Fill Your Advance Beneficiary Notice of Non-coverage Form

Different PDF Templates

Aia Qualification Statement - The AIA A305 form is a key step in securing construction contracts with major clients.

Baseball Evaluation Sheets - Facilitates communication between coaches and players regarding skillsets.

The Employment Application PDF form is a vital tool for prospective employees, ensuring that all necessary details for the hiring process are collected efficiently. By completing this standardized document, applicants can provide their personal information, work history, and educational background. To begin your application process, visit the link to Fill PDF Forms and follow the instructions provided.

Batting Lineup Strategy - Record the name of the opposing team here.

Similar forms

The Advance Beneficiary Notice of Non-coverage (ABN) form is similar to the Medicare Summary Notice (MSN). The MSN is a statement that Medicare sends to beneficiaries every three months, detailing the services received and the amounts covered. Like the ABN, the MSN informs beneficiaries about what is and isn’t covered under Medicare, but it is issued after services are rendered rather than before. This helps beneficiaries understand their financial responsibilities after receiving care.

The Employment Verification Form serves as a crucial document that confirms an individual's job history and employment details. Typically used by employers and financial institutions, this form aids in ensuring the accuracy of information provided by potential employees or borrowers. To expedite the process of verifying employment, consider filling out the form by clicking the button below. For additional resources, you can visit https://pdftemplates.info/.

Another document akin to the ABN is the Notice of Exclusions from Medicare Benefits (NEMB). The NEMB is issued when Medicare denies coverage for specific services. It explains why the service is not covered and what the beneficiary’s options are. Both the ABN and NEMB serve to inform beneficiaries about potential costs, but the ABN is proactive, allowing beneficiaries to make informed decisions before receiving care.

The Pre-Admission Screening (PAS) form shares similarities with the ABN as it assesses whether a patient requires specific services before admission. The PAS ensures that patients receive appropriate care based on their needs. Like the ABN, it aims to clarify the coverage status of services, helping patients understand what to expect regarding their insurance before undergoing treatment.

The Explanation of Benefits (EOB) is another document that parallels the ABN. An EOB is sent by insurance companies after a claim has been processed, detailing what services were covered, what was paid, and any amounts owed by the beneficiary. While the ABN is provided before services are rendered, the EOB provides a summary after care has been received, helping beneficiaries track their healthcare expenses.

The Consent for Treatment form is also similar to the ABN in that it requires patient acknowledgment before services are provided. Patients must understand the treatment they will receive and any associated costs. While the ABN focuses on coverage and potential out-of-pocket expenses, the Consent for Treatment ensures that patients are informed about the procedures themselves.

The Coverage Determination Request form has a connection to the ABN as well. This document is used when a beneficiary or provider seeks clarification on whether a specific service will be covered under Medicare. Both forms aim to provide clarity regarding coverage, but the Coverage Determination Request is a formal inquiry, while the ABN is a notification of potential non-coverage.

The Medical Necessity form is another document that shares a purpose with the ABN. It is often required by insurance companies to justify the need for specific services. This form helps ensure that treatments align with the patient’s medical needs. Both the Medical Necessity form and the ABN serve to clarify the rationale for services, with the ABN focusing on potential coverage issues.

The Patient Responsibility Agreement can be compared to the ABN as it outlines the financial obligations of the patient before services are rendered. This agreement specifies what the patient will owe, similar to how the ABN informs beneficiaries about potential costs. Both documents aim to ensure that patients understand their financial responsibilities ahead of time.

Finally, the Out-of-Pocket Cost Estimate is similar to the ABN in that it provides beneficiaries with an estimate of expected costs for services. This document helps patients budget for upcoming medical expenses, just as the ABN alerts them to potential non-coverage. Both serve to enhance transparency in healthcare costs, allowing beneficiaries to make informed decisions about their care.

