Free Deed Template for California

Create Other Popular Deed Forms for Different States

Michigan Property Transfer Affidavit - Often a requirement for securing financing on properties.

How Do I Get My Deed to My House - Important for transferring inherited property to heirs.

Georgia Deed Transfer Forms - A key document for title companies conducting property research.

The Chick Fil A Job Application form serves as the primary document for individuals seeking employment at this popular fast-food chain. Filled with essential sections that collect personal information, work history, and availability, the form plays a crucial role in the hiring process. If you're ready to join the team, you can easily access and complete the application by visiting Fill PDF Forms.

What Does a House Deed Look Like in Ohio - Often needs to be notarized for validity.

Similar forms

The California Grant Deed is similar to the California Deed form. Both documents serve the purpose of transferring property ownership from one party to another. A Grant Deed includes specific assurances from the seller, such as the guarantee that the property has not been sold to anyone else and that it is free from any undisclosed encumbrances. This gives buyers a level of security regarding their new ownership. In contrast, the California Deed form may have different stipulations or requirements depending on the context of the transaction.

For those considering their future planning, the important Durable Power of Attorney document is essential. This legal form allows individuals to designate someone to make decisions on their behalf during periods of incapacity, ensuring that their preferences are followed even when they cannot communicate directly.

The Quitclaim Deed is another document that shares similarities with the California Deed form. Like the California Deed, a Quitclaim Deed transfers ownership of property. However, it does not provide any guarantees about the title. This means that if there are any issues with the property’s title, the new owner may have no recourse against the previous owner. While both documents facilitate the transfer of property, the Quitclaim Deed is often used in situations involving family transfers or when the parties know each other well.

The Warranty Deed is also comparable to the California Deed form. A Warranty Deed offers a higher level of protection for the buyer. It guarantees that the seller holds clear title to the property and has the right to sell it. This type of deed provides a legal promise that if any title issues arise, the seller is responsible for resolving them. While the California Deed form may include certain warranties, the Warranty Deed typically provides broader assurances.

The Bargain and Sale Deed is yet another document that resembles the California Deed form. This type of deed implies that the seller has the right to sell the property but does not guarantee that the title is clear. It is often used in foreclosure sales or tax sales, where the seller may not have complete knowledge of the property’s title status. Like the California Deed, it facilitates the transfer of ownership but does so with less assurance regarding title issues.

The Special Purpose Deed is similar in function to the California Deed form, as it is used for specific types of transactions, such as transferring property from a trust or an estate. This deed allows for the transfer of property under unique circumstances and often includes specific provisions tailored to the situation. While both documents transfer ownership, the Special Purpose Deed addresses particular legal requirements that may not apply to standard transactions.

The Trustee’s Deed is another document that functions similarly to the California Deed form. It is used when a property is sold by a trustee, often in the context of a trust or foreclosure. The Trustee’s Deed transfers ownership but may include limitations or conditions based on the trust’s terms. Like the California Deed, it serves to convey property, but the context of its use can significantly alter its implications.

The Executor’s Deed also shares similarities with the California Deed form. This document is used to transfer property from a deceased person’s estate to their heirs or beneficiaries. It is typically executed by the executor of the estate and conveys ownership in a way that reflects the decedent’s wishes. While both documents facilitate the transfer of property, the Executor’s Deed is specifically tied to the distribution of an estate.

Finally, the Affidavit of Death is another document that can be compared to the California Deed form. While it does not directly transfer property, it is often used in conjunction with a deed to clarify ownership after an owner has passed away. This affidavit provides evidence of the owner’s death and can help streamline the transfer process. Although it serves a different primary function, it is an important part of the overall property transfer process in certain circumstances.

