Free Deed in Lieu of Foreclosure Template for California

Create Other Popular Deed in Lieu of Foreclosure Forms for Different States

Deed in Lieu Vs Foreclosure - This is an alternative that may lessen the impact of a foreclosure on a homeowner’s credit score.

The California Bill of Sale form serves as a legal document that records the transfer of ownership of personal property from one individual to another. This form is crucial for providing evidence of the transaction and outlining the details of the sale, such as the buyer, seller, and item description. To ensure your transaction is documented properly, consider filling out the form by clicking the button below or visiting Fill PDF Forms.

Deed in Lieu of Foreclosure Ohio - A means for homeowners to finalize their mortgage responsibilities with a sense of closure.

Similar forms

The California Deed in Lieu of Foreclosure form is similar to a mortgage modification agreement. Both documents aim to provide a solution to homeowners facing financial difficulties. A mortgage modification agreement alters the terms of an existing loan, potentially reducing monthly payments or extending the loan term. This can help the homeowner avoid foreclosure by making the mortgage more manageable. In contrast, a deed in lieu transfers ownership of the property back to the lender, allowing the homeowner to walk away from the mortgage without further liability. Both options seek to mitigate the impact of foreclosure on the homeowner's credit and financial situation.

For those looking to understand the necessary paperwork, an informative resource is the comprehensive guide on the Trailer Bill of Sale form that outlines its importance in trailer ownership transfers.

Another document that shares similarities with the Deed in Lieu of Foreclosure is a short sale agreement. In a short sale, a homeowner sells their property for less than the amount owed on the mortgage, with the lender's approval. This process can prevent foreclosure while allowing the homeowner to move on from a financially burdensome situation. Like a deed in lieu, a short sale can be less damaging to the homeowner's credit than a foreclosure. However, a short sale requires finding a buyer and can take longer to complete than a deed in lieu, which is a more direct transfer of ownership.

A third comparable document is a forbearance agreement. This agreement allows a homeowner to temporarily pause or reduce mortgage payments due to financial hardship. During this period, the lender may agree not to initiate foreclosure proceedings. While a forbearance agreement provides immediate relief, it does not resolve the underlying debt. In contrast, a deed in lieu of foreclosure relinquishes the property entirely, providing a more permanent solution. Both documents aim to assist homeowners, but they cater to different stages of financial distress.

The fourth document that resembles the Deed in Lieu of Foreclosure is a bankruptcy filing. Filing for bankruptcy can provide homeowners with protection from creditors and an opportunity to reorganize their debts. Chapter 13 bankruptcy, for instance, allows individuals to create a repayment plan over three to five years. While bankruptcy can stop foreclosure temporarily, a deed in lieu offers a more straightforward resolution by transferring property ownership to the lender. Both options can relieve financial pressure, but bankruptcy involves a more complex legal process.

Similar to the Deed in Lieu of Foreclosure is a loan assumption agreement. In this arrangement, a buyer takes over the existing mortgage from the seller, assuming responsibility for the remaining debt. This can be beneficial for sellers who wish to avoid foreclosure. While a deed in lieu involves relinquishing ownership to the lender, a loan assumption allows for the continuation of the mortgage under new ownership. Both documents can facilitate a smoother transition out of a financial crisis, but they operate under different circumstances.

Lastly, a real estate deed transfer is another document that shares similarities with the Deed in Lieu of Foreclosure. A deed transfer occurs when property ownership is conveyed from one party to another, often without a mortgage involved. While a deed in lieu specifically addresses the transfer of property to avoid foreclosure, a general deed transfer can happen for various reasons, such as sales or gifts. Both processes involve the transfer of property rights, but the intent and implications differ significantly, particularly concerning the underlying financial obligations.

