Fill Your Auto Insurance Card Form

Different PDF Templates

Dekalb County Water New Service Application - This form allows for the reactivation of a previously closed water account.

How to Check How Many College Credits You Have - Review the terms related to the release of your academic records.

The Employment Application PDF form is a standardized document used by employers to gather essential information about job applicants. This form typically includes sections for personal details, work history, and educational background, facilitating a streamlined hiring process. To get started, fill out the form by clicking the button below or visit Fill PDF Forms to access it directly.

Acord 130 - The Acord 130 highlights important factors influencing insurance premiums and policy terms.

Similar forms

The Auto Insurance Card serves a specific purpose in demonstrating proof of insurance coverage for a vehicle. Similarly, a Driver's License functions as an official document that certifies an individual's ability to operate a motor vehicle. Both documents must be presented upon demand; while the Auto Insurance Card proves financial responsibility, the Driver's License verifies the driver's identity and qualifications. Each document is issued by a state authority, and both contain critical information, such as personal details and expiration dates, ensuring that they are up-to-date and valid for use on the road.

Another document that shares similarities with the Auto Insurance Card is the Vehicle Registration Certificate. This certificate serves as proof that a vehicle is registered with the state, providing essential details about the vehicle, including its identification number and the owner's information. Just like the Auto Insurance Card, the Vehicle Registration Certificate must be kept in the vehicle and presented when required, such as during a traffic stop or an accident. Both documents are crucial for legal compliance and help ensure that vehicles are properly insured and registered for use on public roads.

The Proof of Insurance Letter is yet another document akin to the Auto Insurance Card. This letter, typically issued by an insurance company, confirms that an individual holds an active insurance policy for their vehicle. While the Auto Insurance Card is a physical card that must be kept in the vehicle, the Proof of Insurance Letter can be a temporary document, often used when a card is not immediately available. Both documents serve the same fundamental purpose of providing evidence of insurance coverage and may include similar information, such as policy numbers and effective dates.

A Certificate of Insurance is also comparable to the Auto Insurance Card. This document is often used in situations where proof of insurance is required for contractual obligations, such as leasing a vehicle or entering into agreements with other parties. Like the Auto Insurance Card, a Certificate of Insurance outlines the details of the insurance policy, including coverage limits and the insured party's information. Both documents are essential in demonstrating that an individual has the necessary insurance coverage to protect against potential liabilities while operating a vehicle.

To facilitate your rental process, it is important to review the terms outlined in this comprehensive Missouri Lease Agreement form, which details the key responsibilities and obligations of landlords and tenants.

Lastly, a Title Document, which establishes ownership of a vehicle, shares some similarities with the Auto Insurance Card. While the Auto Insurance Card proves financial responsibility, the Title Document proves legal ownership. Both documents include important vehicle information, such as the Vehicle Identification Number (VIN) and details about the owner. Furthermore, both documents must be kept accessible, as they may be required during vehicle transactions or legal matters. Together, they form a comprehensive understanding of a vehicle's legal and financial standing.