Instructions on Writing Advance Beneficiary Notice of Non-coverage

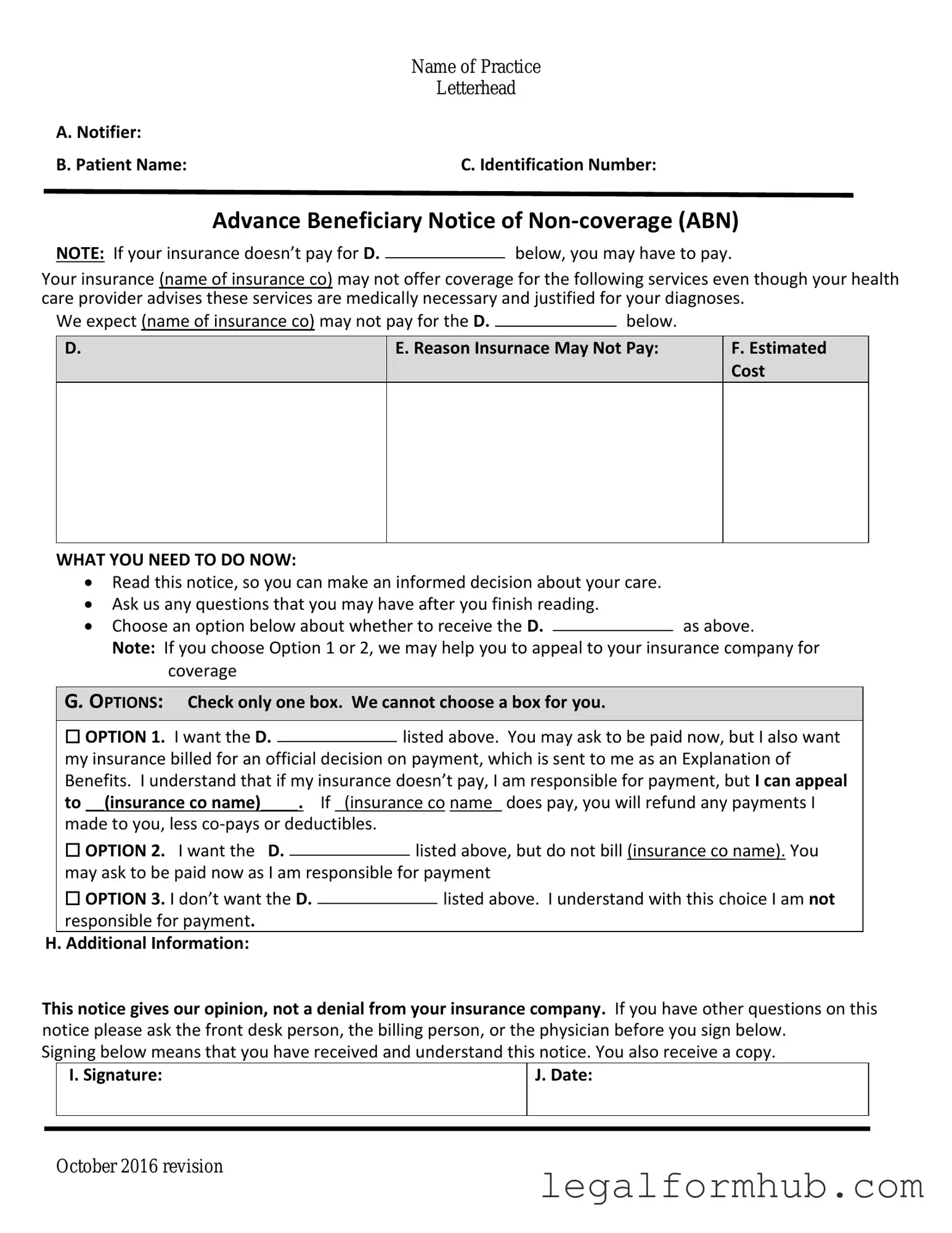

After receiving the Advance Beneficiary Notice of Non-coverage (ABN), it is essential to complete the form accurately. This will ensure that you understand your potential financial responsibilities for the services that may not be covered by Medicare. Follow these steps to fill out the form correctly.