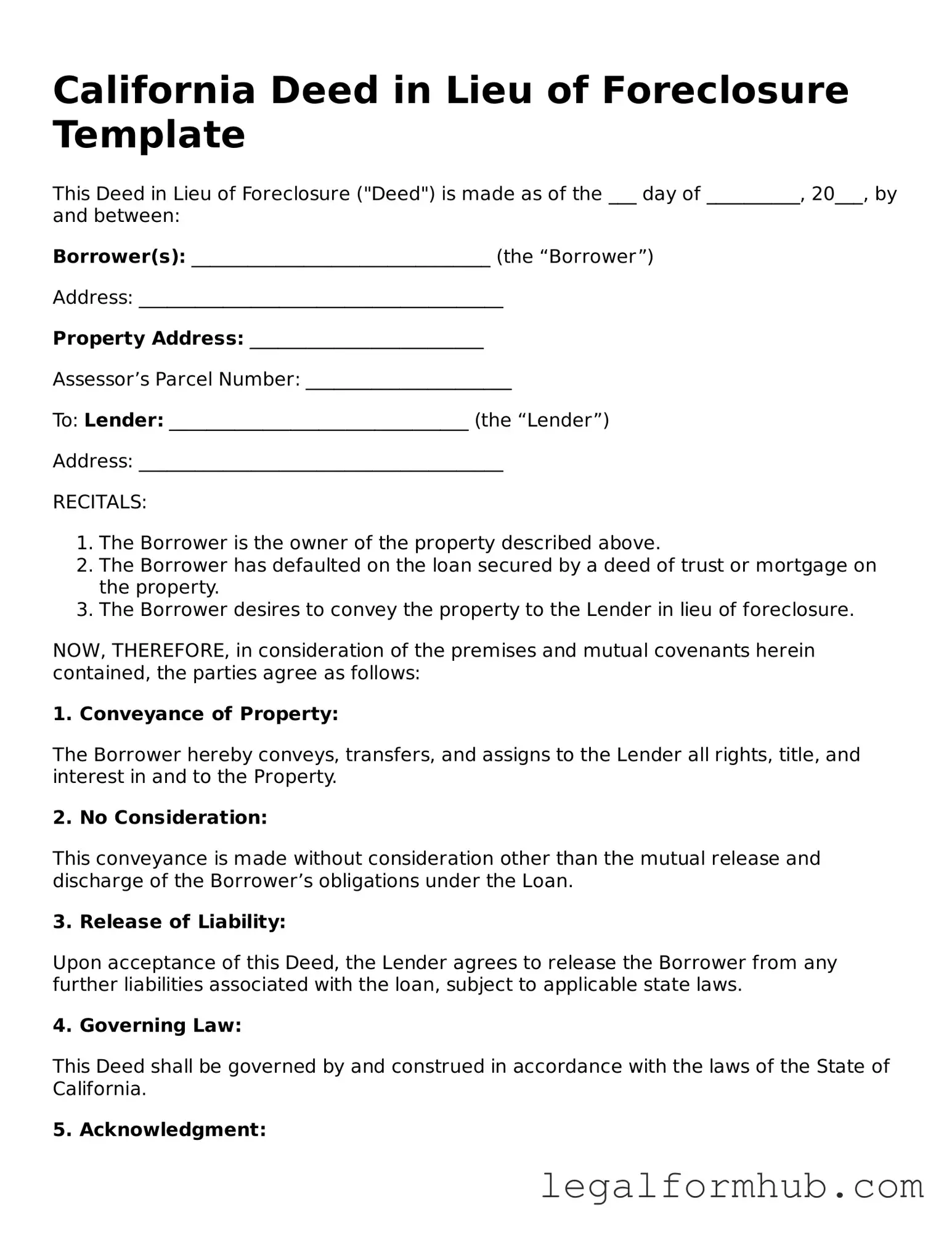

Instructions on Writing California Deed in Lieu of Foreclosure

After completing the California Deed in Lieu of Foreclosure form, you will need to submit it to the appropriate parties, typically your lender. This process can help facilitate the transfer of property ownership and may assist in resolving any outstanding mortgage obligations. Ensure that all required information is accurate and that you follow the necessary steps for submission.

