Fill Your Broker Price Opinion Form

Different PDF Templates

California Corrective Deed - This form can provide legal protection against future disputes regarding the document.

In order to ensure clear understanding and protection in situations where liability might arise, it is essential to utilize the Arizona Hold Harmless Agreement, a legal document that protects one party from liability for damages or injuries incurred by another party. This form is commonly used in various contexts, including real estate transactions and event planning. For more detailed information and a template, you can visit arizonapdfs.com/hold-harmless-agreement-template/. By signing this agreement, individuals or organizations agree to assume responsibility for certain risks, thereby shielding others from potential legal claims.

Goodwill Receipt - Keep the receipt close to show your support for Goodwill's mission.

Similar forms

The Broker Price Opinion (BPO) form shares similarities with the Comparative Market Analysis (CMA). Both documents aim to assess a property's value based on comparable sales in the area. A CMA typically includes a detailed analysis of recently sold homes, active listings, and expired listings. This helps in determining a fair market price for the property in question. While a BPO is often used by lenders for foreclosure and short sale situations, a CMA is frequently utilized by real estate agents to guide sellers and buyers in setting prices. Both tools rely on comparable properties to provide insights into market trends and pricing strategies.

Another document that resembles the BPO is the Appraisal Report. An appraisal is a professional assessment conducted by a licensed appraiser to determine a property's market value. Like the BPO, it considers comparable sales, property condition, and market conditions. However, an appraisal is usually more formal and detailed, often required by lenders for mortgage purposes. While the BPO provides a quicker estimate, the appraisal offers a comprehensive analysis, making it a critical document in real estate transactions.

The Property Condition Report is also akin to the BPO. This document focuses specifically on the physical state of a property, detailing any repairs or issues that may affect its value. While the BPO provides a broader market perspective, the Property Condition Report zeroes in on the condition of the property itself. Both documents are essential in evaluating a property's worth, especially in situations where repairs may influence the selling price or the decision to purchase.

Another similar document is the Listing Agreement. This contract between a property owner and a real estate agent outlines the terms of the sale, including the listing price, duration, and agent responsibilities. While the BPO estimates a property's value based on market conditions, the Listing Agreement formalizes the relationship between the seller and the agent, ensuring both parties understand their obligations. The BPO may inform the listing price set in the agreement, making them interconnected in the selling process.

The Seller's Disclosure Statement is yet another document that aligns with the BPO. This statement provides potential buyers with important information about the property, including any known defects or issues. While the BPO assesses market value, the Seller's Disclosure focuses on transparency regarding the property's condition. Both documents play a vital role in real estate transactions, helping buyers make informed decisions while protecting sellers from future liability.

When considering the purchase or sale of a dog, it is crucial to have the proper documentation to ensure a smooth transfer of ownership. Similar to real estate transactions where documents like the Broker Price Opinion and Listing Agreement are used, the Dog Bill of Sale serves a vital role in confirming the details of the transaction. To facilitate this process, you can easily Fill PDF Forms for a clear and straightforward experience.

Lastly, the Real Estate Purchase Agreement is similar to the BPO in that it outlines the terms of a property sale. This legally binding contract includes details such as the purchase price, closing date, and contingencies. While the BPO provides an estimate of value, the Purchase Agreement finalizes the transaction based on that value. Both documents are essential in the buying and selling process, ensuring clarity and agreement between parties involved.

