Fill Your Business Credit Application Form

Different PDF Templates

Texas Temporary Tag - The Texas Temporary Tag form reflects the state’s commitment to facilitating vehicle ownership.

In the hiring process, the Employment Verification form is essential as it allows employers to validate the work history of potential candidates, ensuring that they meet the necessary qualifications and standards for the role. By utilizing this form, both employers and employees can protect their interests and maintain transparency during the employment verification process. For those looking to streamline this task, you can easily fill out the necessary documentation by visiting Fill PDF Forms.

Employee Status Change Form Template - Essential for documenting promotions that include salary adjustments.

Similar forms

The Business Credit Application form is similar to a Loan Application form. Both documents require detailed information about the applicant's financial status, including income, debts, and assets. The Loan Application form often seeks additional information about the purpose of the loan, which can help lenders assess risk and make informed decisions. Like the Business Credit Application, it aims to evaluate the applicant's ability to repay the borrowed amount.

Another document that shares similarities is the Vendor Credit Application. This form is typically used by suppliers to determine the creditworthiness of a business seeking to purchase goods on credit. Much like the Business Credit Application, it collects information about the business's financial history, trade references, and payment terms. Both forms are essential for establishing trust between the business and the vendor.

The Personal Credit Application is also comparable. While it focuses on individual consumers rather than businesses, it shares the same goal: assessing creditworthiness. Information such as employment history, income, and existing debts is collected in both applications. The personal version may include inquiries about personal credit scores, which can influence lending decisions in a similar way to how business credit scores affect the Business Credit Application.

A Business Loan Agreement is another document that aligns closely with the Business Credit Application. While the former is a contract outlining the terms of a loan, it often references the information provided in the credit application. Both documents require a thorough understanding of the business's financial health, and the agreement may stipulate conditions based on the insights gathered from the credit application.

For those interested in vehicle transactions, understanding the important aspects of the Motor Vehicle Bill of Sale is vital. This document facilitates a smooth transfer of ownership, providing both parties with legal protection during the sale.

The Partnership Agreement is relevant as well. Although it primarily outlines the terms of a business partnership, it can include financial commitments that may require credit assessments. Similar to the Business Credit Application, it necessitates a clear understanding of each partner's financial standing and obligations, which can influence credit decisions and partnership dynamics.

The Lease Application for commercial property also shares common elements. Landlords often require potential tenants to submit this form to evaluate their financial stability. Like the Business Credit Application, it asks for information about income, liabilities, and business history, helping landlords determine the risk of leasing to a particular business.

The Credit Report is another document that is intertwined with the Business Credit Application. While the application requests information from the applicant, the credit report provides an external assessment of their creditworthiness. Both documents work together to paint a complete picture of a business's financial reliability, influencing lending and credit decisions.

The Financial Statement is a crucial document that mirrors the Business Credit Application in many ways. It provides a snapshot of a business's financial health, including assets, liabilities, and equity. Lenders often request financial statements alongside credit applications to verify the information provided and assess the overall financial stability of the business.

Finally, the Trade Reference Form can be seen as a companion to the Business Credit Application. This document gathers information from other businesses that have extended credit to the applicant. It serves to validate the claims made in the credit application regarding payment history and reliability, reinforcing the assessment of creditworthiness.