- Obtain the California Deed in Lieu of Foreclosure form. This can usually be found online or through your lender.

- Fill in the property address. Include the complete street address, city, state, and ZIP code.

- Provide the names of all parties involved. This includes the current owner(s) of the property and the lender.

- Enter the legal description of the property. This may be found on the original deed or through your county's assessor's office.

- Specify the date of the transfer. This is the date when the deed will take effect.

- Sign the form. All owners must sign the document in the presence of a notary public.

- Have the form notarized. Ensure that the notary public completes their section of the form.

- Make copies of the completed form for your records.

- Submit the original form to your lender along with any required additional documents.

Misconceptions

Many homeowners facing financial difficulties may consider a deed in lieu of foreclosure as a solution. However, several misconceptions surround this process. Understanding these misconceptions can help individuals make informed decisions.

- Misconception 1: A deed in lieu of foreclosure is the same as a short sale.

- Misconception 2: You can simply hand over the keys to your lender.

- Misconception 3: A deed in lieu will not affect your credit score.

- Misconception 4: You cannot negotiate the terms of a deed in lieu.

- Misconception 5: A deed in lieu eliminates all debt associated with the property.

- Misconception 6: You must be in foreclosure to pursue a deed in lieu.

- Misconception 7: A deed in lieu is a quick and easy solution.

A deed in lieu involves transferring ownership of the property back to the lender, while a short sale requires the lender's approval to sell the home for less than the mortgage amount.

This process is not that simple. Homeowners must formally execute a deed in lieu, which includes legal documentation and approval from the lender.

While it may be less damaging than a foreclosure, a deed in lieu will still negatively impact your credit score.

Homeowners can negotiate certain terms, such as the release of liability for any remaining mortgage balance.

This is not always true. If there are second mortgages or other liens, those debts may still remain after the deed in lieu.

While many people consider this option during foreclosure, homeowners can initiate a deed in lieu before the foreclosure process begins.

The process can be lengthy and complex, requiring careful consideration and coordination with the lender.

Key takeaways

Filling out and using the California Deed in Lieu of Foreclosure form can be a significant step for homeowners facing financial difficulties. Here are some key takeaways to consider:

- Understanding the Purpose: A Deed in Lieu of Foreclosure allows a homeowner to transfer ownership of their property to the lender to avoid the foreclosure process.

- Eligibility Requirements: Homeowners must demonstrate that they are unable to continue making mortgage payments and that the property is not subject to other liens.

- Consulting with Professionals: It is advisable to consult with a real estate attorney or a housing counselor before proceeding to ensure all legal implications are understood.

- Preparing Documentation: Homeowners will need to gather necessary documents, including the mortgage agreement and any relevant financial statements.

- Negotiating Terms: Homeowners should discuss the terms of the deed with the lender, including any potential forgiveness of debt and impact on credit scores.

- Filing the Deed: After completing the form, the deed must be filed with the county recorder’s office to officially transfer ownership.

- Impact on Credit: A Deed in Lieu of Foreclosure may still affect a homeowner's credit score, but it is generally less damaging than a foreclosure.

- Tax Implications: Homeowners should be aware of potential tax consequences that may arise from the cancellation of debt associated with the deed.

File Overview

| Fact Name | Description |

|---|---|

| Purpose | A Deed in Lieu of Foreclosure allows a homeowner to transfer ownership of their property to the lender to avoid foreclosure proceedings. |

| Governing Law | This process is governed by California Civil Code Section 1475 et seq. |

| Eligibility | Homeowners must be facing financial difficulties and unable to keep up with mortgage payments to qualify. |

| Benefits | It can help homeowners avoid the lengthy and costly foreclosure process, and it may have less impact on their credit score. |