Free Durable Power of Attorney Template for California

Create Other Popular Durable Power of Attorney Forms for Different States

Does Durable Power of Attorney Cover Medical - Many people find this form crucial in managing health and wellness decisions.

Durable Power of Attorney Michigan - This legal tool can provide assurance that your financial matters will be respected during difficulties.

The Employment Verification Form is a document used to confirm an individual's employment history, job title, and salary from previous employers. This form serves as a vital tool for prospective employers, providing them with credible information to help in their hiring decisions. To ensure a smooth hiring process, consider filling out the verification form by clicking the button below or visit Fill PDF Forms for more information.

North Carolina Power of Attorney Requirements - This document provides peace of mind for you and your loved ones regarding future care and finances.

Similar forms

The California Durable Power of Attorney (DPOA) form is similar to the General Power of Attorney. Both documents allow a person to appoint someone else to make decisions on their behalf. However, the DPOA remains effective even if the principal becomes incapacitated, while a General Power of Attorney typically becomes void under such circumstances. This distinction makes the DPOA a crucial tool for long-term planning.

Another document similar to the DPOA is the Medical Power of Attorney. This document specifically grants authority to make medical decisions for the principal if they are unable to do so. While the DPOA covers financial and legal matters, the Medical Power of Attorney focuses solely on healthcare decisions. Both documents empower a trusted individual to act on behalf of the principal, but they serve different purposes.

The Healthcare Proxy is akin to the Medical Power of Attorney. Like the latter, it allows an individual to designate someone to make healthcare decisions. The key difference lies in the terminology and specific state laws governing each document. Both aim to ensure that a person's medical preferences are honored when they cannot communicate them directly.

A Living Will shares similarities with the Durable Power of Attorney, particularly regarding end-of-life decisions. A Living Will outlines a person's wishes regarding medical treatment in scenarios where they cannot express their desires. While the DPOA allows someone to make decisions on behalf of the principal, the Living Will communicates the principal's preferences directly to healthcare providers.

For those looking to finalize their mobile home sales, understanding the process is vital. You can find the necessary information in the essential guide for completing your Mobile Home Bill of Sale.

The Revocable Trust is another document that can be compared to the DPOA. Both can manage assets and provide for the principal's needs. A Revocable Trust allows the principal to maintain control over their assets during their lifetime and can help avoid probate. In contrast, the DPOA focuses on delegating decision-making authority to another individual, rather than managing assets directly.

The Advance Healthcare Directive combines elements of both the Medical Power of Attorney and Living Will. It allows individuals to specify their healthcare preferences and appoint someone to make decisions on their behalf. This document ensures that both medical wishes and decision-making authority are clearly communicated, similar to the functions of the DPOA but in a healthcare context.

The Financial Power of Attorney is closely related to the Durable Power of Attorney. Both documents allow someone to manage financial matters for the principal. However, the Financial Power of Attorney may not necessarily remain effective if the principal becomes incapacitated unless specified otherwise. The DPOA is specifically designed to endure such circumstances.

The Special Power of Attorney is another variant that permits the principal to delegate authority for specific tasks or transactions. Unlike the DPOA, which grants broad powers, the Special Power of Attorney is limited in scope. It can be useful for particular situations, such as selling property or handling a single financial transaction, while the DPOA covers ongoing decision-making needs.

The Guardianship document is similar in that it involves decision-making on behalf of another person, but it typically pertains to minors or individuals deemed incompetent. A court appoints a guardian, while a DPOA allows individuals to choose their own agent. Both ensure that someone is looking out for the best interests of another, but the processes and authority levels differ significantly.

Lastly, the Estate Plan is a broader document that encompasses various legal instruments, including the Durable Power of Attorney. An Estate Plan outlines how a person's assets and healthcare decisions will be managed during their lifetime and after death. While the DPOA is a specific component focused on decision-making authority, the Estate Plan provides a comprehensive strategy for managing an individual's affairs.

