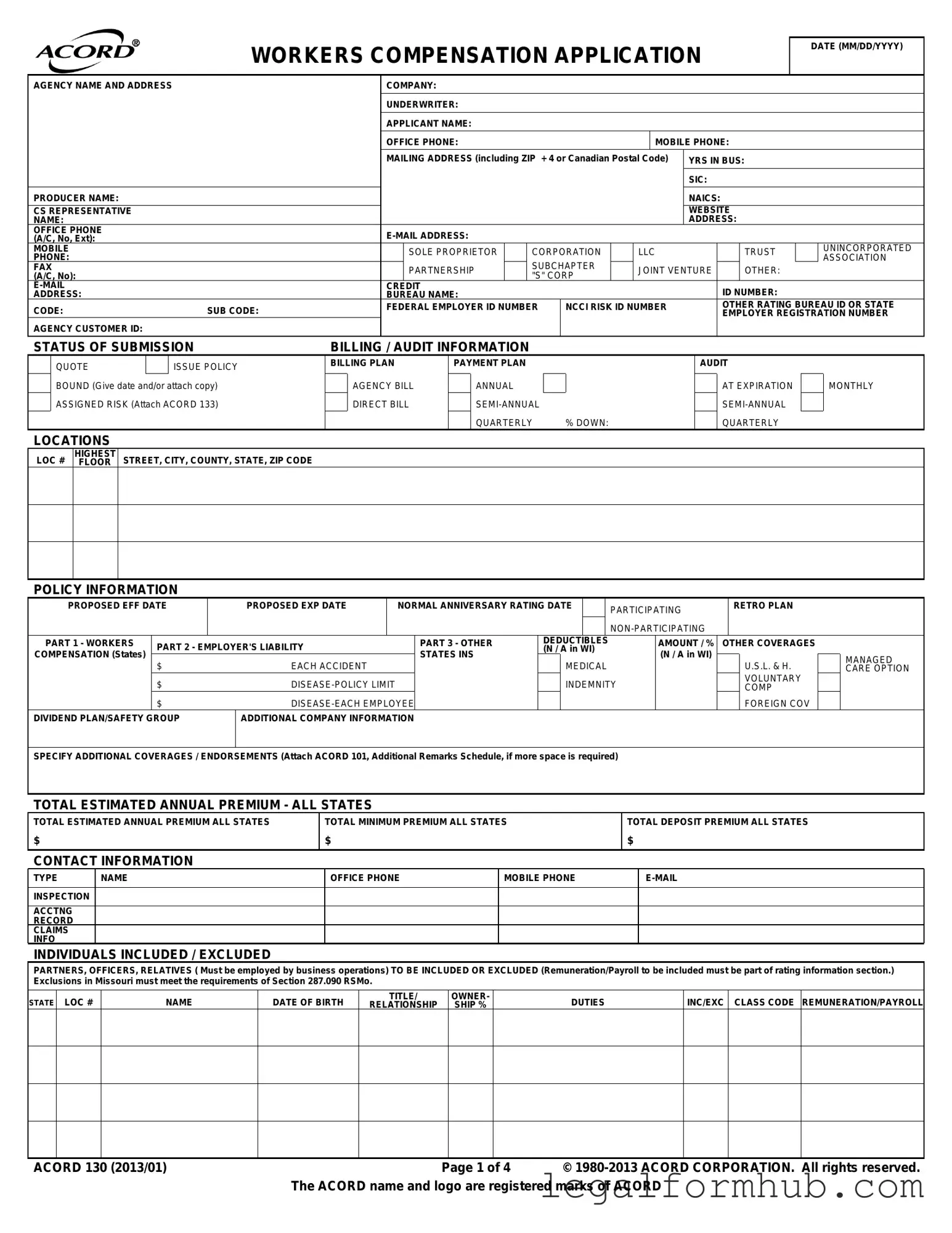

Fill Your Acord 130 Form

Different PDF Templates

Direction to Pay Form Contractor - Signing this form authorizes the insurance company to release funds directly to the body shop.