Instructions on Writing Business Credit Application

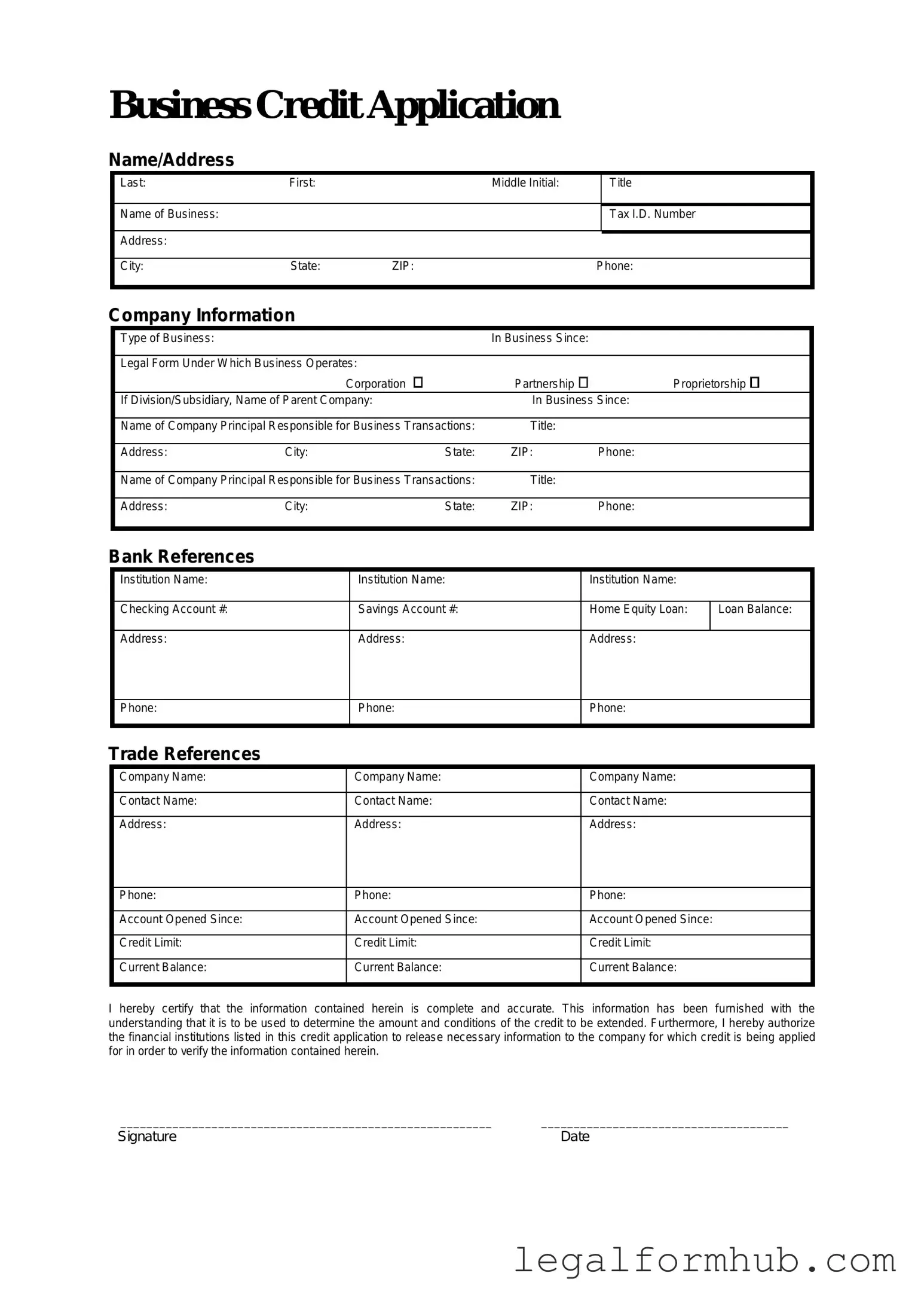

Completing the Business Credit Application form is an important step toward securing the credit your business needs. After filling out the form, you will submit it for review, and the lender will assess your application based on the information provided. Follow these steps carefully to ensure that your application is accurate and complete.

- Begin by entering your business name in the designated field.

- Provide the business address, including street, city, state, and zip code.

- Fill in the primary contact person’s name and their position within the company.

- Include a phone number and email address for the primary contact.

- Indicate the type of business structure (e.g., sole proprietorship, partnership, corporation).

- State the date the business was established.

- List the federal tax identification number (EIN) if applicable.

- Provide a brief description of your business activities.

- Detail the amount of credit requested.

- Include information about your bank, such as the bank name and account number.

- List at least three trade references, including their names, addresses, and phone numbers.

- Sign and date the application to certify that the information provided is accurate.

After completing these steps, review the form for any errors or missing information. A thorough review will help avoid delays in processing your application. Once you are satisfied, submit the form to the lender as instructed.

Misconceptions

Many people have misunderstandings about the Business Credit Application form. Here are ten common misconceptions and explanations to clarify them:

-

It is only for large businesses.

This form is available to businesses of all sizes. Small businesses can also apply for credit using this form.

-

Filling it out guarantees credit approval.

Submitting the application does not guarantee that credit will be granted. Approval depends on various factors, including creditworthiness.

-

Personal credit information is not needed.

In some cases, personal credit information may be required, especially for small businesses or sole proprietors.

-

It is a complicated process.

The application is designed to be straightforward. Most businesses can complete it with basic information.

-

Only one application can be submitted.

Businesses can submit multiple applications to different creditors as needed.

-

There is no fee to apply.

While many creditors do not charge a fee, some may have application fees. It is important to check with each creditor.

-

All creditors use the same form.

Each creditor may have their own version of the Business Credit Application form, which can vary in requirements.

-

Once submitted, the application cannot be changed.

Applicants can often update their information if necessary before a decision is made.

-

It is only for credit lines, not loans.

The application can be used for both credit lines and loans, depending on the creditor’s offerings.

-

There is no follow-up after submission.

Creditors may follow up with applicants for additional information or clarification after the application is submitted.

Key takeaways

When filling out and using the Business Credit Application form, several key points should be considered to ensure a smooth process.

- Accurate Information: Provide correct and up-to-date information about the business. Inaccuracies can lead to delays or denials.

- Business Structure: Clearly indicate the type of business entity, such as sole proprietorship, partnership, or corporation. This helps lenders assess risk.

- Financial History: Include a brief overview of the business’s financial history. This may include revenue, profit margins, and existing debts.

- Credit References: List at least three credit references. These should be reliable sources that can vouch for the business's creditworthiness.

- Personal Guarantee: Be prepared to provide a personal guarantee if required. This may involve personal credit checks for business owners.

- Read Terms Carefully: Review the terms and conditions associated with the credit application. Understanding these terms is crucial before signing.

- Submit Supporting Documents: Attach any necessary supporting documents, such as financial statements or tax returns, to strengthen the application.

- Follow Up: After submission, follow up with the lender to confirm receipt and inquire about the timeline for processing the application.

- Keep Copies: Retain copies of the completed application and any submitted documents for future reference. This can help in case of discrepancies.

Each of these takeaways plays a vital role in successfully navigating the Business Credit Application process.

File Information

| Fact Name | Description |

|---|---|

| Purpose | The Business Credit Application form is used by businesses to apply for credit from suppliers or financial institutions. |

| Information Required | Typically, the form requires details such as business name, address, contact information, and financial history. |

| Personal Guarantee | Many applications require a personal guarantee from business owners, ensuring personal liability for the debt. |

| State-Specific Forms | Some states may have specific requirements or forms governed by local laws, such as California's Business and Professions Code. |

| Confidentiality | Information provided on the form is generally kept confidential, but applicants should review the privacy policy of the lender. |

| Approval Process | After submission, lenders review the application, which may include checking credit scores and financial stability. |

| Impact on Credit Score | Applying for business credit can impact the business's credit score, especially if multiple applications are made in a short period. |

| Fees | Some lenders may charge fees for processing the application or for credit checks, which should be disclosed upfront. |

| Legal Considerations | It's essential to understand the legal implications of the application, including any agreements entered into upon approval. |