Free Employment Verification Template for California

Create Other Popular Employment Verification Forms for Different States

E-verify Georgia Requirements - Required by agencies for public assistance qualifications.

State of Ohio Employment Verification - It is commonly required for loan applications, rental agreements, and new jobs.

The Free And Invoice PDF form not only simplifies the invoicing process but also ensures you can manage your financial records effectively. By utilizing this form, both individuals and businesses can maintain clarity in their transactions. To begin your journey towards hassle-free invoicing, you can Fill PDF Forms and experience the ease it brings.

Texas Job Verification Letter - It aids in background checks for new hires in various industries.

Similar forms

The I-9 form is a crucial document for employment verification in the United States. Like the California Employment Verification form, it is used to confirm an employee's identity and eligibility to work. Employers must complete the I-9 for every new hire, ensuring they have the necessary documentation to prove their legal status. Both forms require personal information from the employee, such as name and address, and they must be filled out within a specific timeframe after hiring.

The W-4 form, while primarily a tax document, shares similarities with the California Employment Verification form in that it requires employees to provide personal information. The W-4 helps employers determine the correct amount of federal income tax to withhold from an employee's paycheck. Just like the Employment Verification form, the W-4 must be completed by the employee at the start of employment, reflecting the need for accurate information to ensure compliance with federal regulations.

The Employee's Withholding Allowance Certificate, often referred to as the DE 4 in California, is another document related to employment verification. This form is used to determine state income tax withholding. Similar to the California Employment Verification form, it requires the employee to provide personal information and make declarations about their tax situation. Both documents play a role in ensuring that the employer meets legal obligations regarding taxation and employee status.

The California New Hire Reporting form is also comparable to the Employment Verification form. This document is required by law to report newly hired employees to the state’s Employment Development Department. Both forms collect essential information about the employee, including their name, address, and Social Security number. The New Hire Reporting form serves a different purpose, focusing on child support enforcement, but it still emphasizes the importance of accurate employee information.

To ensure proper risk management, it is advisable to utilize a comprehensive Release of Liability form. This document serves to protect individuals and organizations from potential legal claims related to injuries that may arise during activities. For further details and to access the form, click here: comprehensive Release of Liability guide.

Finally, the Background Check Authorization form is similar in that it requires employees to provide consent and personal information. Employers often use this document to conduct background checks on potential hires. Like the California Employment Verification form, it is designed to ensure that the employer has the necessary information to make informed hiring decisions. Both forms highlight the importance of transparency and compliance in the hiring process.