To facilitate the transfer of ownership, it is important to use the proper documentation, and you can easily obtain the necessary forms online. For quick access, you can visit Fill PDF Forms to complete your California Boat Bill of Sale form efficiently.

Miscellaneous Information - Electronic filing is available for those who need to submit multiple forms.

Puppy Missed 3rd Round of Shots - This documentation integrates transparency between pet owners and veterinarians.

Similar forms

The ACORD 130 form serves as a comprehensive application for workers' compensation insurance, but it shares similarities with several other forms used in the insurance industry. One such document is the ACORD 125 form, which functions as a general insurance application. Like the ACORD 130, the ACORD 125 gathers essential information about the applicant, including business details and coverage needs. Both forms aim to facilitate the underwriting process by ensuring that insurers have a clear understanding of the risks involved and the specifics of the coverage being sought.

If you are looking to complete your transaction smoothly, exploring the comprehensive trailer bill of sale process can be beneficial. For more information, visit this resource on Trailer Bill of Sale.

Another closely related document is the ACORD 133 form, which is specifically designed for assigned risk applications. This form is utilized when businesses cannot obtain workers' compensation insurance through the standard market. Similar to the ACORD 130, the ACORD 133 collects detailed information about the business and its operations, allowing insurers to assess the risk and determine appropriate coverage options. Both forms require thorough disclosures regarding the applicant's history and operational practices, ensuring that insurers can make informed decisions.

The ACORD 101 form is an additional document that shares commonalities with the ACORD 130. This form serves as an additional remarks schedule and is often attached to various ACORD applications to provide extra space for comments or clarifications. In both cases, the intention is to enhance the clarity of the application and provide insurers with any additional context that may be relevant to their underwriting decisions.

Next, the ACORD 140 form, which is used for general liability insurance applications, also bears similarities to the ACORD 130. Both forms require detailed information about the applicant's business operations, including the nature of the work performed and any associated risks. The ACORD 140, like the ACORD 130, aims to ensure that insurers have a comprehensive understanding of the applicant's business to accurately assess risk and determine appropriate coverage limits.

The ACORD 25 form, primarily used for property insurance applications, shares a similar structure with the ACORD 130. Both documents require information about the applicant's business location, operations, and any relevant historical data. This information is crucial for insurers to evaluate potential risks associated with property coverage, just as it is for workers' compensation coverage on the ACORD 130.

Another relevant form is the ACORD 27, which is utilized for commercial auto insurance applications. The ACORD 27, like the ACORD 130, collects information about the applicant's operations and the types of vehicles used in the business. Both forms aim to provide insurers with a clear picture of the risks involved, enabling them to offer tailored coverage solutions that meet the specific needs of the applicant.

The ACORD 126 form, which is used for commercial package policies, also has similarities to the ACORD 130. Both forms require detailed information about the business, including operational practices and risk exposures. The ACORD 126 consolidates various types of coverage into a single application, while the ACORD 130 focuses specifically on workers' compensation, yet both serve the purpose of providing insurers with the necessary information to assess risk accurately.

Additionally, the ACORD 38 form, which is used for personal auto insurance applications, demonstrates similarities in its approach to gathering applicant information. While the ACORD 130 is focused on workers' compensation, both forms require detailed personal and operational information to ensure that insurers can evaluate risk effectively. This shared emphasis on thoroughness helps create a more transparent underwriting process.

Lastly, the ACORD 20 form, which serves as a general liability claim report, shares a common goal with the ACORD 130 in that both documents aim to facilitate communication between the applicant and the insurer. While the ACORD 20 focuses on claims rather than applications, both forms require detailed information to ensure that insurers have the context needed to make informed decisions regarding coverage and risk management.

Instructions on Writing Acord 130

Completing the Acord 130 form is an important step in applying for workers' compensation insurance. This form gathers essential information about your business, including details about your operations, employees, and insurance history. Accurate and thorough completion is crucial to ensure proper coverage and compliance.

- Fill in the Date: Enter the date of application in the format MM/DD/YYYY.

- Agency Information: Provide the agency name and address.

- Company and Underwriter: Specify the insurance company and underwriter details.

- Applicant Information: Enter the applicant's name, office phone, and mobile phone.

