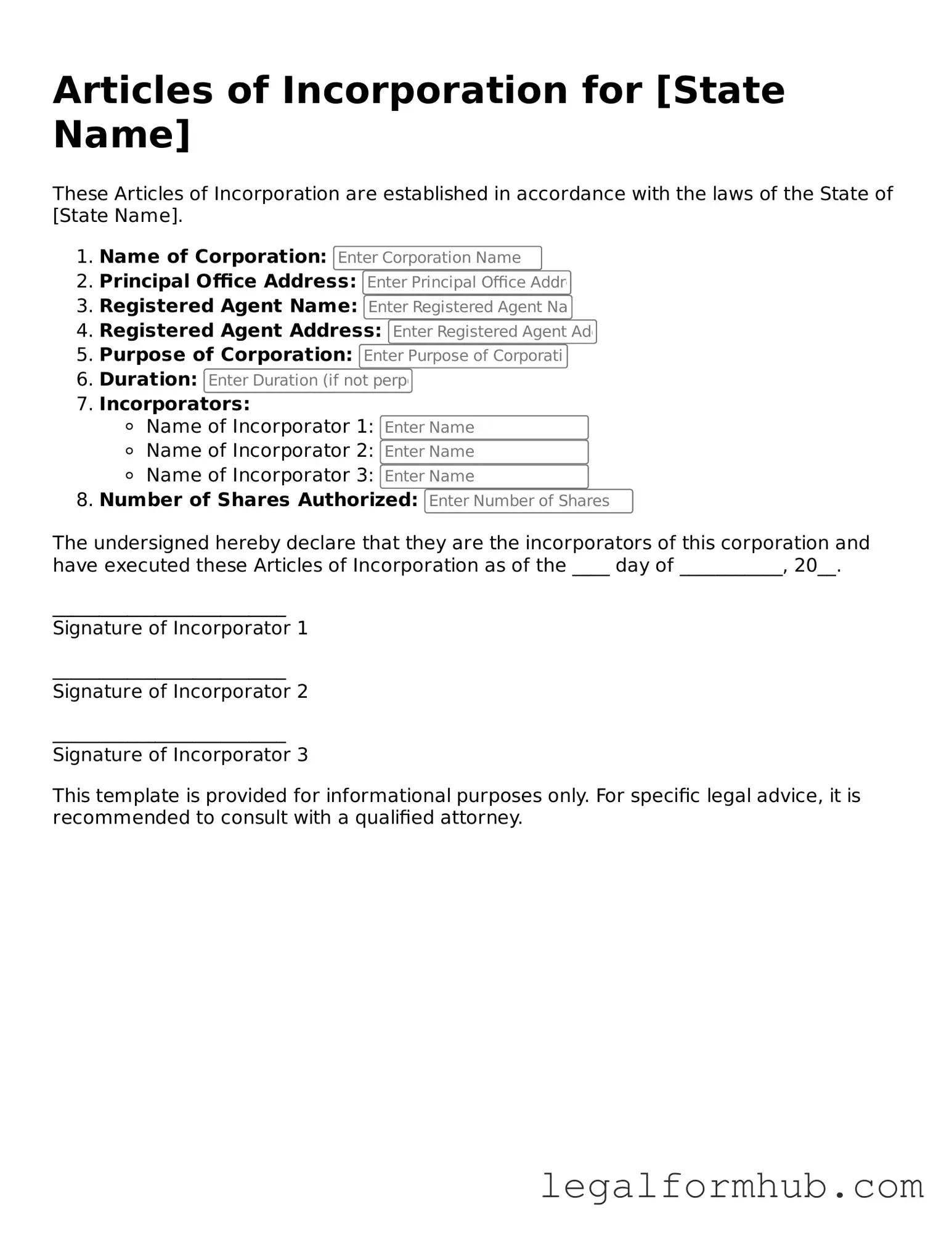

Printable Articles of Incorporation Document

More Forms:

Example of a Character Letter for Court - This letter details the custodial parent’s skills in resolving conflicts with the child.

In many situations, having a solid grasp of the Arizona Hold Harmless Agreement is essential to ensure compliance and safeguard interests, and you can find a comprehensive template for this invaluable document at arizonapdfs.com/hold-harmless-agreement-template/, which simplifies the process of drafting and understanding its implications.

Trader Joes Application - Able to handle transactions accurately and efficiently while offering friendly service.

Articles of Incorporation - Tailored for Each State

Similar forms

The Articles of Incorporation are often compared to the Certificate of Incorporation. Both documents serve as foundational legal paperwork that officially establishes a corporation. The Certificate of Incorporation typically includes similar information, such as the corporation's name, purpose, and details about its stock. While the terminology may differ from state to state, the function remains the same: to create a distinct legal entity recognized by the state.

The Bylaws are another document that parallels the Articles of Incorporation. Bylaws outline the internal rules and procedures for managing the corporation. While the Articles provide a high-level overview of the corporation's existence, Bylaws delve into the specifics of governance, including the roles of officers, the process for holding meetings, and how decisions are made. Both documents are essential for the corporation's operation but serve different purposes.

The Operating Agreement is similar to the Articles of Incorporation, particularly for Limited Liability Companies (LLCs). This document outlines the management structure and operating procedures of the LLC. Like the Articles, the Operating Agreement is crucial for defining the entity's legal standing and operational framework. It provides clarity on ownership interests and responsibilities, ensuring that all members understand their roles.

The Partnership Agreement shares similarities with the Articles of Incorporation, especially when establishing a partnership. This document details the rights and responsibilities of each partner, including profit-sharing arrangements and decision-making processes. While the Articles create a corporation, the Partnership Agreement formalizes a business relationship among individuals, highlighting the legal obligations that bind them together.

