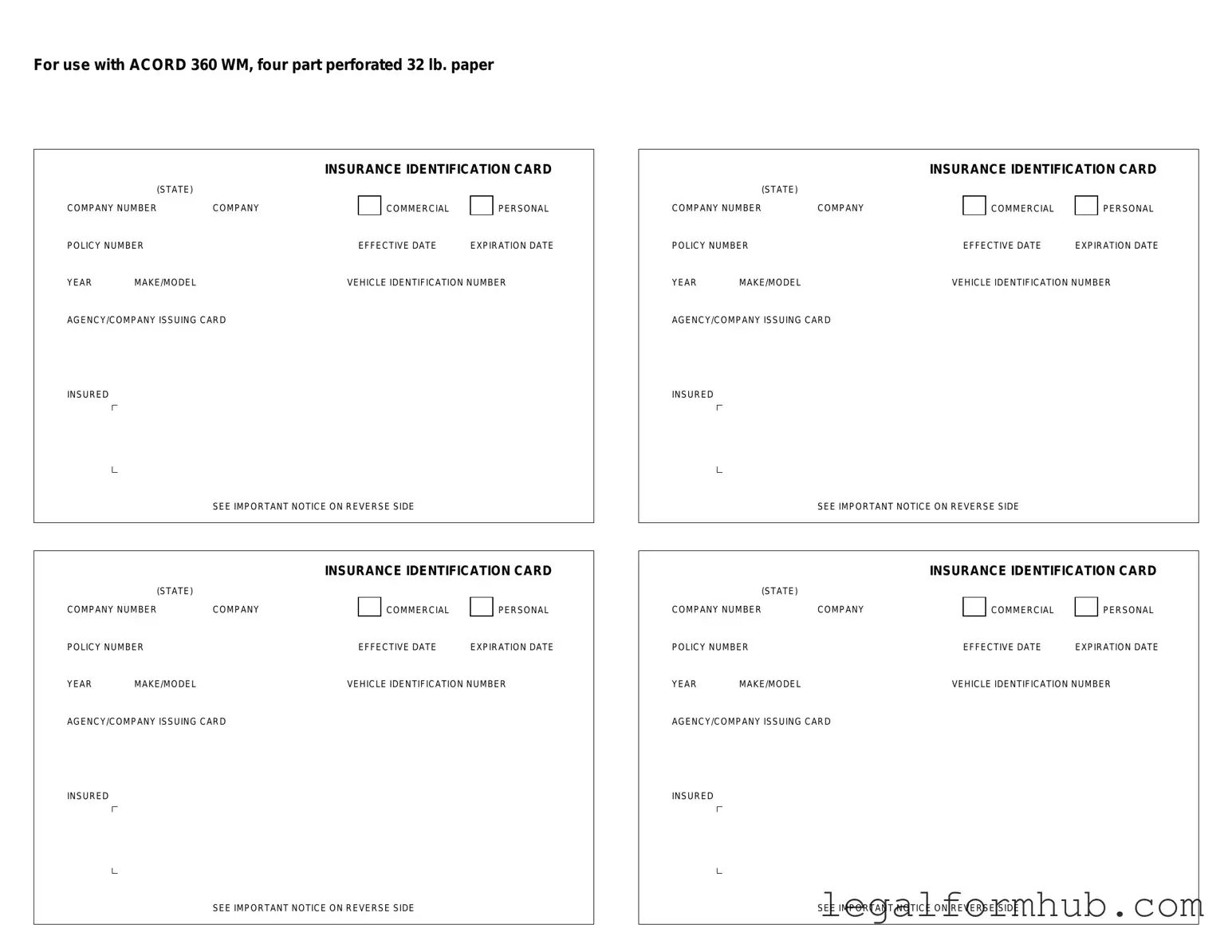

Fill Your Acord 50 WM Form

Different PDF Templates

Cuddle Application - Engage with people who understand the importance of human touch.

Obtaining a Doctors Excuse Note is essential to ensure that your absence from work or school is properly documented for medical reasons. For convenient access to the necessary documentation, you can use this resource: Fill PDF Forms to fill out the required form efficiently.

Form 6059B Customs Declaration - Providing correct information on the CBP 6059B is essential.

Profit and Loss Balance Sheet Template - Track your business progress by comparing different periods’ data.

Similar forms

The ACORD 25 Certificate of Liability Insurance is a key document that serves a similar purpose to the ACORD 50 WM form. Both forms provide proof of insurance coverage, but the ACORD 25 focuses specifically on liability insurance. This document outlines the types of coverage, policy limits, and the insured parties. Just like the ACORD 50 WM, it is often required by clients or businesses to ensure that contractors or vendors have adequate liability protection before beginning work.

The ACORD 27 Evidence of Property Insurance is another document that shares similarities with the ACORD 50 WM form. While the ACORD 50 WM may cover various types of insurance, the ACORD 27 is specifically designed to confirm property insurance coverage. It details the property insured, coverage limits, and any applicable deductibles. Both forms are used to provide assurance to third parties that the necessary insurance is in place, thus minimizing financial risk.

For those looking to secure their future legal decisions, understanding the importance of a Durable Power of Attorney is crucial. This vital document grants the designated individual the authority to make decisions when you're unable to do so. To explore how to effectively implement this, check out this guide on initiating a Durable Power of Attorney process.