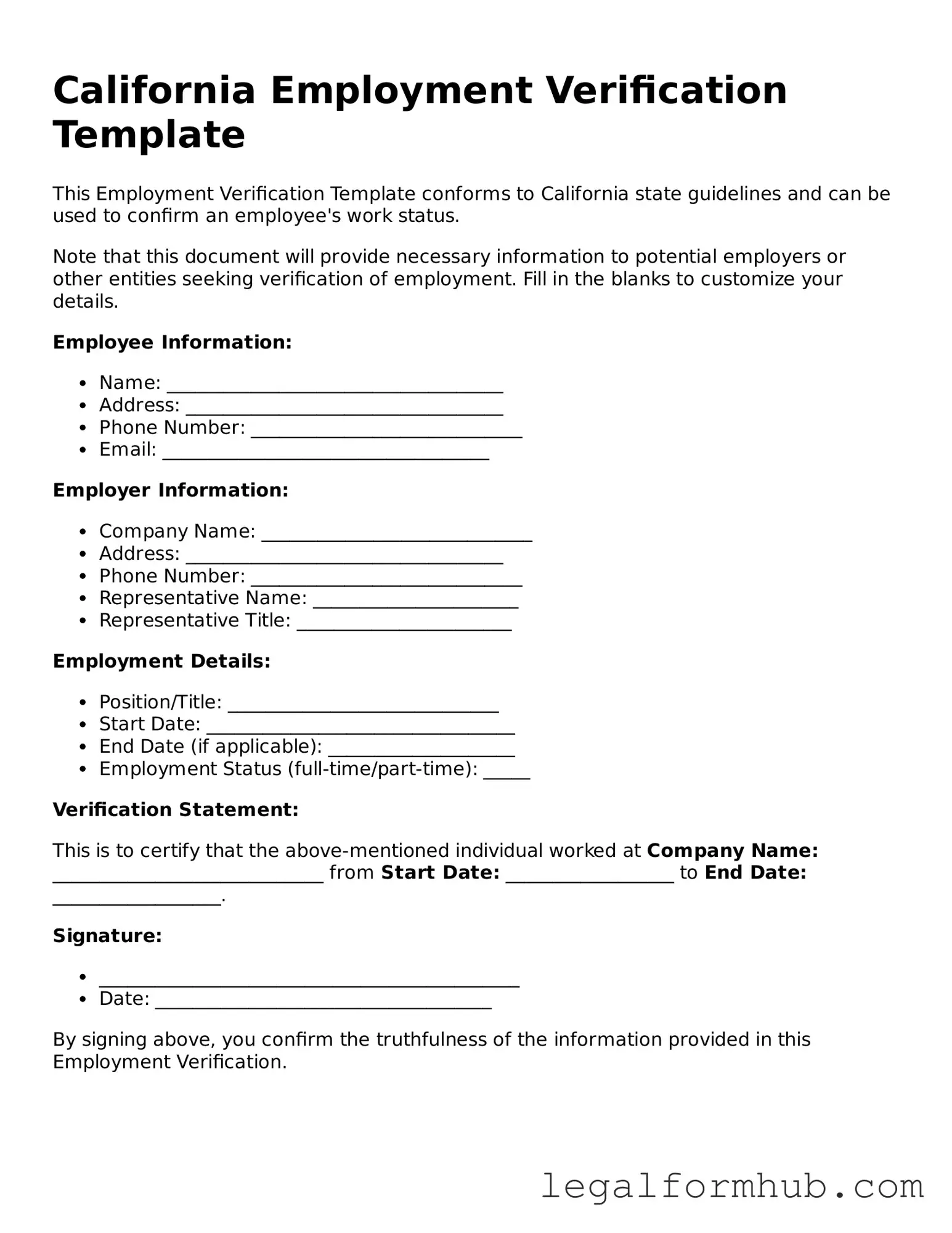

Instructions on Writing California Employment Verification

Completing the California Employment Verification form is straightforward. You'll need to provide specific information about your employment history, including your job title, dates of employment, and employer details. Follow these steps carefully to ensure accurate completion.

- Obtain the form: Download or print the California Employment Verification form from the official website or your employer's resources.

- Fill in your personal information: Enter your full name, address, and contact information at the top of the form.

- Provide employment details: List your current or most recent employer's name, address, and phone number.

- Include job title and dates: Write your job title and the start and end dates of your employment.

- Document your work duties: Briefly describe your main responsibilities and tasks in the position.

- Sign and date the form: At the bottom, sign the form and add the date to certify that the information is accurate.

- Submit the form: Send the completed form to the designated recipient, whether it's your employer, a government agency, or another party.

Misconceptions

Understanding the California Employment Verification form is essential for both employers and employees. However, several misconceptions often arise. Here’s a list of ten common misunderstandings about this important document:

- It is only needed for new hires. Many believe that the form is only required when someone starts a new job. In reality, it may also be necessary for promotions, transfers, or when verifying employment for loans or rentals.

- Employers can refuse to provide verification. Some think that employers can simply decline to fill out the form. However, under California law, employers are generally obligated to provide accurate employment verification upon request.

- All employers must use the same form. There is a misconception that there is a standardized form that all employers must use. In fact, while many companies may have their own version, the essential information required remains consistent across the state.

- Only full-time employees can be verified. This is not true. Part-time, temporary, and contract workers can also have their employment verified using this form.

- Verification is only for the employee’s current job. Some individuals believe that the form only pertains to current employment. However, past employment can also be verified if the former employer is willing to provide that information.

- Employers can disclose any information they want. There is a belief that employers can share any details about an employee. In reality, employers are limited in what they can disclose, typically focusing on job title, dates of employment, and salary.

- Employees have no rights regarding verification. Many think that once they submit a verification request, they have no control. Employees actually have the right to request corrections if they believe the information provided is inaccurate.

- The form is only for specific industries. Some assume that only certain sectors, like finance or healthcare, require employment verification. In truth, this process is common across all industries.

- Employment verification takes a long time. There is a notion that the verification process is lengthy. While it can vary, many employers strive to complete the process quickly, often within a few business days.

- Once verified, the information cannot change. Some believe that once employment is verified, it remains static. However, changes in job title, salary, or employment status can occur, and the verification should be updated accordingly.

By clearing up these misconceptions, both employers and employees can navigate the employment verification process with greater confidence and understanding.

Key takeaways

When filling out and using the California Employment Verification form, there are several important points to consider. Below are key takeaways that can help ensure the process is completed correctly.

- The form is typically used to confirm an individual's employment status, job title, and dates of employment.

- Accurate information is essential; errors can lead to delays or complications in the verification process.

- Employers are responsible for providing truthful and complete information on the form.

- Employees may need to provide consent for their employer to release specific details about their employment.

- The completed form may be requested by various entities, including lenders, landlords, or government agencies.

Understanding these points can facilitate smoother communication between employers and those requesting employment verification.

File Overview

| Fact Name | Description |

|---|---|

| Purpose | The California Employment Verification form is used to confirm an employee's identity and eligibility to work in the United States. |

| Governing Law | This form is governed by California Labor Code Section 2810.5, which outlines the requirements for employment verification. |

| Required Information | Employers must collect personal information such as the employee's name, address, and Social Security number. |

| Timing | Employers are required to complete the verification process within three days of an employee's start date. |

| Documentation | Employees must provide acceptable documents that prove both identity and employment eligibility, such as a passport or a driver's license with a Social Security card. |

| Record Keeping | Employers must retain the completed form for a minimum of three years after the employee's termination. |

| Penalties | Failure to comply with the verification requirements can result in penalties, including fines and potential legal action. |

| Confidentiality | Employers are obligated to keep the information collected on this form confidential and secure. |