The Certificate of Good Standing is another document that relates to the Articles of Incorporation. While the Articles are filed to create a corporation, the Certificate of Good Standing is a state-issued document that confirms the corporation is legally registered and compliant with state requirements. It serves as proof that the corporation has fulfilled its obligations, such as filing annual reports and paying taxes, which is essential for maintaining its legal status.

The Business License is akin to the Articles of Incorporation in that both are necessary for legal operation. While the Articles establish the corporation, the Business License grants permission to operate within a specific jurisdiction. This document ensures that the business complies with local regulations and zoning laws, allowing it to function legally in its chosen market.

To facilitate the transfer of boat ownership in California, it's essential to utilize the appropriate documentation, such as the California Boat Bill of Sale form. This form formalizes the transaction, ensuring that both the buyer and seller have clear, recorded details regarding the ownership transfer. For those looking to streamline this process, you can easily access the necessary documentation through Fill PDF Forms, ensuring a comprehensive and compliant transaction.

The Employer Identification Number (EIN) is similar to the Articles of Incorporation in that it is a critical step for businesses seeking to operate legally. The EIN is issued by the IRS and is used for tax purposes. While the Articles create the corporation, the EIN allows it to open bank accounts, hire employees, and file taxes. Both documents are essential for the legal and financial identity of the business.

The Shareholder Agreement can also be compared to the Articles of Incorporation. This document outlines the rights and responsibilities of shareholders within the corporation. While the Articles of Incorporation establish the corporation's existence, the Shareholder Agreement governs the relationship among shareholders, detailing voting rights, transfer of shares, and dispute resolution. Both documents are vital for ensuring smooth operations and clear communication among stakeholders.

Finally, the Annual Report is similar to the Articles of Incorporation in that it is a required document for corporations. While the Articles are filed at the inception of the corporation, the Annual Report must be submitted periodically to maintain good standing. This report provides updated information about the corporation's activities, financial status, and changes in management. Both documents are essential for regulatory compliance and transparency in business operations.

Instructions on Writing Articles of Incorporation

Filling out the Articles of Incorporation form is an important step in establishing a corporation. Once completed, this form will be submitted to the appropriate state authority, allowing your business to be officially recognized. Below are the steps to accurately complete the form.

- Gather Required Information: Collect all necessary details, including the name of the corporation, the purpose of the business, and the names and addresses of the initial directors.

- Choose a Corporate Name: Ensure the name is unique and complies with state regulations. It should not be similar to existing businesses.

- Specify the Duration: Indicate whether the corporation is intended to exist perpetually or for a specific period.

- State the Purpose: Clearly describe the business activities the corporation will engage in.

- List Initial Directors: Provide the names and addresses of the individuals who will serve as the initial directors of the corporation.

- Designate a Registered Agent: Identify a registered agent who will be responsible for receiving legal documents on behalf of the corporation.

- Include Incorporator Information: Fill in the name and address of the person completing the form, known as the incorporator.

- Review and Sign: Carefully review all information for accuracy. The incorporator must sign the form to validate it.

- Submit the Form: Send the completed Articles of Incorporation to the appropriate state office, along with any required fees.

Misconceptions

There are several misconceptions about the Articles of Incorporation form that can lead to confusion. Here are four common misunderstandings:

-

It's only for large businesses.

Many people think that only large corporations need to file Articles of Incorporation. In reality, any business that wants to operate as a corporation, regardless of size, must complete this form. This includes small businesses and startups.

-

Filing is optional.

Some believe that filing Articles of Incorporation is optional. However, if you want to establish your business as a corporation, it is a necessary step. Without it, your business won't have the legal protections and benefits that come with incorporation.

-

It guarantees success.

People often think that simply filing the Articles of Incorporation will ensure their business's success. While incorporation provides certain advantages, such as limited liability, it does not guarantee profitability or market success. Business success depends on many other factors.

-

It's a one-time process.

Many assume that once they file the Articles of Incorporation, they can forget about it. In truth, corporations must comply with ongoing requirements, such as annual reports and fees, to maintain their status. Staying informed about these obligations is crucial for continued compliance.

Key takeaways

Filling out the Articles of Incorporation form is an essential step in starting a corporation. Here are some key takeaways to keep in mind:

- Understand the Purpose: The Articles of Incorporation serve as the official document that establishes your corporation's existence.

- Choose a Name: Select a unique name for your corporation that complies with state regulations. It should not be similar to existing businesses.

- Designate a Registered Agent: This is a person or business that will receive legal documents on behalf of your corporation.

- Specify the Business Purpose: Clearly outline what your corporation will do. This can be broad, but it should reflect your business activities.

- Include Share Information: Indicate the number of shares your corporation is authorized to issue and their par value, if applicable.

- File with the State: Submit the completed form to the appropriate state agency, usually the Secretary of State, along with any required fees.

- Keep Records: Once filed, maintain a copy of the Articles of Incorporation for your records. It’s an important document for your corporation.

By following these guidelines, you can ensure a smoother process in establishing your corporation.

File Overview

| Fact Name | Description |

|---|---|

| Purpose | The Articles of Incorporation form establishes a corporation as a legal entity. |

| Required Information | This form typically requires the corporation's name, address, and the names of the initial directors. |

| Filing Fee | A filing fee is usually required, and the amount can vary by state. |

| Governing Laws | Each state has its own laws governing the incorporation process, such as the California Corporations Code. |

| Public Record | Once filed, the Articles of Incorporation become part of the public record. |

| Amendments | Changes to the Articles may require filing an amendment form with the state. |