Instructions on Writing Broker Price Opinion

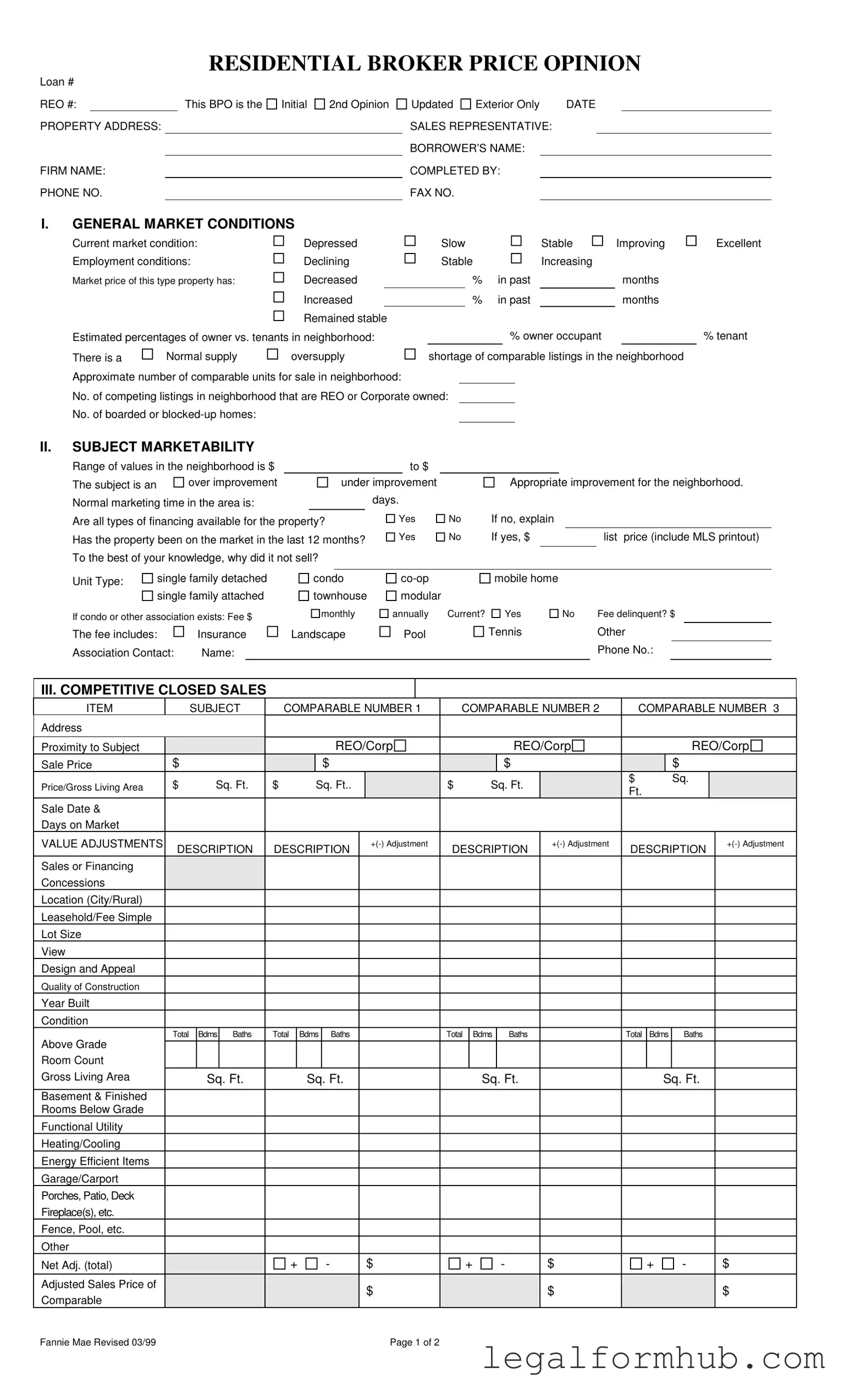

Completing the Broker Price Opinion (BPO) form requires careful attention to detail and accurate information about the property and its market conditions. Following the steps outlined below will help ensure that the form is filled out correctly and thoroughly.

- Begin by entering the Loan # and REO # at the top of the form.

- Fill in the PROPERTY ADDRESS, FIRM NAME, and PHONE NO..

- Indicate whether this is an Initial, 2nd Opinion, or Updated BPO, and specify if it is Exterior Only.

- Write the DATE and the name of the SALES REPRESENTATIVE.

- Enter the BORROWER’S NAME and the name of the person COMPLETED BY.

- Provide the FAX NO. if applicable.

In the first section, labeled GENERAL MARKET CONDITIONS, assess the current market condition and employment conditions. Indicate the market price trends and the estimated percentages of owners versus tenants in the neighborhood. Note the supply of comparable listings and any boarded or blocked-up homes.

- In the SUBJECT MARKETABILITY section, outline the range of values in the neighborhood and any improvements needed for the property.

- Specify the normal marketing time for the area and whether all types of financing are available.

- Indicate if the property has been on the market in the last 12 months and provide the list price if applicable.

- Identify the Unit Type and provide details about any association fees.