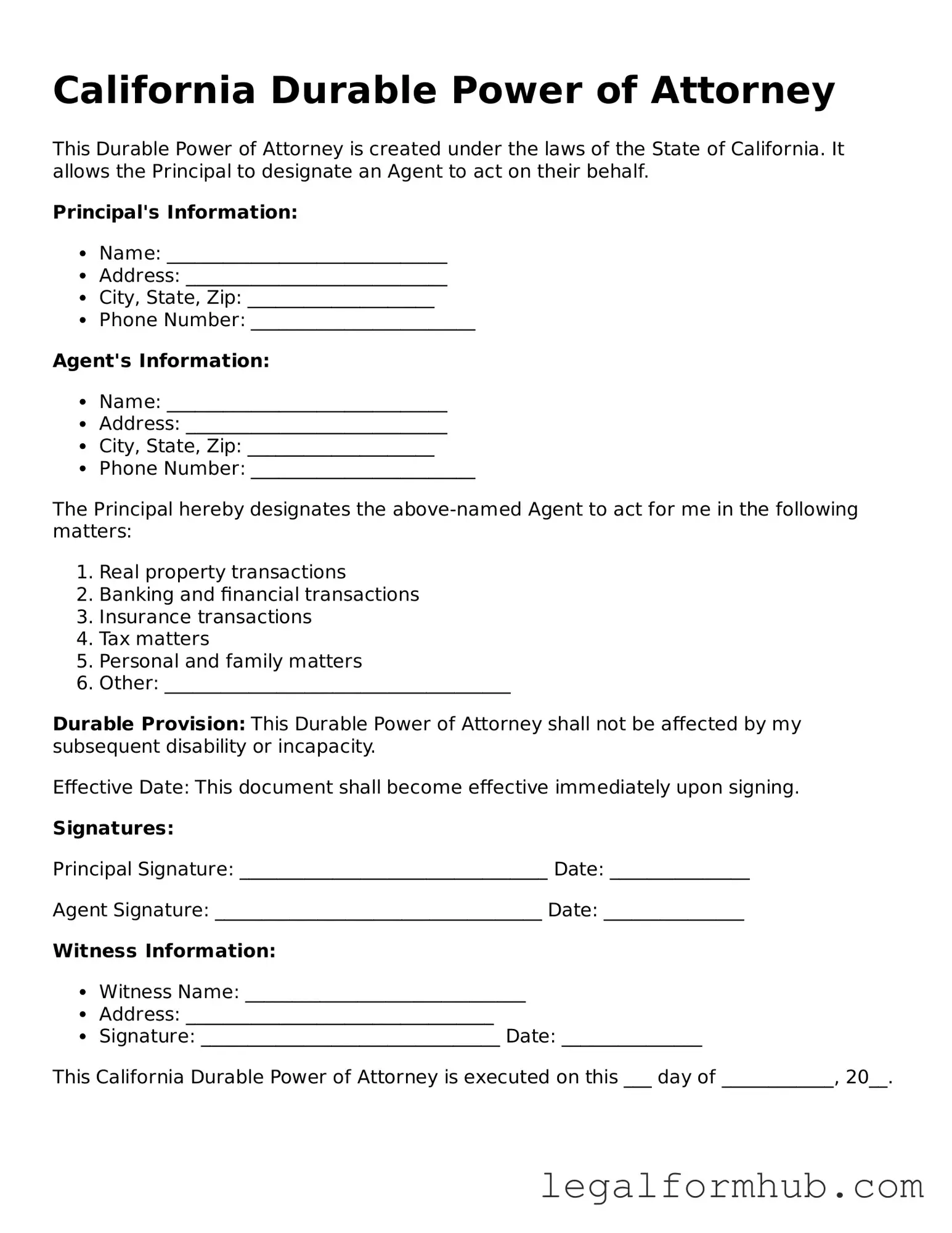

Instructions on Writing California Durable Power of Attorney

Filling out the California Durable Power of Attorney form requires careful attention to detail. This document allows you to appoint someone to make decisions on your behalf in the event you become incapacitated. Follow these steps to complete the form accurately.

- Obtain the California Durable Power of Attorney form. You can find it online or at legal supply stores.

- Start by entering your full name and address at the top of the form.

- Clearly state the name and address of the person you are appointing as your agent. This person will have the authority to act on your behalf.

- Specify the powers you wish to grant your agent. You can choose general powers or limit them to specific areas, such as financial or healthcare decisions.

- Indicate when the power of attorney becomes effective. You can choose to make it effective immediately or upon a specific event, such as your incapacity.

- Sign and date the form in the designated area. Your signature must be witnessed or notarized, depending on your preference.