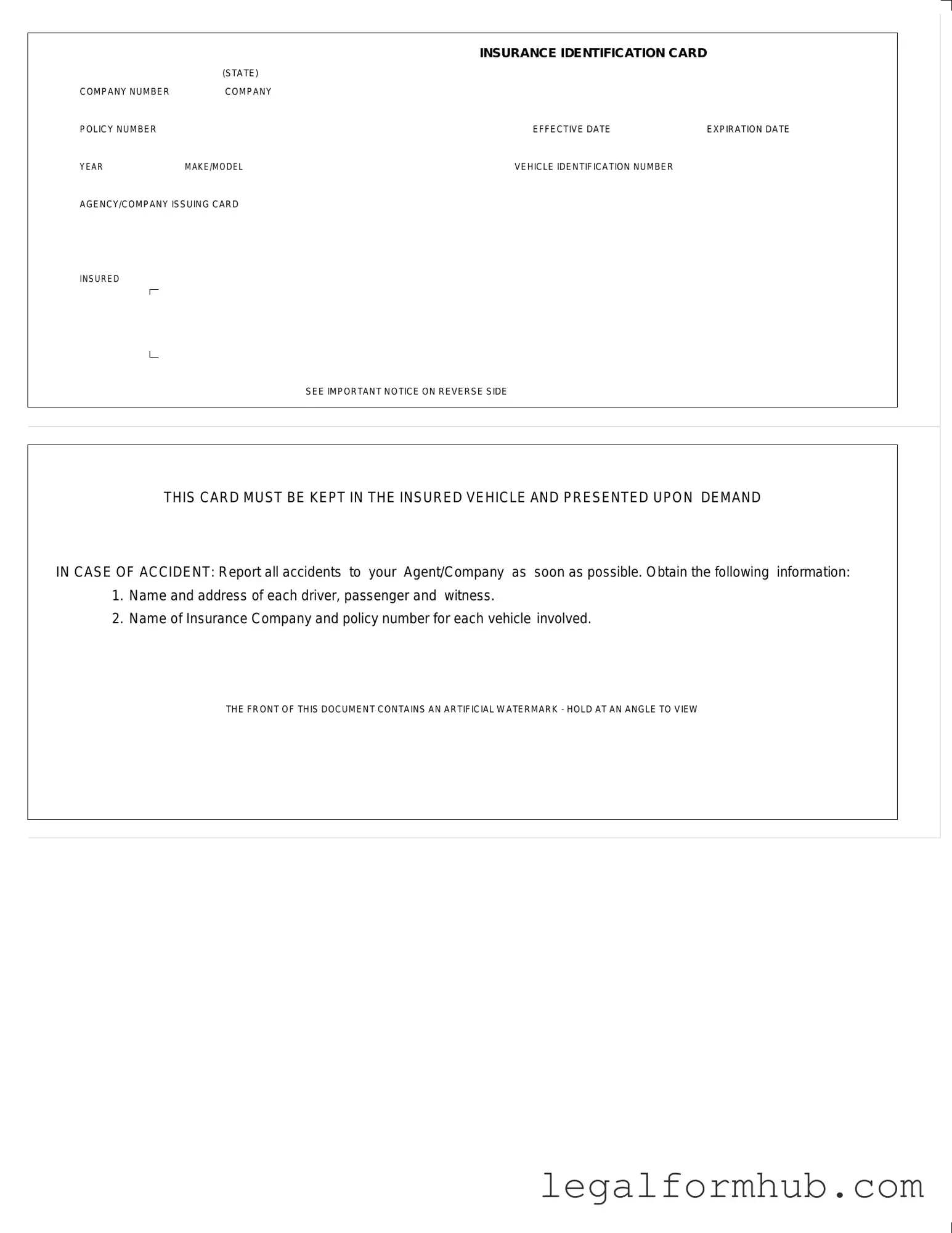

Instructions on Writing Auto Insurance Card

Completing the Auto Insurance Card form is an important task that ensures you have the necessary information readily available while driving. It is crucial to fill out this form accurately to avoid any issues in the event of an accident. Follow the steps below to ensure that all required information is entered correctly.

- Locate the form: Start by finding the Auto Insurance Card form, which should be provided by your insurance company.

- Fill in the company details: Enter the name of your insurance company in the designated area. Next, input the company number and policy number as they appear on your insurance documents.

- Effective and expiration dates: Record the effective date when your policy starts, followed by the expiration date when your coverage ends.

- Vehicle information: Provide details about your vehicle, including the year, make/model, and the vehicle identification number (VIN).

- Agency information: Write the name of the agency or company that is issuing the insurance card.

- Review: Double-check all the information you have entered to ensure accuracy. This is essential for avoiding complications later.

- Keep the card: Once completed, ensure that the card is kept in your vehicle at all times. It must be presented upon request in case of an accident.

After you have filled out the form, it is advisable to familiarize yourself with the important notice on the reverse side. This notice provides essential information on what to do in the event of an accident, including how to report it to your insurance agent or company.

Misconceptions

Auto insurance cards are crucial documents that provide proof of insurance coverage. However, several misconceptions surround them. Here are seven common misunderstandings:

- Misconception 1: The auto insurance card is only needed for accidents.

- Misconception 2: The card is valid indefinitely as long as the policy is active.

- Misconception 3: The information on the card is not important.

- Misconception 4: You can use a digital copy instead of a physical card.

- Misconception 5: The auto insurance card is the same as the insurance policy.

- Misconception 6: You don’t need to report minor accidents.

- Misconception 7: The watermark on the card is just for decoration.

This is not true. While it is essential to have your card during an accident, it is also required to show proof of insurance when registering your vehicle or during a traffic stop.

Many believe that once they receive their card, it remains valid forever. In reality, the card must be updated whenever there is a change in coverage, such as a new vehicle or an adjustment in policy terms.

Some people think that the details on the card are insignificant. However, the card contains vital information, including the policy number and the insurance company’s contact details, which are crucial in case of an accident.

While many states allow digital copies, not all do. It is essential to check your state’s regulations to ensure compliance. Keeping a physical card in the vehicle is often still a requirement.

This is a common misunderstanding. The card is merely proof of insurance coverage, while the policy is a detailed document outlining the terms, conditions, and limits of your coverage.

Many believe that only serious accidents require reporting. However, it is advisable to report all accidents to your insurance company, regardless of severity, to avoid complications later on.

Some may overlook the watermark, thinking it’s purely decorative. In fact, it serves as a security feature to help prevent fraud and ensure that the card is legitimate.

Understanding these misconceptions can help ensure that you are adequately prepared and compliant with insurance requirements.

Key takeaways

When filling out and using the Auto Insurance Card form, keep these key takeaways in mind:

- The form includes essential details such as company number, policy number, and effective and expiration dates.

- Ensure that the vehicle identification number is accurately entered to avoid any issues during claims.

- This card must be kept in the insured vehicle at all times and presented upon demand in case of an accident.

- In the event of an accident, report it to your insurance agent or company as soon as possible.

- Gather necessary information from all parties involved, including names, addresses, and insurance details.

Remember, the front of this document features an artificial watermark. To view it, hold the card at an angle.

File Information

| Fact Name | Description |

|---|---|

| Document Type | This is an Insurance Identification Card, which serves as proof of auto insurance coverage. |

| Company Number | The card includes a unique company number assigned to the insurance provider. |

| Policy Number | Each card lists the specific policy number under which the insured vehicle is covered. |

| Effective Date | The effective date indicates when the insurance coverage begins. |

| Expiration Date | This date marks when the insurance coverage will end unless renewed. |

| Vehicle Information | The card provides details about the vehicle, including its year, make, model, and Vehicle Identification Number (VIN). |

| Issuing Agency | The name of the agency or company that issued the insurance card is clearly stated. |

| Legal Requirement | Most states require that this card be kept in the insured vehicle and presented upon demand in case of an accident. |

| Important Notice | The card includes a notice advising the insured to report all accidents to their agent or company promptly. |