Printable Business Bill of Sale Document

Common Business Bill of Sale Documents:

How to Write Up a Bill of Sale for a Boat - Facilitates easier resale of the boat in the future.

To ensure a smooth transfer process during the sale of your trailer, it's important to have the required documentation ready. The California Trailer Bill of Sale serves as an essential record of ownership change, and for your convenience, you can quickly generate the necessary paperwork by visiting Fill PDF Forms.

Similar forms

A Business Bill of Sale is similar to a Vehicle Bill of Sale. Both documents serve the purpose of transferring ownership from one party to another. In the case of a Vehicle Bill of Sale, it specifically details the sale of a motor vehicle, including information such as the vehicle identification number (VIN), make, model, and year. This document provides legal proof of the transaction and protects both the buyer and the seller by clearly outlining the terms of the sale, including the purchase price and any warranties or conditions attached to the sale.

Another document that resembles the Business Bill of Sale is the Personal Property Bill of Sale. This form is used to transfer ownership of personal items, such as furniture, electronics, or collectibles. Similar to the Business Bill of Sale, it includes essential details about the items being sold, including descriptions, conditions, and the agreed-upon price. Both documents aim to provide a clear record of the transaction, ensuring that both parties understand their rights and responsibilities.

The Equipment Bill of Sale is also comparable to the Business Bill of Sale, as it specifically addresses the sale of equipment, often used in commercial settings. This document outlines the specifics of the equipment being sold, including serial numbers, condition, and any warranties. Like the Business Bill of Sale, it serves to protect both the buyer and seller by documenting the transaction and confirming the transfer of ownership, which is crucial for tax and liability purposes.

For those interested in a simplified transaction process, an effective resource is the comprehensive general bill of sale guide available at fillable-forms.com, which outlines necessary details and legal requirements to ensure a smooth transfer of ownership in various contexts.

In addition, the Real Estate Bill of Sale is another document that shares similarities with the Business Bill of Sale. While it primarily focuses on the sale of real property, it often includes personal property that is part of the real estate transaction, such as appliances or fixtures. This document helps clarify what is included in the sale and provides a legal record of the transfer, ensuring that both parties are aware of what is being conveyed.

Lastly, the Inventory Bill of Sale can be likened to the Business Bill of Sale, particularly in situations where a business is being sold along with its inventory. This document details the items included in the sale, such as stock, supplies, and other assets. It serves to protect both the buyer and seller by providing a comprehensive list of what is being transferred, ensuring clarity and preventing disputes over what was included in the sale.