- Begin by entering the date on which you are filling out the form at the top right corner.

- In the section labeled "Beneficiary's Name," write your full name as it appears on your Medicare card.

- Next, provide your Medicare number in the designated area. This is usually found on your Medicare card.

- Fill in your address, including street, city, state, and ZIP code, in the appropriate fields.

- In the "Provider's Name" section, write the name of the healthcare provider or facility issuing the ABN.

- Indicate the specific service or item you are receiving that may not be covered by Medicare. Be as detailed as possible.

- In the "Reason Medicare May Not Pay" section, briefly explain why you believe Medicare may deny coverage for this service. This could include reasons like the service being deemed not medically necessary.

- Sign and date the form at the bottom to confirm that you understand the information provided and accept responsibility for payment if Medicare does not cover the service.

Once you have completed the form, keep a copy for your records. Submit the original to your healthcare provider. They will review the information and proceed accordingly.

Misconceptions

The Advance Beneficiary Notice of Non-coverage (ABN) form is often misunderstood. Here are six common misconceptions about this important document:

- The ABN is only for Medicare recipients. Many believe that the ABN applies solely to Medicare beneficiaries. However, the form can also be relevant for individuals with other insurance plans that follow Medicare guidelines.

- Receiving an ABN means that the service will not be covered. Some people think that an ABN automatically indicates that a service will not be covered. In reality, the ABN is a notification that coverage may not be guaranteed, but it does not confirm non-coverage.

- You must sign the ABN to receive services. Many assume that signing the ABN is mandatory for receiving care. This is not true; patients can choose not to sign the ABN, but they should be aware that they may be responsible for payment if the service is not covered.

- The ABN is the same as a waiver of liability. Some individuals confuse the ABN with a waiver of liability. While both documents address coverage issues, the ABN specifically informs beneficiaries about potential non-coverage, whereas a waiver of liability pertains to the provider's responsibility.

- You can ignore the ABN if you believe the service is necessary. It is a misconception that beneficiaries can disregard the ABN if they feel a service is essential. Ignoring the ABN could lead to unexpected costs if the service is ultimately deemed non-covered.

- Providers must always issue an ABN. Some people think that healthcare providers are required to issue an ABN for every service. In fact, an ABN is only necessary when a provider believes that Medicare may not cover a specific service or item.

Understanding these misconceptions can help beneficiaries make informed decisions regarding their healthcare services and potential costs.

Key takeaways

When filling out and using the Advance Beneficiary Notice of Non-coverage (ABN) form, keep these key takeaways in mind:

- Understand the Purpose: The ABN informs you that Medicare may not cover a specific service or item.

- Fill it Out Correctly: Ensure all required fields are completed accurately to avoid confusion later.

- Review the Options: The form provides choices for you to accept or decline the service, so consider your options carefully.

- Keep a Copy: Always retain a copy of the signed ABN for your records and future reference.

- Ask Questions: If you’re unsure about anything on the form, ask your healthcare provider for clarification.

- Know Your Rights: You have the right to appeal if you believe the service should be covered by Medicare.

File Information

| Fact Name | Description |

|---|---|

| Purpose | The Advance Beneficiary Notice of Non-coverage (ABN) informs Medicare beneficiaries that a service may not be covered by Medicare. |

| When to Use | Providers must issue an ABN before delivering services that they believe may not be covered by Medicare. |

| Beneficiary Rights | Beneficiaries have the right to refuse services after receiving an ABN, knowing they may have to pay out of pocket. |

| State-Specific Forms | Some states may have their own versions of the ABN, governed by state laws that align with federal regulations. |

| Delivery Method | The ABN must be delivered in person or via mail, ensuring the beneficiary understands its contents. |

| Signature Requirement | Beneficiaries must sign the ABN to acknowledge they understand the potential for non-coverage. |

| Validity Period | The ABN is valid for the specific service and timeframe indicated on the form, and it must be completed correctly to be enforceable. |