Fill Your Adp Pay Stub Form

Different PDF Templates

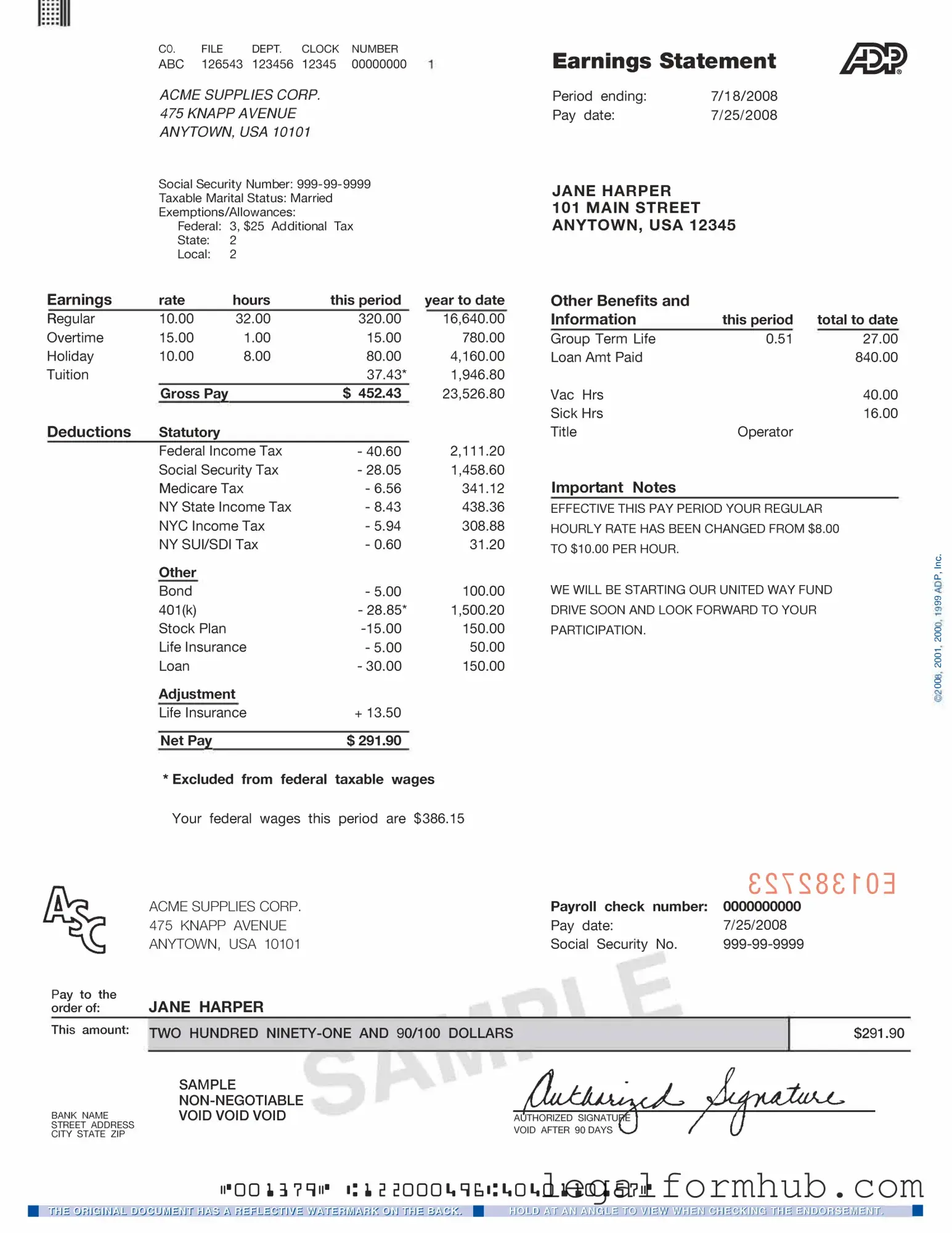

How to Make a Payroll Check - Employers utilize the Payroll Check form to ensure accurate payment.

Paystubs for Independent Contractor - The form allows for the inclusion of varying rates per project.

To facilitate your vehicle transaction, it's important to utilize the Florida Motor Vehicle Bill of Sale, which can be easily obtained online. By filling out this form accurately, you can avoid potential disputes and ensure compliance with state laws. For convenience, you can access the form through this link: Fill PDF Forms, making the process straightforward and efficient for both the buyer and seller.

How to Create a Job Application - The application form collects vital information to determine job fit.

Similar forms

The W-2 form is similar to the ADP Pay Stub in that both documents provide essential information about an employee's earnings. The W-2 summarizes annual wages and taxes withheld for the year. Employees receive it at the end of the tax year, which helps them file their income tax returns. While the pay stub details earnings for a specific pay period, the W-2 gives a broader view of financial activity over the entire year.

