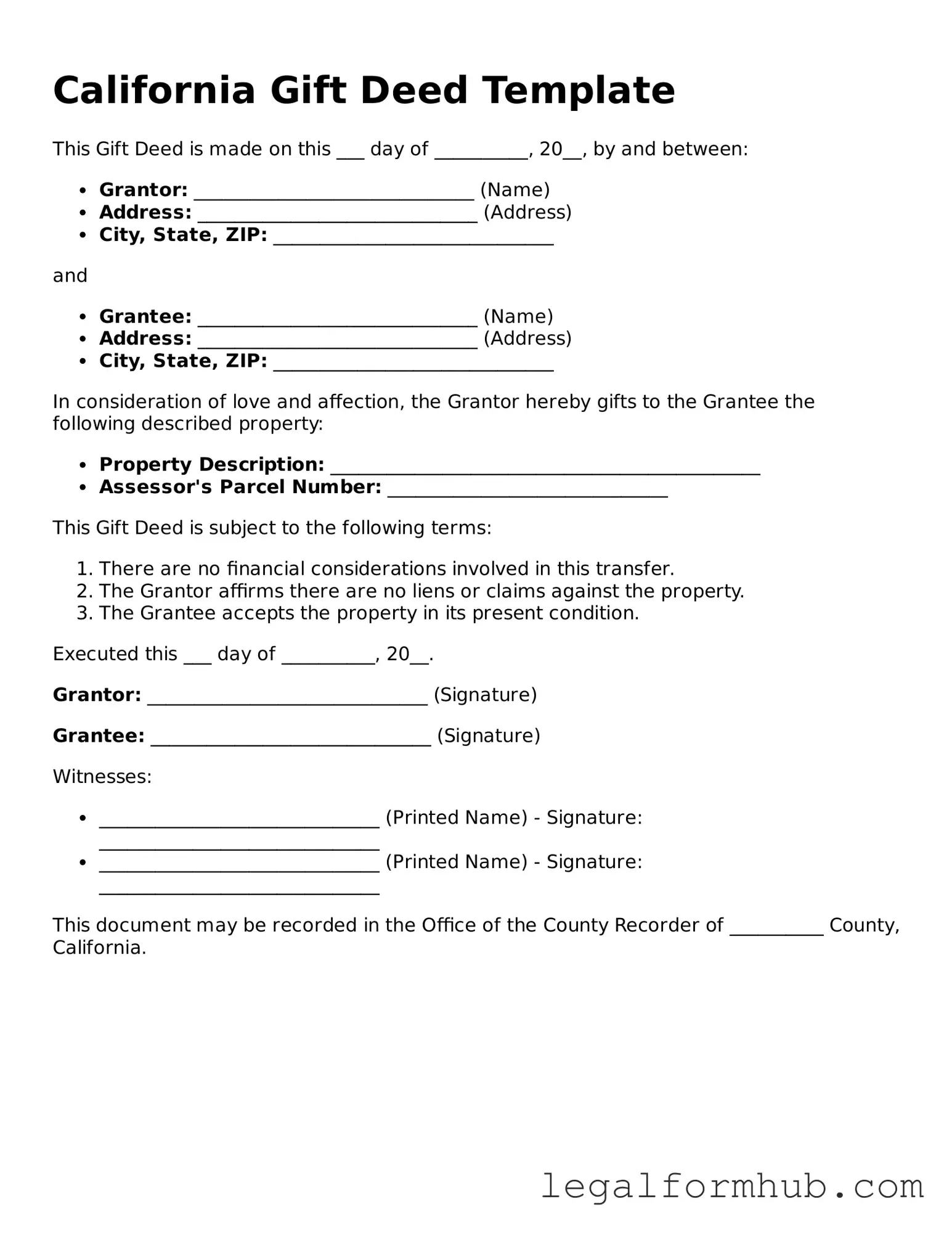

Instructions on Writing California Gift Deed

After you have gathered the necessary information, you are ready to fill out the California Gift Deed form. This document will need to be completed accurately to ensure that the transfer of property is recognized. Follow these steps carefully to fill out the form correctly.