- Have your signature witnessed by at least one adult who is not related to you and who will not benefit from your estate. Alternatively, you can have the form notarized.

- Make copies of the completed form for your records and to provide to your agent and any relevant institutions.

After completing the form, ensure that all parties involved understand their roles and responsibilities. Keep the original document in a safe place, and inform your agent where it is located. This will facilitate access when needed.

Misconceptions

Understanding the California Durable Power of Attorney (DPOA) is crucial for anyone considering this legal document. Unfortunately, several misconceptions can lead to confusion. Here are ten common misconceptions about the DPOA in California:

- A Durable Power of Attorney is only for the elderly. Many people believe that only seniors need a DPOA. In reality, anyone can benefit from this document, especially if they want to ensure their financial and healthcare decisions are made according to their wishes in case they become incapacitated.

- A DPOA can only be used for financial matters. While a DPOA is often associated with financial decisions, it can also cover healthcare decisions if specified. A separate healthcare directive may also be necessary for specific medical choices.

- Once a DPOA is signed, it cannot be changed. This is not true. As long as the person who created the DPOA is mentally competent, they can modify or revoke it at any time.

- The agent has unlimited power. An agent's authority is not limitless. The DPOA document outlines the specific powers granted, and the agent must act in the best interest of the principal.

- A DPOA takes effect immediately. In California, a DPOA can be designed to take effect immediately or only when the principal becomes incapacitated. It’s essential to clarify this in the document.

- All DPOA forms are the same. This is misleading. Different states have different requirements and forms. It’s important to use the correct California-specific form to ensure it meets state laws.

- Once a DPOA is in place, I don’t need to worry about anything. A DPOA is an important tool, but it doesn’t replace the need for ongoing discussions about your wishes with family and your agent.

- Only lawyers can create a DPOA. While consulting a lawyer can be beneficial, individuals can create a DPOA on their own using state-approved forms, provided they understand the requirements.

- A DPOA is the same as a living will. A DPOA and a living will serve different purposes. A DPOA focuses on appointing someone to make decisions on your behalf, while a living will outlines your wishes regarding medical treatment.

- Agents can act without any oversight. Agents are required to act in the principal’s best interest and may be held accountable for their actions. There are legal consequences for misuse of authority.

Understanding these misconceptions can help you make informed decisions about your future and ensure your wishes are honored when it matters most.

Key takeaways

Filling out and using the California Durable Power of Attorney form can be a crucial step in managing financial and legal matters. Here are some key takeaways to consider:

- The form allows you to appoint someone you trust to make decisions on your behalf if you become unable to do so.

- It is important to choose an agent who is responsible and understands your wishes.

- The Durable Power of Attorney remains effective even if you become incapacitated.

- In California, the form does not require witnesses or notarization to be valid, but having it notarized can add an extra layer of protection.

- You can specify which powers you are granting to your agent, making it customizable to your needs.

- Review the document periodically to ensure it still reflects your wishes, especially if your circumstances change.

- Be aware that your agent has a fiduciary duty to act in your best interest.

- Inform your agent about the location of important documents and accounts to facilitate their role.

- If you change your mind, you can revoke the Durable Power of Attorney at any time, as long as you are competent.

- Keep copies of the signed document in a safe place and provide a copy to your agent and relevant financial institutions.

Understanding these points can help ensure that your Durable Power of Attorney is effective and serves your intentions. Proper planning today can provide peace of mind for the future.

File Overview

| Fact Name | Details |

|---|---|

| Definition | A California Durable Power of Attorney form allows an individual to designate another person to manage their financial and legal affairs if they become incapacitated. |

| Governing Law | The form is governed by the California Probate Code, specifically Sections 4000-4545. |

| Durability | This type of power of attorney remains effective even if the principal becomes mentally incapacitated. |

| Principal and Agent | The person granting authority is called the principal, while the person receiving authority is known as the agent or attorney-in-fact. |

| Limitations | The agent cannot make healthcare decisions unless specifically granted that authority in a separate document. |

| Revocation | The principal can revoke the durable power of attorney at any time, as long as they are mentally competent. |

| Witness Requirements | The form must be signed by the principal and witnessed by at least one adult who is not the agent. |

| Notarization | While notarization is not required, it is recommended to enhance the document's validity. |

| Effective Date | The power of attorney can become effective immediately upon signing or can be set to activate upon the principal's incapacity. |