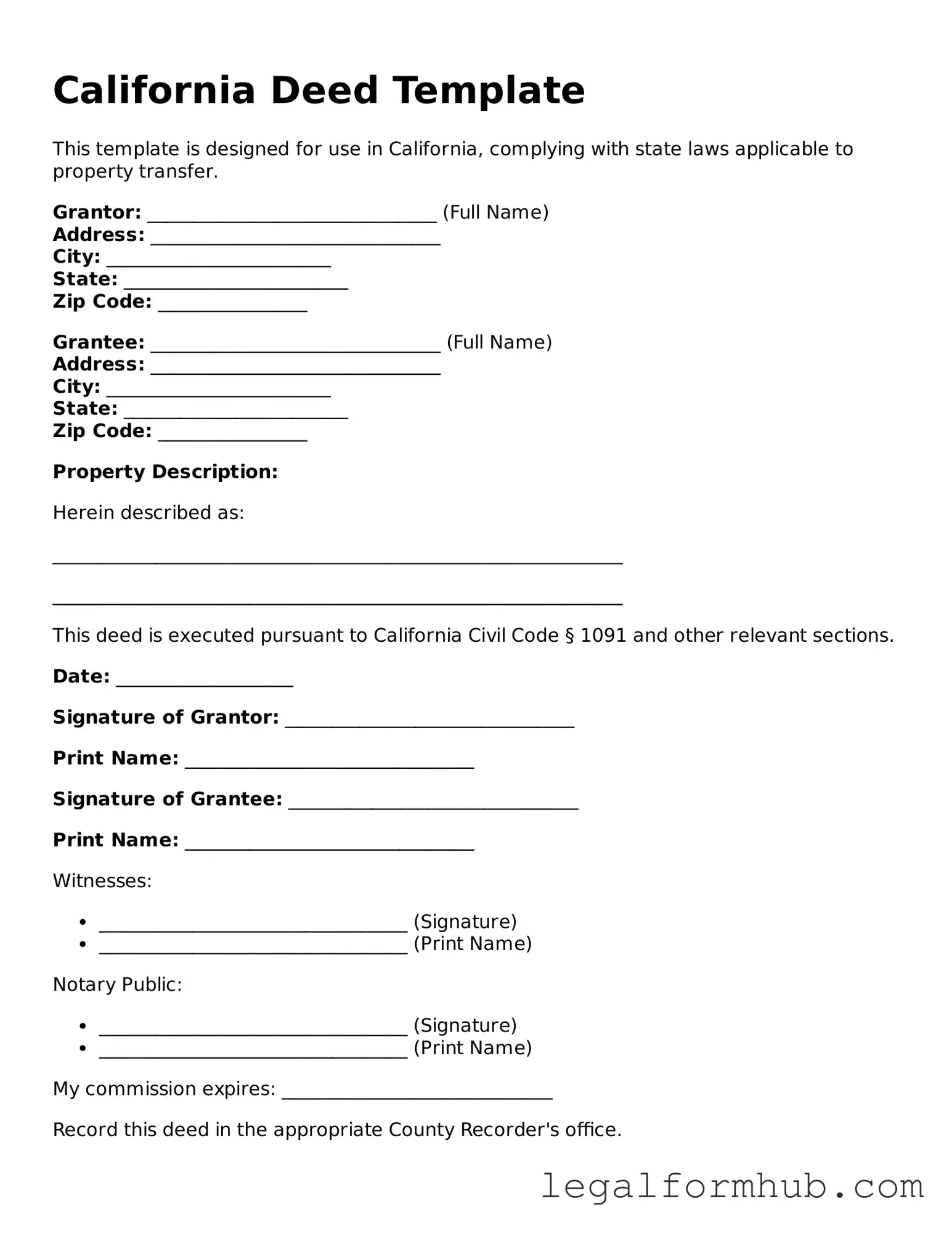

Instructions on Writing California Deed

Once you have gathered the necessary information, filling out the California Deed form is straightforward. This document requires accurate details about the property and the parties involved. After completing the form, you will need to file it with the appropriate county office to make it official.

- Start by entering the date at the top of the form.

- Fill in the name of the grantor (the person transferring the property).

- Provide the grantor's address, including city, state, and ZIP code.

- Next, enter the name of the grantee (the person receiving the property).

- Include the grantee's address, also with city, state, and ZIP code.

- Describe the property being transferred. Include the address and any legal description if available.

- Indicate the type of transfer (e.g., gift, sale, etc.).

- Sign the document where indicated. The grantor must sign it.

- Have the signature notarized. A notary public will verify the identity of the grantor.

- Make copies of the completed deed for your records.

- Finally, file the original deed with the county recorder’s office in the county where the property is located.

Misconceptions

Understanding the California Deed form is essential for anyone involved in real estate transactions. However, several misconceptions can lead to confusion. Here are nine common misconceptions:

- All deeds are the same. Many people believe that all deed forms serve the same purpose. In reality, different types of deeds, such as grant deeds and quitclaim deeds, serve distinct legal functions.

- A deed must be notarized to be valid. While notarization is often required for a deed to be recorded, it is not always necessary for the deed to be legally valid between the parties involved.

- Only attorneys can prepare a deed. This is not true. While attorneys can assist in preparing deeds, individuals can also create them, provided they understand the necessary elements.

- Once a deed is signed, it cannot be changed. A deed can be amended or revoked under certain conditions, depending on the circumstances and the type of deed.

- Deeds do not need to be recorded. While recording a deed is not mandatory, failing to do so can lead to disputes over property ownership and may affect the rights of future buyers.

- All property transfers require a new deed. In some cases, property can be transferred through other legal means, such as through a trust or inheritance, without the need for a new deed.

- Only the seller needs to sign the deed. Both the seller and buyer must sign the deed for it to be valid, ensuring mutual agreement on the property transfer.

- Deeds are only important during the sale of a property. Deeds play a crucial role in various situations, including inheritance, divorce settlements, and property gifts.

- Once a deed is recorded, it cannot be contested. A recorded deed can still be challenged in court, especially if there are claims of fraud or other legal issues involved.

By understanding these misconceptions, individuals can navigate the complexities of real estate transactions more effectively.

Key takeaways

When filling out and using the California Deed form, it is essential to keep several key points in mind:

- Accurate Information: Ensure that all names, addresses, and property descriptions are correct. Mistakes can lead to complications in ownership.

- Signatures Required: The deed must be signed by the grantor (the person transferring the property). In some cases, notarization may be necessary.

- Recording the Deed: After completion, the deed should be filed with the county recorder's office. This step is crucial for the deed to be legally recognized.

- Consider Tax Implications: Be aware of any potential tax consequences related to the transfer of property. Consulting a tax professional can be beneficial.

- Keep Copies: Always retain a copy of the completed deed for your records. This documentation is important for future reference.

By following these guidelines, you can help ensure a smooth process when dealing with property transfers in California.

File Overview

| Fact Name | Details |

|---|---|

| Definition | A California Deed form is a legal document used to transfer ownership of real property from one party to another. |

| Types of Deeds | Common types include Grant Deed, Quitclaim Deed, and Warranty Deed, each serving different purposes in property transfer. |

| Governing Laws | The California Civil Code, particularly Sections 1050-1070, governs the use and requirements of deed forms in the state. |

| Signature Requirements | The deed must be signed by the grantor (the person transferring the property) to be valid. |

| Recording | To provide public notice of the property transfer, the deed should be recorded with the county recorder's office. |

| Tax Implications | Transfer of property may trigger tax implications, including reassessment for property tax purposes. |