- Begin by entering the date at the top of the form.

- In the section for the "Grantor," write the full name of the person giving the gift. Include their address and any other required identifying information.

- Next, in the "Grantee" section, enter the full name of the person receiving the gift, along with their address.

- Describe the property being transferred. Include the address and any legal description that applies. This may require a bit of research to ensure accuracy.

- Indicate the value of the property being gifted. This may be necessary for tax purposes.

- Sign the form in the designated area. The grantor's signature is essential for the deed to be valid.

- Have the signature notarized. This step adds an extra layer of legitimacy to the document.

- Finally, submit the completed form to the appropriate county recorder's office. This step ensures that the gift deed is officially recorded.

Once you have completed these steps, you will have successfully filled out the California Gift Deed form. Remember to keep a copy for your records and ensure that the deed is recorded promptly to protect the interests of both parties involved.

Misconceptions

Understanding the California Gift Deed form is essential for anyone considering transferring property as a gift. However, several misconceptions can lead to confusion. Here are five common misunderstandings:

- Gift Deeds are only for family members. Many believe that a Gift Deed can only be used to transfer property between family members. In reality, anyone can give a gift of property to another person, regardless of their relationship.

- There are no tax implications with a Gift Deed. Some individuals think that transferring property as a gift is completely tax-free. While the recipient may not owe taxes at the time of the gift, the giver may need to file a gift tax return if the value exceeds the annual exclusion limit set by the IRS.

- A Gift Deed does not require any formalities. It is a common belief that a Gift Deed can be created informally. However, for the deed to be valid, it must be in writing, signed by the giver, and typically notarized to ensure legal recognition.

- Once a Gift Deed is signed, it cannot be revoked. Many assume that a Gift Deed is final and cannot be changed. In fact, the giver may revoke the gift before it is recorded or if certain conditions are met, depending on the circumstances.

- A Gift Deed transfers all rights and responsibilities immediately. Some people think that a Gift Deed means the recipient assumes all responsibilities right away. While the deed transfers ownership, any liens or obligations tied to the property may still need to be addressed separately.

Clarifying these misconceptions can help ensure that property transfers are handled smoothly and with full understanding of the implications involved.

Key takeaways

When filling out and using the California Gift Deed form, consider these key takeaways:

- Understand the Purpose: A Gift Deed is used to transfer property ownership without any exchange of money. It’s a way to give property as a gift.

- Identify the Parties: Clearly list the names of the donor (the person giving the gift) and the recipient (the person receiving the gift). Ensure all names are spelled correctly.

- Property Description: Provide a detailed description of the property being gifted. This includes the address and legal description to avoid any confusion.

- Signatures Required: The Gift Deed must be signed by the donor. In some cases, the recipient may also need to sign, depending on the situation.

- Notarization: To make the Gift Deed legally binding, it should be notarized. This adds an extra layer of validity to the document.

- Recording the Deed: After completing the form, file it with the county recorder’s office where the property is located. This ensures that the gift is officially recognized.

File Overview

| Fact Name | Description |

|---|---|

| Definition | A California Gift Deed is a legal document used to transfer property ownership as a gift without any exchange of money. |

| Governing Law | The California Gift Deed is governed by California Civil Code Section 11911. |

| Parties Involved | The deed involves a donor (the person giving the gift) and a donee (the person receiving the gift). |

| Form Requirements | The deed must be in writing, signed by the donor, and must clearly identify the property being transferred. |

| Consideration | No monetary consideration is required for a Gift Deed; it is a voluntary transfer. |

| Tax Implications | Gifts may have tax implications, including potential gift tax liabilities for the donor. |

| Recording | While not mandatory, recording the Gift Deed with the county recorder is advisable to provide public notice of the transfer. |

| Revocation | A Gift Deed is generally irrevocable once executed, unless specific conditions allow for revocation. |

| Legal Effect | The transfer of property becomes effective immediately upon execution of the deed, unless otherwise stated. |

| Use Cases | Commonly used for transferring property between family members or friends without financial transactions. |