Free Articles of Incorporation Template for California

Create Other Popular Articles of Incorporation Forms for Different States

Texas Company Registration - Requires a declaration of the corporation's business address.

Llc Online Application Michigan - Designate how the corporation will manage profits.

Illinois Articles of Incorporation - Can help establish corporate governance policies.

The creation of a solid foundation for your business can be achieved through an effective and tailored operating agreement template for LLCs, ensuring that all parties are aligned on management and operational protocols.

Georgia Secretary of State Forms - The incorporation process can vary depending on the corporation type, like nonprofit or C-Corp.

Similar forms

The California Articles of Incorporation form shares similarities with the Certificate of Incorporation, commonly used in other states. Both documents serve as foundational legal papers that establish a corporation's existence. They outline essential details such as the corporation's name, purpose, and the address of its registered office. This document is filed with the Secretary of State and provides the legal framework necessary for the corporation to operate within its jurisdiction.

Another document closely related to the Articles of Incorporation is the Bylaws. While the Articles of Incorporation lay out the basic structure of the corporation, the Bylaws provide the internal rules and guidelines for its governance. They cover aspects such as the roles of directors and officers, meeting procedures, and voting rights. Together, these documents create a comprehensive governance framework for the corporation.

The Certificate of Formation is another document that serves a similar purpose, particularly in limited liability companies (LLCs). Like the Articles of Incorporation, the Certificate of Formation is filed with the state to legally establish the entity. It includes critical information such as the LLC's name, address, and the name of its registered agent. Both documents are essential for formalizing the business structure and protecting the owners from personal liability.

The Statement of Information is also akin to the Articles of Incorporation, but it serves a different function. This document is typically filed after incorporation and provides updated information about the corporation, including its officers, directors, and business address. While the Articles of Incorporation establish the corporation, the Statement of Information ensures that the state has current records, which is crucial for compliance and transparency.

The Operating Agreement is similar to the Bylaws but is specific to LLCs. This document outlines the management structure and operational procedures of the LLC. It details the rights and responsibilities of members, profit distribution, and decision-making processes. Like the Articles of Incorporation, the Operating Agreement is vital for establishing the entity's governance and protecting the interests of its members.

The Partnership Agreement, while intended for partnerships rather than corporations, shares the foundational purpose of outlining the structure and operational guidelines of a business entity. This document details each partner's roles, profit-sharing arrangements, and dispute resolution methods. Just as the Articles of Incorporation provide clarity on corporate structure, the Partnership Agreement ensures all partners are aligned on their business operations.

If you are looking to streamline your invoicing process, the Fill PDF Forms is an excellent resource to consider. This tool allows you to create invoices with ease, ensuring that you can focus on other important aspects of your business while maintaining proper financial tracking.

The Certificate of Good Standing is another important document that complements the Articles of Incorporation. This certificate verifies that a corporation is legally registered and compliant with state regulations. It is often required when a business seeks to expand or enter contracts in other jurisdictions. While the Articles of Incorporation initiate the corporation, the Certificate of Good Standing confirms its ongoing legitimacy.

Finally, the Annual Report is similar in that it provides essential updates about the corporation to the state. This document typically includes financial statements, changes in management, and other significant developments. While the Articles of Incorporation establish the corporation's initial framework, the Annual Report ensures that the corporation maintains transparency and accountability over time.