The 1099 form is another document that shares similarities with the ADP Pay Stub. This form is typically used for independent contractors or freelancers, detailing income earned outside of traditional employment. Like the pay stub, the 1099 shows earnings and may include tax withholding information. Both documents are crucial for understanding income and preparing for tax obligations, though they serve different employment scenarios.

An employment verification form is a document that employers use to confirm a potential employee's work history and qualifications. This form serves as an important tool for both hiring managers and applicants, providing essential information about job responsibilities, employment dates, and salary details. Ready to streamline your hiring process? Fill out the Employment verification form form by clicking the button below.

The direct deposit statement is also akin to the ADP Pay Stub. This document confirms that an employee's wages have been electronically transferred to their bank account. It typically includes details about the amount deposited and any deductions made. While the pay stub provides a comprehensive view of earnings and deductions for a specific pay period, the direct deposit statement confirms the transaction, ensuring employees are aware of their financial status after payment.

Instructions on Writing Adp Pay Stub

Filling out the ADP Pay Stub form is a straightforward process that ensures accurate recording of your payment details. Completing this form correctly is essential for maintaining transparent financial records. Follow the steps below to fill out the form accurately.

- Begin by entering your employee identification number at the top of the form.

- Next, provide your name as it appears on your payroll records.

- Fill in your address, ensuring that it is current and complete.

- Indicate your pay period by entering the start and end dates.

- Record your gross pay for the period, which includes all earnings before deductions.

- List any deductions, such as taxes, retirement contributions, or health insurance premiums.

- Calculate your net pay by subtracting total deductions from gross pay.

- Finally, sign and date the form to verify that the information is accurate.

Misconceptions

Understanding your pay stub is crucial for managing your finances and ensuring that you are being compensated fairly. However, several misconceptions can cloud this understanding. Here are four common myths about the ADP pay stub form, along with clarifications to help you navigate your pay information more effectively.

- Myth 1: The pay stub only shows my gross earnings.

- Myth 2: I cannot access my pay stub if I lose it.

- Myth 3: All deductions are mandatory and cannot be changed.

- Myth 4: Pay stubs are only important during tax season.

Many people believe that the pay stub only reflects gross earnings, but it actually provides a comprehensive breakdown. You will find details about your net pay, deductions, and various contributions, giving you a complete picture of your earnings and withholdings.

Some think that losing a physical pay stub means they cannot retrieve their information. In reality, ADP offers online access to pay stubs. You can easily log in to your account and view or print past pay stubs whenever you need them.

While some deductions, like taxes, are required, others may be optional. For example, contributions to retirement plans or health insurance may be adjusted based on your preferences. Always check with your HR department if you have questions about your deductions.

Many people underestimate the importance of their pay stubs outside of tax season. They are essential for budgeting, applying for loans, or verifying income. Keeping track of your pay stubs year-round can help you manage your finances more effectively.

Key takeaways

When it comes to understanding and using the ADP Pay Stub form, several key points can enhance your experience. Here are some important takeaways:

- Understand the Layout: Familiarize yourself with the sections of the pay stub. Each area provides specific information about your earnings, deductions, and taxes.

- Verify Personal Information: Always check that your name, address, and Social Security number are correct. Errors can lead to complications with tax filings.

- Review Earnings: Look closely at your gross pay, which is the total amount earned before any deductions. This figure is crucial for understanding your overall compensation.

- Check Deductions: Deductions can include taxes, health insurance, retirement contributions, and other withholdings. Knowing what is taken out helps you manage your finances better.

- Understand Net Pay: Net pay is what you take home after deductions. This is the amount that will be deposited into your bank account or given as a check.

- Track Hours Worked: If you are an hourly employee, ensure that the hours listed are accurate. Discrepancies can affect your earnings significantly.

- Utilize Year-to-Date Totals: Year-to-date (YTD) figures provide a cumulative total of earnings and deductions. This information is helpful for budgeting and tax preparation.

- Keep Records: Store your pay stubs for future reference. They can be useful for loan applications, tax filings, or verifying employment history.

By keeping these points in mind, you can effectively navigate your ADP Pay Stub form and ensure that you have a clear understanding of your financial standing.

File Information

| Fact Name | Description |

|---|---|

| Purpose | The ADP Pay Stub form provides employees with a detailed breakdown of their earnings, deductions, and net pay for each pay period. |

| Components | The pay stub typically includes information such as gross pay, taxes withheld, retirement contributions, and other deductions. |

| State-Specific Requirements | Some states have specific laws governing the information that must be included on pay stubs, such as California's Labor Code Section 226. |

| Accessibility | Employees can often access their pay stubs electronically through ADP's online portal or receive them in paper format, depending on employer policies. |

| Frequency | Pay stubs are typically issued on a regular schedule, such as bi-weekly or monthly, aligning with the employer's payroll practices. |

| Importance for Employees | Reviewing pay stubs is crucial for employees to ensure accuracy in their pay, track earnings, and understand their tax obligations. |