Instructions on Writing Business Bill of Sale

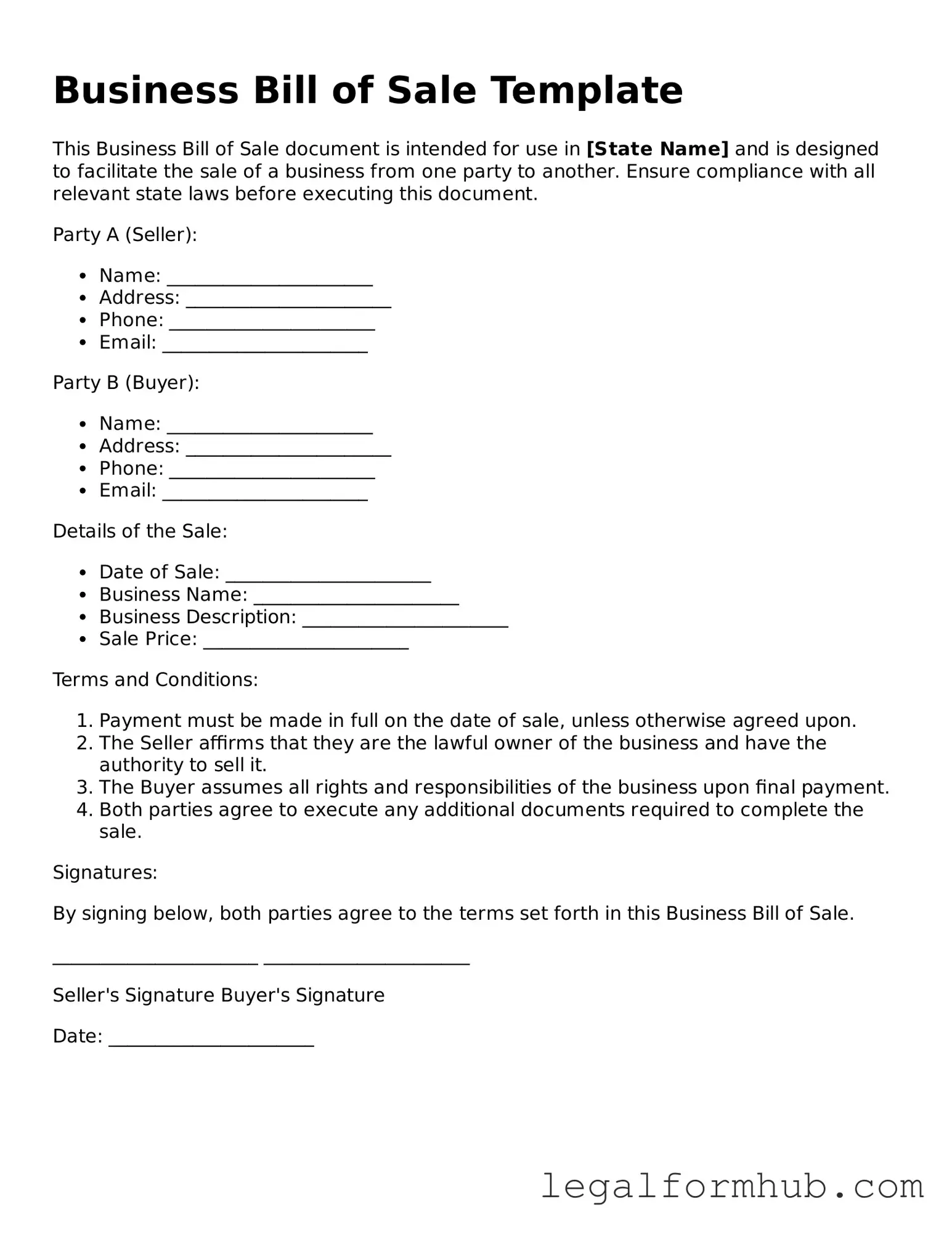

Once you have gathered all necessary information, you are ready to complete the Business Bill of Sale form. This document is essential for formalizing the sale of a business and ensuring that all parties involved are clear on the terms of the transaction. Follow the steps below to fill out the form accurately.

- Begin by entering the date of the sale at the top of the form.

- Provide the full legal name of the seller. Ensure that the name matches the name on any legal documents related to the business.

- Next, enter the seller's contact information, including their address, phone number, and email address.

- In the next section, fill in the buyer's full legal name, making sure it is accurate and complete.

- Include the buyer's contact information, similar to what you provided for the seller.

- Clearly describe the business being sold. This may include the business name, location, and any relevant identification numbers.

- Specify the purchase price for the business. This amount should be clear and unambiguous.

- Indicate the payment method that will be used for the transaction, such as cash, check, or bank transfer.

- Both parties should sign and date the form at the bottom. Make sure that signatures are legible.

- Finally, provide a witness signature if required, and include the date of the witness signature.

After completing the form, ensure that both parties retain a copy for their records. This will help protect their interests and provide clarity in the future. If you have any questions about the next steps in the process, don't hesitate to reach out for assistance.