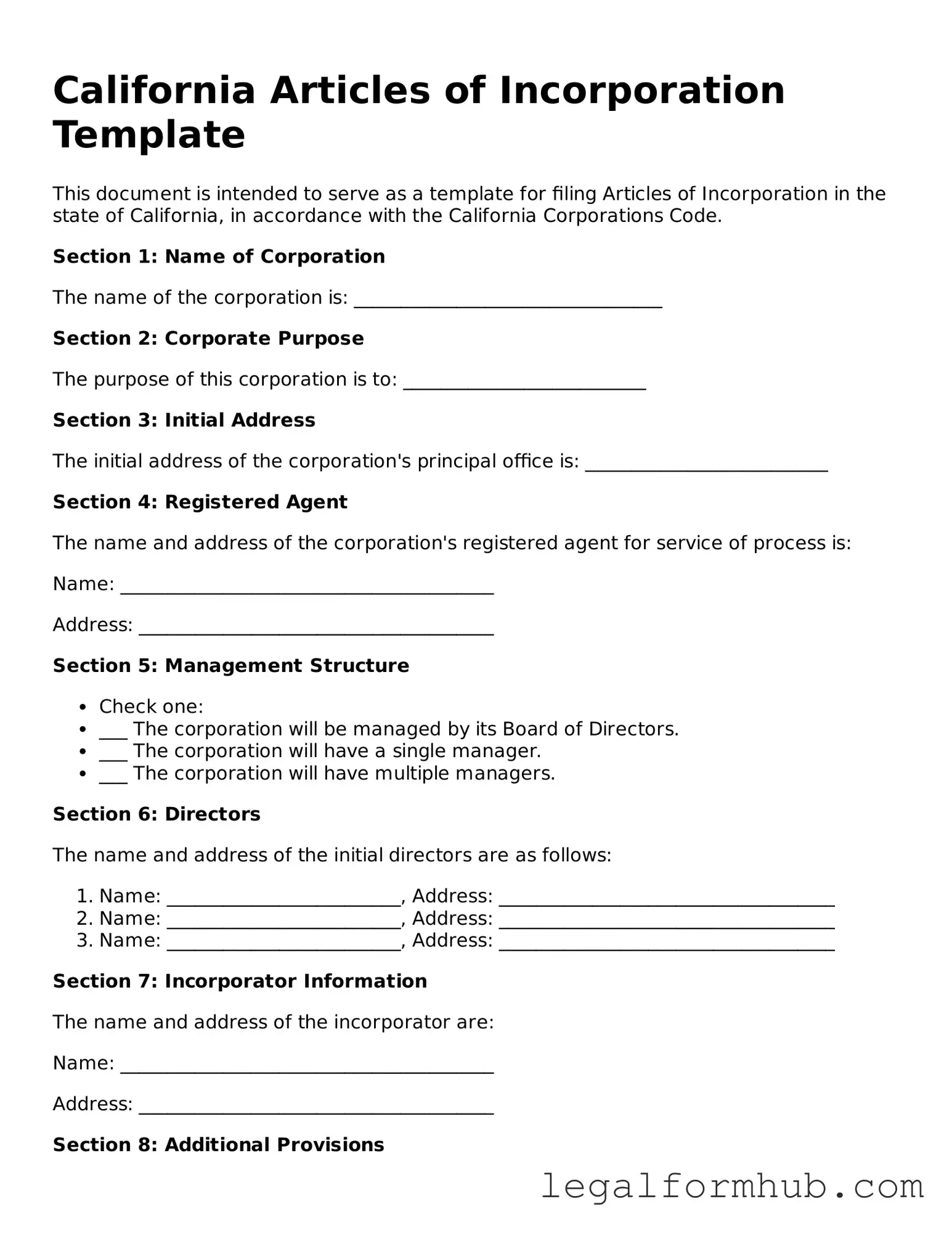

Instructions on Writing California Articles of Incorporation

After completing the California Articles of Incorporation form, you will need to submit it to the California Secretary of State along with the required filing fee. Ensure that you have all necessary information ready to avoid delays in processing your application.

- Obtain a copy of the California Articles of Incorporation form. This can be downloaded from the California Secretary of State's website or obtained in person.

- Begin by entering the name of your corporation. Ensure that the name complies with California naming requirements and is not already in use.

- Provide the purpose of your corporation. This should be a brief statement outlining the primary activities your corporation will engage in.

- Indicate the address of the corporation's initial registered office. This must be a physical address in California, not a P.O. Box.

- List the name and address of the initial agent for service of process. This person or entity will receive legal documents on behalf of the corporation.

- Specify the number of shares the corporation is authorized to issue. If applicable, include the classes of shares and their respective rights and preferences.

- Include the name and address of the incorporator. This is the individual responsible for filing the Articles of Incorporation.

- Review the form for accuracy and completeness. Ensure that all required fields are filled out correctly.

- Sign and date the form. The incorporator must sign the document to validate it.

- Prepare the required filing fee. Check the California Secretary of State's website for the current fee amount.

- Submit the completed form and payment to the California Secretary of State by mail or in person.

Misconceptions

Understanding the California Articles of Incorporation form is essential for anyone looking to establish a corporation in the state. However, several misconceptions often arise. Here are five common misunderstandings:

-

Incorporation guarantees business success.

Many believe that simply filing the Articles of Incorporation will ensure their business thrives. In reality, success depends on various factors, including market demand, management, and strategy.

-

All businesses must file Articles of Incorporation.

Not every business structure requires incorporation. Sole proprietorships and partnerships do not need to file Articles of Incorporation, as they operate under different legal frameworks.

-

The process is quick and simple.

While the form itself may seem straightforward, the overall process can be complex. It involves careful planning, gathering necessary information, and understanding state requirements.

-

Once filed, Articles of Incorporation cannot be changed.

Some individuals think that after filing, the information is set in stone. However, amendments can be made if circumstances change or if errors are discovered.

-

Filing Articles of Incorporation is the only requirement.

Incorporation is just one step. Businesses must also comply with local regulations, obtain necessary licenses, and fulfill ongoing reporting obligations.

Clarifying these misconceptions can help individuals navigate the incorporation process more effectively and set their businesses up for success.

Key takeaways

When filling out and using the California Articles of Incorporation form, there are several important points to keep in mind. Understanding these key takeaways can help ensure a smoother process.

- Choose the Right Entity Type: Decide whether you are forming a corporation, nonprofit, or another type of entity. This choice affects the specific requirements you will need to follow.

- Provide Accurate Information: Fill in the form with precise details about your corporation, including the name, address, and purpose. Inaccuracies can lead to delays or rejection.

- Include Required Statements: Certain statements must be included, such as the corporation's purpose and the agent for service of process. Make sure these are clearly stated.

- File with the Secretary of State: After completing the form, submit it to the California Secretary of State. Be aware of the filing fees and acceptable payment methods.

- Understand the Importance of Bylaws: While bylaws are not filed with the Articles, they are essential for governing your corporation. Draft them carefully to outline how your corporation will operate.

- Maintain Compliance: After incorporation, stay informed about ongoing compliance requirements, such as annual reports and tax obligations. This will help keep your corporation in good standing.

By keeping these points in mind, you can navigate the process of completing and using the California Articles of Incorporation form more effectively.

File Overview

| Fact Name | Description |

|---|---|

| Purpose | The California Articles of Incorporation form is used to legally create a corporation in California. |

| Governing Law | This form is governed by the California Corporations Code, specifically Sections 200-220. |

| Filing Requirement | Corporations must file the Articles of Incorporation with the California Secretary of State to be recognized legally. |

| Information Required | The form requires details such as the corporation's name, purpose, and the address of the principal office. |

| Filing Fee | A filing fee is required when submitting the Articles of Incorporation, which varies based on the type of corporation. |