Next, move to the COMPETITIVE CLOSED SALES section. Here, list comparable properties and their details, including sale prices and adjustments needed.

- For each comparable property, enter the Address, Sale Price, Sale Date, and any necessary adjustments.

- Calculate the Adjusted Sales Price for each comparable.

In the MARKETING STRATEGY section, indicate the condition of the property and the most likely buyer type. Then, detail any repairs needed to bring the property to an average marketable condition.

- Itemize all necessary repairs and check those recommended for successful marketing.

- Calculate the GRAND TOTAL FOR ALL REPAIRS.

Proceed to the COMPETITIVE LISTINGS section. Similar to the previous section, list comparable properties with their details.

- Provide the List Price and any adjustments needed for each comparable listing.

- Calculate the Adjusted Sales Price for each listing.

Finally, determine the MARKET VALUE and suggested list prices for both as-is and repaired conditions. Include any relevant comments regarding the property.

- Sign and date the form to finalize your submission.

Misconceptions

- Misconception 1: A Broker Price Opinion (BPO) is the same as a formal appraisal.

- Misconception 2: BPOs are only for foreclosures or bank-owned properties.

- Misconception 3: A BPO guarantees the sale price of a property.

- Misconception 4: The BPO process is too complicated for real estate agents.

- Misconception 5: A BPO is not as reliable as an appraisal.

While both BPOs and appraisals estimate property value, they serve different purposes. A BPO is often quicker and less detailed, typically used for internal decision-making by lenders or real estate agents.

BPOs can be used for a variety of properties, not just those in foreclosure. They are helpful for determining market value in many situations, including traditional sales and investment properties.

A BPO provides an estimate based on market conditions and comparable sales, but it does not guarantee what a buyer will pay. The final sale price may vary based on negotiations and buyer interest.

While the BPO form includes various details, it is designed to be straightforward. Most agents find it manageable, especially with experience in evaluating properties.

Although BPOs are less formal, they can still provide valuable insights into property value. Many lenders and investors rely on BPOs for quick assessments, especially in fast-moving markets.

Key takeaways

Understanding how to fill out and effectively use the Broker Price Opinion (BPO) form is crucial for real estate professionals. Here are nine key takeaways to guide you through the process:

- Know the Market Conditions: Accurately assess the current market conditions, including employment trends and the supply of comparable listings. This information sets the stage for your valuation.

- Evaluate Property Marketability: Determine the range of values in the neighborhood and assess whether the property is an over-improvement, under-improvement, or appropriately improved.

- Identify Financing Options: Be aware of the types of financing available for the property. If certain financing options are unavailable, provide a clear explanation.

- Analyze Comparable Sales: Carefully compare the subject property to similar properties that have sold recently. Pay attention to sale prices, adjustments for differences, and the overall condition of each comparable.

- Consider Marketing Strategies: Decide on a marketing strategy that fits the property’s condition, whether it's selling as-is or after repairs. This choice can significantly impact potential buyers.

- Document Necessary Repairs: Itemize all repairs needed to bring the property to marketable condition. This helps in setting realistic expectations for costs and timelines.

- Review Competitive Listings: Analyze current listings in the area. Understanding what similar properties are listed for can help you set a competitive price.

- Establish Market Value: Ensure that the suggested list price aligns with the competitive closed sales. This is vital for attracting buyers.

- Provide Detailed Comments: Use the comments section to note any special concerns or unique features of the property. This information can be valuable for potential buyers and lenders.

By following these takeaways, you can enhance your ability to complete the Broker Price Opinion form effectively, ultimately leading to more informed decisions in the real estate market.

File Information

| Fact Name | Description |

|---|---|

| Purpose | The Broker Price Opinion (BPO) form is used to estimate the value of a property, often for lenders or real estate professionals assessing market conditions. |

| Market Conditions | The form includes sections to evaluate current market conditions, including employment status and the number of comparable listings available in the neighborhood. |

| Property Details | It requires detailed information about the subject property, including its condition, occupancy status, and any necessary repairs. |

| Comparative Analysis | The BPO form facilitates a comparative analysis by allowing the appraiser to list comparable sales and listings, helping to determine a fair market value. |

| State-Specific Regulations | In some states, the use of BPOs is governed by specific real estate laws, which may require licensed professionals to complete them. |