Misconceptions

The Business Bill of Sale form is a crucial document for transferring ownership of a business, yet several misconceptions surround it. Understanding these misconceptions can help ensure a smooth transaction. Here are eight common misunderstandings:

-

It is only necessary for large businesses. Many people believe that only large corporations need a Business Bill of Sale. In reality, any size business can benefit from this document, as it formalizes the transfer of ownership regardless of scale.

-

It is the same as a personal bill of sale. Some assume that a Business Bill of Sale is identical to a personal bill of sale. However, business transactions often involve more complex elements, such as assets, liabilities, and contracts, which require specific details in the business form.

-

It is not legally binding. A common misconception is that a Business Bill of Sale does not hold legal weight. In fact, when properly executed, it is a legally binding document that protects both the buyer and seller in the transaction.

-

It only covers physical assets. Many believe that the form only pertains to tangible items like equipment and inventory. In truth, it can also include intangible assets such as trademarks, customer lists, and goodwill.

-

It can be written informally. Some think that a simple handwritten note can suffice. However, a well-structured Business Bill of Sale is essential to ensure all necessary details are included and legally recognized.

-

It is only needed for the sale of the entire business. Many individuals think that this form is only relevant when selling the entire business. In fact, it can also be used for partial sales or transfers of specific assets.

-

Once signed, it cannot be changed. Some believe that after signing, the document is set in stone. While it is true that changes can be complicated, amendments can be made if both parties agree and follow the proper procedures.

-

It is not necessary if there is a verbal agreement. Many think that a verbal agreement is enough to finalize a business sale. However, relying solely on verbal agreements can lead to disputes; a written Business Bill of Sale provides clear evidence of the transaction.

Understanding these misconceptions can help both buyers and sellers navigate the process of transferring business ownership more effectively. Clarity in documentation fosters trust and reduces the likelihood of disputes down the road.

Key takeaways

When filling out and using a Business Bill of Sale form, it is crucial to understand its purpose and implications. Here are key takeaways to guide you through the process:

- Understand the Purpose: A Business Bill of Sale serves as a legal document that transfers ownership of a business or its assets from one party to another.

- Identify the Parties: Clearly state the names and contact information of both the seller and the buyer to avoid any ambiguity.

- Detail the Assets: List all items being sold, including equipment, inventory, and intellectual property. Be as specific as possible.

- Set a Purchase Price: Clearly indicate the total amount being paid for the business or its assets. This amount should reflect the agreed-upon valuation.

- Include Terms of Sale: Outline any conditions or warranties associated with the sale. This may include payment terms or contingencies.

- Consider Legal Requirements: Depending on your state, there may be specific legal requirements for a Bill of Sale. Ensure compliance to avoid future disputes.

- Signatures Matter: Both parties should sign and date the document. This validates the agreement and confirms the transfer of ownership.

- Keep Copies: After the sale, both the buyer and seller should retain copies of the Bill of Sale for their records. This serves as proof of the transaction.

- Consult a Professional: If unsure about any aspect of the sale, consider seeking legal advice. A professional can provide valuable insights and help protect your interests.

File Overview

| Fact Name | Details |

|---|---|

| Definition | A Business Bill of Sale is a legal document that transfers ownership of a business or its assets from one party to another. |

| Purpose | This form serves to provide proof of the transaction and can help protect both the buyer and seller in case of disputes. |

| Contents | Typically includes details about the buyer, seller, business assets being sold, and the sale price. |

| Governing Law | Each state has its own laws governing business transactions, so it's essential to refer to state-specific regulations. |

| Execution | The form must be signed by both parties to be legally binding, often requiring notarization for added security. |

| Tax Implications | Both buyers and sellers may have tax obligations resulting from the sale, which should be considered before finalizing the transaction. |

| Asset Types | Can cover various assets, including equipment, inventory, and intellectual property, depending on the business type. |

| State Variations | Forms may vary by state; for example, California has specific requirements under the California Commercial Code. |

| Record Keeping | It is advisable for both parties to keep a copy of the Bill of Sale for their records, ensuring clarity in future dealings. |