The ACORD 130 Commercial General Liability Application is also akin to the ACORD 50 WM form. This application gathers essential information about a business’s operations and insurance needs. While the ACORD 50 WM may provide a summary of coverage, the ACORD 130 delves deeper into the specifics of the business, including its operations and potential risks. Both documents are crucial in the insurance application process, helping insurers assess risk and determine appropriate coverage options.

The ACORD 41 Additional Insured Endorsement is another document that parallels the ACORD 50 WM form. This endorsement is often attached to a primary insurance policy to extend coverage to additional parties. While the ACORD 50 WM may indicate who is covered under a policy, the ACORD 41 specifically names additional insured parties, clarifying their protection under the primary policy. Both documents are vital in ensuring that all necessary parties are adequately protected in the event of a claim.

Lastly, the ACORD 51 Workers’ Compensation Application shares similarities with the ACORD 50 WM form. While the ACORD 50 WM may cover various types of insurance, the ACORD 51 focuses solely on workers’ compensation coverage. It gathers information about the business and its employees to assess risk and determine appropriate coverage. Both forms are essential for businesses to demonstrate compliance with insurance requirements and protect against potential liabilities.

Instructions on Writing Acord 50 WM

Completing the Acord 50 WM form is an important step in the process you are undertaking. It is essential to fill it out accurately to ensure your information is processed correctly. Follow these steps carefully to complete the form.

- Begin by entering the applicant's name at the top of the form. Make sure to provide the full legal name.

- Next, fill in the address of the applicant. Include street address, city, state, and ZIP code.

- Provide a contact number where the applicant can be reached. This should be a reliable phone number.

- In the designated area, enter the email address of the applicant. Ensure that it is a current and functioning email.

- Fill out the policy number related to the application. This number is typically found on previous documentation.

- Indicate the effective date of the policy. This is the date when the coverage begins.

- Complete the section regarding coverage details. Be as specific as possible about the type of coverage being requested.

- Sign and date the form at the bottom. The signature should be that of the applicant or an authorized representative.

After completing the form, review all the information for accuracy. Once verified, submit it according to the instructions provided by your insurance company or agent. This ensures that your application will be processed without delays.

Misconceptions

The Acord 50 WM form is a vital document in the insurance industry, yet several misconceptions surround its purpose and use. Here are seven common misunderstandings:

- Misconception 1: The Acord 50 WM form is only for large businesses.

- Misconception 2: Completing the form is overly complicated.

- Misconception 3: It is unnecessary if you already have an insurance policy.

- Misconception 4: The form is only needed once.

- Misconception 5: Only the insurance agent needs to fill it out.

- Misconception 6: The Acord 50 WM form is not legally binding.

- Misconception 7: It can be submitted without thorough review.

This form is applicable to businesses of all sizes. Small and medium enterprises can benefit from using it to streamline their insurance processes.

While it may seem daunting at first, the Acord 50 WM form is designed to be user-friendly. Clear instructions guide users through each section.

The Acord 50 WM form serves as a summary of coverage and is essential for updating or renewing policies. It provides crucial information to insurers.

Regular updates are necessary. Changes in business operations, ownership, or coverage needs require revisiting and completing the form again.

While agents play a key role, business owners should also be involved. Their insights ensure that the information accurately reflects the business's needs.

Although the form itself is not a contract, the information provided is crucial for establishing the terms of insurance coverage. Accuracy is paramount.

Submitting the form without careful review can lead to mistakes. Ensuring accuracy prevents potential issues with coverage later on.

Key takeaways

The Acord 50 WM form is a crucial document in the insurance industry, particularly for workers' compensation. Understanding how to fill it out correctly can streamline the process of obtaining coverage and help ensure compliance with state regulations.

- Purpose of the Form: The Acord 50 WM form is primarily used to provide information about workers' compensation insurance for businesses.

- Accurate Information: Ensure all information entered is accurate. Inaccuracies can lead to delays or denial of coverage.

- Business Details: Clearly state the name, address, and contact information of the business. This establishes the identity of the insured entity.

- Employee Information: Include details about the number of employees and their roles. This information helps insurers assess risk.

- Coverage Limits: Specify the desired coverage limits. Understanding the needs of the business can guide this decision.

- State Requirements: Be aware of the specific workers' compensation requirements in your state, as they can vary significantly.

- Signature Requirement: A signature is necessary to validate the form. This confirms that the information provided is truthful and complete.

- Submission Process: Follow the submission guidelines provided by the insurer. Each company may have different protocols for processing the form.

- Review Period: After submission, be prepared for a review period during which the insurer may request additional information.

- Keep Copies: Retain copies of the completed form and any correspondence with the insurer for your records. This can be helpful in future dealings.

Filling out the Acord 50 WM form with care and attention to detail can significantly impact the efficiency of obtaining workers' compensation insurance. By following these key takeaways, businesses can navigate the process more effectively.

File Information

| Fact Name | Description |

|---|---|

| Purpose | The Acord 50 WM form is used for providing a summary of insurance coverage for workers' compensation policies. |

| Governing Law | This form is governed by state-specific workers' compensation laws. For example, in California, it adheres to the California Labor Code. |

| Standardization | The Acord 50 WM form is standardized to ensure consistency across different insurance providers, facilitating easier comparisons. |

| Information Required | The form typically requires information such as the insured's name, address, policy number, and coverage limits. |

| Usage | Insurance agents and brokers commonly use this form to communicate essential coverage details to clients and stakeholders. |

| Submission | The completed form is submitted to the relevant insurance company and may also be required by state regulatory agencies. |