- Mailing Address: Fill in the complete mailing address, including ZIP + 4 or Canadian Postal Code.

- Business Information: Indicate the years in business, Standard Industrial Classification (SIC), and North American Industry Classification System (NAICS) codes.

- Producer Information: Provide the producer's name and contact details, including office phone and email address.

- Business Structure: Check the appropriate box for your business type (e.g., sole proprietor, corporation, LLC).

- Contact Information: List the contact person's name, office phone, mobile phone, and email.

- Policy Information: Enter the proposed effective date and expiration date of the policy.

- Workers Compensation Details: Fill in the relevant sections for workers' compensation, employer's liability, and other coverages.

- Estimated Premiums: Provide the total estimated annual premium and other premium details.

- Individuals Included/Excluded: List individuals who are included or excluded from coverage, along with their details.

- Rating Information: Complete the state rating worksheet for each state where coverage is requested.

- Prior Carrier Information: Provide information about previous insurance carriers and loss history for the past five years.

- General Information: Answer all general questions, especially those requiring explanations for "yes" responses.

- Signature: The authorized representative must sign and date the application, confirming the accuracy of the information provided.

After completing the form, review all entries for accuracy and completeness. Ensure that any required attachments, such as loss runs or additional remarks, are included. Submit the form to your insurance agent or broker to initiate the application process.

Misconceptions

The Acord 130 form is an essential document for businesses applying for workers' compensation insurance. However, several misconceptions can lead to confusion. Here are six common misconceptions about the Acord 130 form:

- It is only for large businesses. Many believe that only large corporations need to fill out the Acord 130 form. In reality, any business with employees, regardless of size, must complete this form to obtain workers' compensation insurance.

- Filling out the form is optional. Some think that submitting the Acord 130 is optional if they already have coverage. However, it is a mandatory part of the application process for new insurance policies or renewals.

- All information is confidential. While the Acord 130 does contain sensitive information, it is important to understand that certain details may be shared with underwriters and state agencies as part of the underwriting process.

- Only payroll information is required. Many applicants assume that payroll details are the only information needed. In fact, the form requires various data, including business operations, employee classifications, and prior insurance history.

- Once submitted, the form cannot be changed. Some believe that any errors or omissions in the form cannot be corrected after submission. In truth, applicants can amend the form if they discover inaccuracies, but it is best to ensure accuracy before submission.

- It is a one-time requirement. A common misconception is that the Acord 130 form is only needed once. Businesses must submit this form periodically, especially during renewals or when there are significant changes in their operations or employee structure.

Understanding these misconceptions can help ensure that businesses complete the Acord 130 form accurately and efficiently, paving the way for appropriate coverage and compliance.

Key takeaways

- Complete All Sections: Ensure every part of the Acord 130 form is filled out accurately. Missing information can delay processing.

- Provide Accurate Contact Information: Include correct agency names, addresses, and phone numbers. This helps maintain clear communication.

- Detail Your Business Operations: Describe your business thoroughly. This includes the nature of operations, products, and services offered.

- Disclose Employee Information: List all employees accurately, including any exclusions. This is crucial for determining coverage and premiums.

- Include Loss History: Provide information on past claims and losses over the last five years. This can impact your premium rates.

- Review Additional Coverages: Specify any additional coverages or endorsements needed. Attach extra documentation if necessary.

- Understand the Submission Process: Be aware of the billing and audit information. Know whether you are submitting for a quote or binding coverage.

File Information

| Fact Name | Detail |

|---|---|

| Purpose | The ACORD 130 form is used to apply for workers' compensation insurance. |

| Application Date | The form requires the applicant to enter the date of application in MM/DD/YYYY format. |

| Governing Laws | Each state may have specific laws governing workers' compensation. For example, Missouri follows Section 287.090 RSMo for exclusions. |

| Contact Information | Applicants must provide multiple contact details, including phone numbers and email addresses. |

| Coverage Options | The form includes sections for various coverage types, such as employer's liability and additional coverages. |

| Fraud Warning | The form includes a warning about the consequences of providing false information, which can lead to criminal penalties. |